It is getting to a week since holders of Argentina’s restructured bonds first had the opportunity to cry default and demand full and immediate payment. So we thought we’d ask.

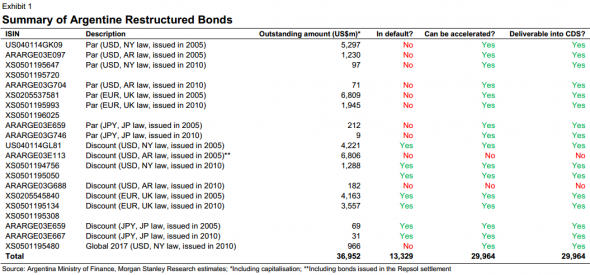

And as Morgan Stanley’s analysts pointed out on Tuesday, there is $13bn of paper out there eligible to be accelerated — $30bn, counting cross-default clauses in debt which has not had payments missed yet.

(Click chart to enlarge)

Where are they then?

Terms require at least a quarter of the holders of any particular restructured bond to demand acceleration. We’ve been sceptical that anyone would actually accelerate, of course.

The holders probably sense a much stronger incentive to sit tight on top of some very large price gains in their bonds over the last few months, whether they’re getting the next few payments on time or not, and to wait out until Argentina settles with holdouts. (This year? Next year, when the RUFO clause sunsets? Next year, when or if there isn’t a Kirchnerite in the Casa Rosada any more?)

The reward, when or if that settlement materialises, would be a yet further drop in Argentine yields as the country left US court limbo behind and accessed markets again. If Paraguay (Paraguay!) can borrow for 30 years at 6 per cent, Argentina probably can do too, even with its economic risk.

We could also point to who is probably holding many of those bonds — investors in distressed debt with relatively resilient attitudes to recalcitrant sovereigns and/or angry US federal judges. Morgan Stanley also note that bondholders may want to avoid accelerating because a subsequent restructuring might remove Argentina’s debt from the big emerging-market bond indices (where it still is, default or not).

Then again, we suspect there are also tourists who have come to the bonds from outside the asset class (from high yield, say). They may not have been around the block with the extent of Argentina’s wackiness before. They thus may well believe they have something to gain by accelerating and then litigating for full payment. Which given how Argentina likes to litigate, is a bad idea.

This would be the prisoner’s dilemma aspect to the trade. The longer time goes on without a holdout deal, the risk rises of restructured bondholders getting fidgety and moving to accelerate, even though it’s a bad idea for everyone.

Morgan Stanley’s analysts also note this risk (emphasis ours):

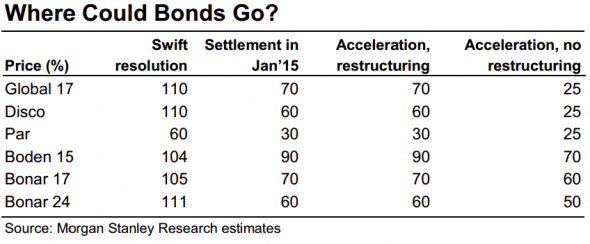

Should investors see no road to resolution, they may decide to accelerate their bonds, which could lead to a restructuring. We see this as a low probability scenario in the near term as we think that many investors consider the current default temporary. However, in the event of no progress on the settlement talks in early 2015, acceleration could become a more likely outcome.Given that solvency was not the trigger for Argentina’s default, we think that a restructuring into local law bonds with the same financial terms – but without the usual covenants in international law bonds and the RUFO clause – could be possible…What if there were challenges by holdouts? Undoubtedly, a restructuring offering local law bonds could still be portrayed as an attempt to evade the court order and therefore could be challenged by the plaintiffs. Full participation in such a restructuring could end with their losing their leverage over Argentina. This could mean that the pari passu order could be unenforceable for the foreseeable future in the absence of any outstanding restructured international law bonds.If their effort to block the restructuring were to prove successful, Argentina could remain in default for a longer time. In this case, valuations could drop towards 25 cents on the international law bonds, in line with historical valuations for defaulted Argentina debt.

Which leads to a fairly expansive range of estimates for restructured bond prices. (Click to enlarge)

After all, the ultimate problem for Elliott is not Argentina’s default per se. It would be Argentina getting to leave US jurisdiction altogether, and Elliott’s holdout bonds technically no longer having New York law restructured debt left to be pari passu with.

On the other hand, they may have legal options even then.

Keine Kommentare:

Kommentar veröffentlichen