PDVSA Default Would Spell Trouble for U.S. Refiners’ Oil Supply

Updated on

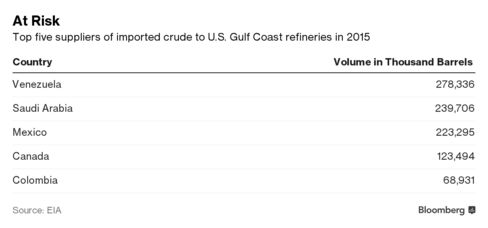

- Venezuela is the main supplier of crude to the Gulf Coast

- Creditors may go after crude tankers and oil payments

A potential default by Petroleos de Venezuela SA would cause trouble for U.S. Gulf Coast refineries, as the Latin American country is the main supplier of foreign oil to the region.

Venezuela’s state-controlled oil company PDVSA has been trying to persuade bondholders to exchange as much as $5.325 billion of outstanding notes maturing in 2017 for longer-term securities that are due in 2020. The deadline for the swap was extended three times and is due Friday, according to a company statement. A failure in exchanging the bonds could make it “difficult” for the company to make payments on its existing debt, PDVSA said.

A default would not only rattle bondholders, but also PDVSA’s suppliers and customers, with U.S. refineries among the first to feel the hit, said Lucas Aristizabal, a senior director at Fitch Ratings. Last year the OPEC member supplied almost a third of all crude oil imported on the Gulf Coast, home to the largest cluster of refineries in the world, according to the U.S. Energy Information Administration.

“If PDVSA defaults, there could be a disruption of oil supply to the U.S. as creditors may try to seize payments made in the U.S.,” Aristizabal said in a phone interview from Chicago. “Bondholders will definitely try to stake a claim on those dollars,” he said.

PDVSA subsidiary Citgo Petroleum Corp., Phillips 66, Valero Energy Corp. and PBF Energy Inc. are among the largest buyers of heavy Venezuelan crude. A number of Gulf Coast refineries have been reconfigured in the past decade to increase their ability to process cheaper, heavier oil into gasoline and diesel.

It’s likely the company will retain control of its assets such as the refineries in Venezuela, said Mara Roberts, a New York-based analyst at BMI Research. The story is different when it comes to oil being exported, she said.

“Oil tankers could also potentially be at risk, with those carrying Venezuelan crude likely to face attachment claims upon arrival,” Roberts said by e-mail. “This could discourage take up of PDVSA’s shipments.”

For more on the PDVSA bond swap, click here

While supply to the U.S. may be at stake, the same may not happen to other buyers including China, which has loaned some $45 billion to Venezuela in the past decade in return for repayment in oil. In the case of China, creditors would have a hard time seizing cargoes, as the oil changes ownership when it’s put on tankers, Aristizabal said. China charters the ships, and PDVSA repays the loans by loading the vessels.

“Once the crude is on board, it belongs to the buyer,” he said. “Because of the way the contracts were written, it would be very hard to have any claims on the oil.”

China imported 298,247 barrels a day of oil from Venezuela last year, up 16 percent from 2014, Chinese customs data show. The U.S., China and India are the main buyers of Venezuelan crude, according to data compiled by Bloomberg.

Oil Production

“Output is unlikely to improve until some of the financing and oilfield service-related agreements signed in recent weeks begin to take effect,” she said. “But if the investments don’t follow through, we are going to see further declines of output and exports would be at risk as well.”

Keine Kommentare:

Kommentar veröffentlichen