Bundesbank Considers Exit Cost From Non-Standard ECB Policy

by- German central bank faces losses on QE holdings as rates rise

- Weidmann to present risk provisions, annual report on Thursday

The Bundesbank may be about to put a price tag on the European Central Bank’s exit from unconventional stimulus.

The German central bank is bracing for losses that may be triggered when the ECB eventually unwinds its bond-buying program and raises interest rates, and President Jens Weidmann has the opportunity to address the matter when he presents his institution’s annual accounts on Thursday. He signaled as much at last year’s event, when he said “potentially considerable” funds might need to be set aside to absorb the costs of tighter monetary policy.

While officials would be acting prudently in covering potential losses, it could feed the acrimony toward the ECB that has built in the country. Record-low rates and the 2.28 trillion-euro ($2.4 trillion) quantitative-easing plan are frequently criticized by politicians, with elections in September set to deliver increased support to euro-skeptic parties such as Alternative for Germany.

The Bundesbank’s core problem is its purchases of negative-yielding bonds, which are guaranteed to lose money as long as they’re on the balance sheet. For now, those losses are far outweighed by income from the negative deposit rate -- effectively a charge on lenders’ excess liquidity -- but as interest rates rise, the financial position could deteriorate.

Worst-Affected

“Building provisions is responsible and provident,” said Carsten Brzeski, chief economist at ING-Diba AG in Frankfurt. “It also fits in with the criticism of QE that exists within the institution and the public.”

A Bundesbank spokesman declined to comment on the risk provisions for 2016.

While the institution isn’t alone in facing losses, it is likely to be one of the worst-affected among the 19 euro-area central banks. For a start, it’s buying more government bonds than its peers because of Germany’s standing as the region’s largest economy. Holdings of the nation’s sovereign debt under QE totaled 322 billion euros at the end of January, with all but a small portion acquired by the Bundesbank.

Rate Path

The Bundesbank’s QE losses in 2015 were tiny compared with the profit from the deposit facility, previous asset-purchase programs such as the Securities Markets Program, and refinancing operations.

| 2015 INTEREST INCOME (MILLION EUROS) | |

|---|---|

| Refinancing Operations | 40 |

| Deposits of Credit Institutions | 248 |

| SMP Portfolio | 1,684 |

| Covered Bond Program 1+2+3 | 305 |

| Public Sector Purchase Program | - 11 |

That balance is likely to shift though as bonds bought under the now-defunct SMP expire over the next three years, and as interest rates start to rise -- a process that economists surveyed by Bloomberg predict will start around 2019.

The Bundesbank currently lends to banks at the ECB’s main refinancing rate of zero percent, and charges 0.4 percent for deposits. When rates turn positive, it may find outgoings on overnight funds outweigh income from loans.

“Monetary-policy decisions solely serve the goal of price stability, not of central-bank profits,” Weidmann said at his accounts presentation in February 2016. Government bonds may be on the balance sheet for a long time, he said, and “could turn into a risk in the future, depending on how the exit is designed or how much interest different positions on our balance sheet will bear.”

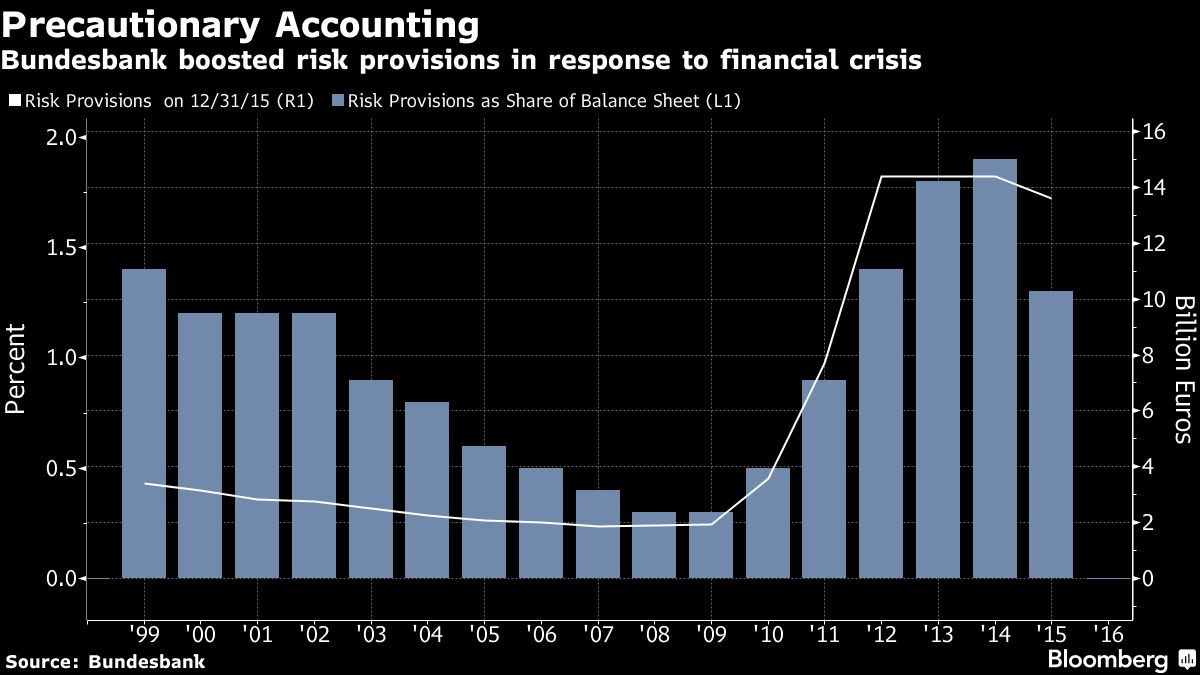

The Bundesbank increased the sum set aside against general risks in each of the three years through 2012, then kept it at 14 billion euros until 2015 when it was reduced by 780 million euros. Unlike the ECB, whose provisions mustn’t exceed its paid-in capital, the Bundesbank is free to set whatever sum it deems appropriate.

Any downturn in the Bundesbank’s finances would probably be some way off. Weidmann’s Lithuanian counterpart Vitas Vasiliauskas, echoing other Governing Council members, said in a Bloomberg interview on Tuesday that it would be “pretty premature” to discuss tapering or changes to the ECB’s forward guidance.

If losses were ultimately to surface, it wouldn’t be the first time, nor would it be fatal. The central bank reported negative results in all but two years from 1971-79 as the deutsche mark appreciated against the dollar. They were rolled into subsequent years.

Even so, Brzeski says that should be the exception.

“Central banks aren’t doing their jobs for a profit,” he said. “But ideally they also shouldn’t make any losses, because those would come back to the taxpayer.”

Keine Kommentare:

Kommentar veröffentlichen