Venezuela Says Oil at $50 Enough to Avoid PDVSA Default

Crude prices around $50 a barrel are enough for Venezuela’s state oil producer to avoid a default on its debt, company president and national oil minister Eulogio Del Pino said Thursday in an interview.

“$50 is enough,” he said on Bloomberg Television from Russia at the St. Petersburg International Economic Forum. The company’s average production cost is around $12 a barrel, he said.

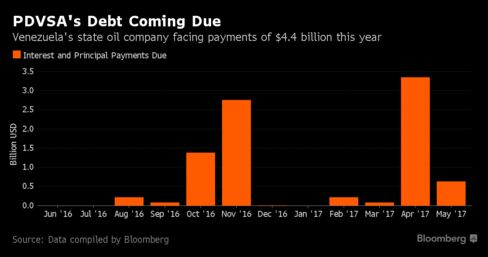

Petroleos de Venezuela SA will be able to make payments on its dollar bonds due later this year, Del Pino said. PDVSA, as the Caracas-based company is known, has interest and principal payments totaling $1.4 billion in October and $2.8 billion in November, according to data compiled by Bloomberg.

"We are working to pay that," Del Pino said, noting that "we have been paying all of our debts" during what he called "the longest cycle of low prices that we have had."

PDVSA’s $3 billion of 12.75 percent bonds due in 2022 have risen along with oil prices since hitting a record low on Feb. 11, the same day when crude futures in New York traded at their lowest since May 2003. They have since gained 12 cents to about 47 cents on the dollar on Thursday, with yields at about 34 percent.

The company will continue to use its refineries in the U.S., most of which are operated by its Citgo Petroleum Corp. subsidiary, to support its business, Del Pino said, when asked if the company had any plans to sell them in order to meet its debt payments. The reopening of a refinery in nearby Aruba will also be a “big plus” for the company, he said.

Service Companies

Del Pino said that PDVSA is working to with some of its “most important” service providers to change their contracts after companies including Halliburton Co. and Schlumberger Ltd. said they have curbed activity in the country because of unpaid invoices.

"We are changing the scheme of the contracts," he said, describing a new scenario in which future oil production will be able to pay for investment needed for new drilling. He said it wasn’t a production sharing agreement and that "the control is going to be all the time in the hands of PDVSA."

“We are changing the way of the relationship,” he said, without directly naming which service companies he was talking about. “They have been operating in the country for more than 100 years. They are not going to leave.”

The country has enough active rigs to sustain production in the Orinoco oil belt and hold off any further decline in output, he added.

A new military service company known as Camimpeg is not yet operating and will eventually focus on providing services to PDVSA and its joint-venture partners in remote, “frontier” areas near the border with Colombia, Del Pino said.

China Demand

The company is currently sending about 300,000 barrels a day to China, Del Pino said, confirming that there had been talks with the Asian country about renegotiating some of its debt.

“We are in that process to talk with our friends, the Chinese,” he said “We’re talking all the time. We’re monitoring the price, the conditions to bring the oil to China. That’s something that is all the time under discussion.”

Venezuela produces about 2.6 million barrels of crude a day, in addition to 150,000 barrels a day of condensate, Del Pino said. That’s more than the 2.3 million barrels a day that Bloomberg estimates show for the country in May. Some secondary production reports that state lower production levels for Venezuela don’t always include some heavier grades of crude, Del Pino said.

Keine Kommentare:

Kommentar veröffentlichen