For Venezuela’s True Believers, the Ultimate Risky Bet Beckons

By- Electricidad de Caracas entices Landesbank Berlin Investment

- $650 million of bonds maturing in April priced at 65 cents

For years, investors in Venezuela and its state oil company, Petroleos de Venezuela SA, took comfort knowing that in the event of a default, there’d be assets they could potentially seize to recoup some of their losses.

But for bond buyers with an even bigger appetite for risk, those willing to throw themselves at the mercy of President Nicolas Maduro’s survival and track record of making good on debt payments, there’s another option: Electricidad de Caracas, the state-run electric utility.

The company’s $650 million of bonds coming due in April trade at just 67 cents on the dollar with a whopping 96 percent yield, making them the riskiest notes maturing over the next year in the world’s riskiest nation. And with good reason. In the event of default, PDVSA bondholders, and possibly even owners of Venezuela’s sovereign debt, could lay claim to the crude producer’s oil, tankers and U.S. refining unit. But Elecar, which PDVSA bought a decade ago, has nothing for overseas investors to seize.

Of course that doesn’t matter if Elecar pays its bonds on time, and investors who’ve put their faith in Venezuela and its state companies have been rewarded with some of the world’s best bond returns over the past decade. While political and economic crises have traders betting that a default is all but inevitable in the next five years, and spurred speculation that Maduro and his government are likely on their way out, plenty of investors think the country has enough cash to hold on for at least a while longer.

"As long as Venezuela pays, PDVSA pays the debt, and as long as PDVSA pays, Elecar pays," said Lutz Roehmeyer, a money manager at Landesbank Berlin Investment, which is the second-largest reported holder of the notes, data compiled by Bloomberg show. He said that regime change is unlikely before Elecar’s bonds come due.

Francisco Rodriguez, the chief economist at Torino Capital, says that since the Elecar bond doesn’t have cross-default provisions with sovereign or PDVSA bonds, the incentive to pay could be lower. Still, he notes that Venezuela’s government has previously treated it with the same diligence as its other debt, and there’s extra reason to pay since he estimates a third of Elecar’s bonds are in the hands of the government or local onshore entities.

Trade volume on the notes was about 10 times higher on Friday than their five-week average, according to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority.

Largest reported holders of Elecar’s bonds due in 2018:

| Holder Name | Percent Outstanding | Percent Change from Last Filing | Last Filing Date |

| Grantham Mayo Van Otterloo & Co. | 17.1% | -15.9% | May 31, 2017 |

| Landesbank Berlin Investment GMB | 1.0% | 0% | July 31, 2017 |

| Invesco LTD | 0.2% | 0% | Sept. 1, 2017 |

| Credit Suisse Group AG | 0.1% | 0% | July 31, 2017 |

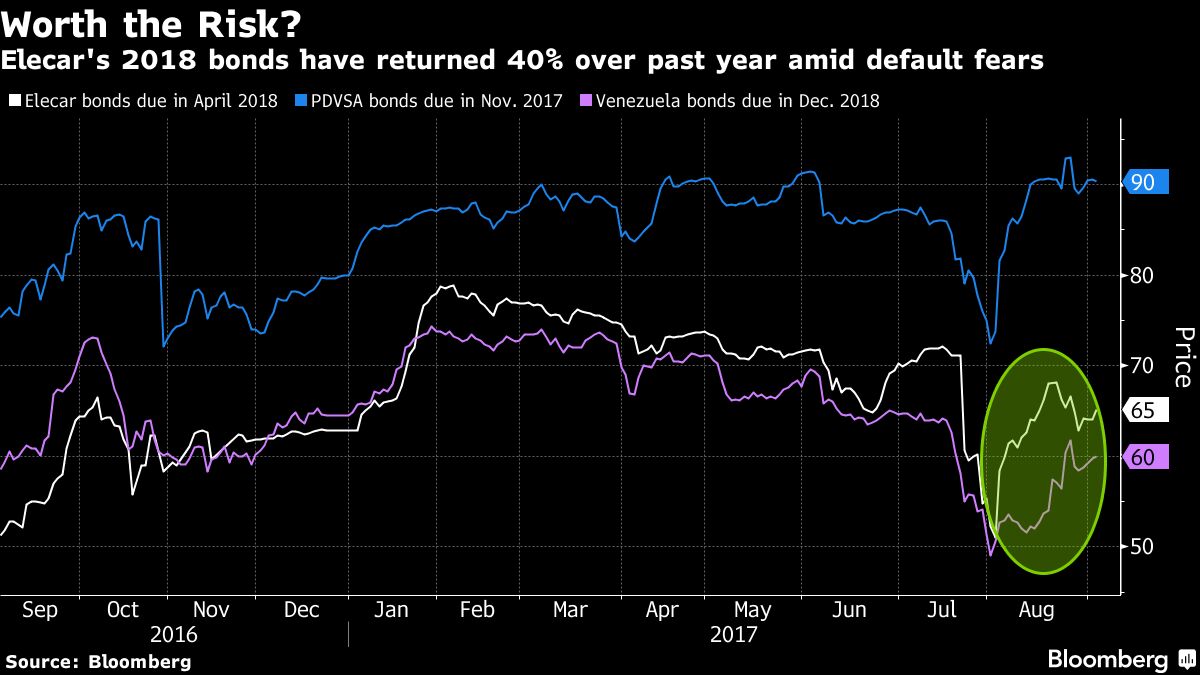

Although Elecar’s notes have returned 13 percent this year, outpacing the 8.1 percent average for emerging-market corporate dollar bonds, there have been rough patches.

Fitch Ratings downgraded them this week to CC, just two steps from default, and said a credit event is “probable” as U.S. sanctions curb the government’s financing options. In July, Simon Zerpa, the company’s principal board member and chief financial officer at PDVSA, was one of more than a dozen Venezuelans blacklisted by the Trump administration.

The implied probability of PDVSA missing a payment over the next six months is 45 percent, according to credit-default swaps data compiled by Bloomberg. Over five years, it’s 99 percent.

At the height of Venezuela’s political turmoil in late July and early August, Elecar’s notes tumbled 29 percent to 51 cents on the dollar. While they’ve since rallied, there’s still significant potential upside for investors with the stomach to ride out the ups and downs until April. Venezuela has two significant debt payments before then, $1 billion due on a sovereign bond in October and $1.2 billion for a PDVSA note in November.

If those payments get made, “this issue shouldn’t be a problem given its relatively small size," said Victor Fu, director of emerging-market sovereign strategy at Stifel Nicolaus & Co.

Keine Kommentare:

Kommentar veröffentlichen