Argentina's Bond Fight Comes Down to Its Worst Bonds

An offer of 730 cents on the dollar doesn't look like enough.

By

9

We've talked a lot about Argentina's sovereign-debt saga, but now that it is perhaps drawing to a close I'd like to tell the story again, from a slightly different perspective. (If you want it from the regular perspective, you know where to go. 1 ) This version of the story starts in 1998, when Argentina issued some bonds called floating rate accrual notes. The FRANs were due in 2005, and their floating interest rate was based on the market yields of other, fixed-rate Argentine debt. 2 The idea was that if Argentina's credit deteriorated, holders of these bonds would be compensated in the form of a higher interest rate. This sounds like a sensible enough idea. It was a terrible, terrible idea. 3

Argentina's credit deteriorated. It defaulted on its bonds in 2001. In one obvious way, this was bad for the FRAN holders: They stopped getting paid. But in another, much more theoretical way, it was great for the FRAN holders: The interest rate on their bonds, which was meant to reflect the risk of Argentina's sovereign credit, went up as Argentina approached and then tipped into default. At one point, just before the 2005 maturity of the FRANs, the holders were supposed to get paid an astonishing 101 percent per year. 4 Of course, they were actually getting paid nothing, so this did them no immediate good. But there they were, with a document saying they were supposed to get 101 percent a year. Remember that document, which has Chekhovian significance in this story.

Anyway, the FRANS' maturity date came and went in 2005, Argentina stopped calculating interest on them, 5 and still no one was getting paid. Argentina made an exchange offer for its bonds, offering holders a swap into new bonds at about 30 cents on the dollar. Many holders accepted this offer, or a later one in 2010; many holders, including holders of about $300 million worth of FRANs, did not. 6 The holders who accepted the offer got shiny new bonds that paid interest (for a while). The holders who didn't -- the holdouts -- got nothing (for a while).

But the holdouts were still out there, nursing grievances, gathering strength, considering options. One option was, of course, to sue. They sued. Specifically, NML Capital, a unit of Paul Singer's Elliott Management, "accelerated the maturity of $32 million of the $102 million in FRANs principal that it had purchased on the secondary market," and sued in a New York federal court for a judgment on those $32 million of FRANs. NML argued to the court that, after Argentina stopped calculating interest on the FRANs in 2005, the FRANs were doomed to walk the earth paying 101 percent interest, the last rate anyone had bothered to calculate, until they were paid off. Argentina argued, basically, that that was unfair. (Because, you know, 101 percent interest is a lot.) The judge in the case was U.S. District Judge Thomas Griesa, who was in the process of getting very sick of Argentina indeed, and he wasn't particularly amused by Argentina's fairness arguments. He ruled for NML, various appeals courts agreed, and ultimately NML got a judgment for $311.2 million in October 2011.

You will notice that $311.2 million is quite a lot more than $32 million. That's what 101 percent interest will do for you.

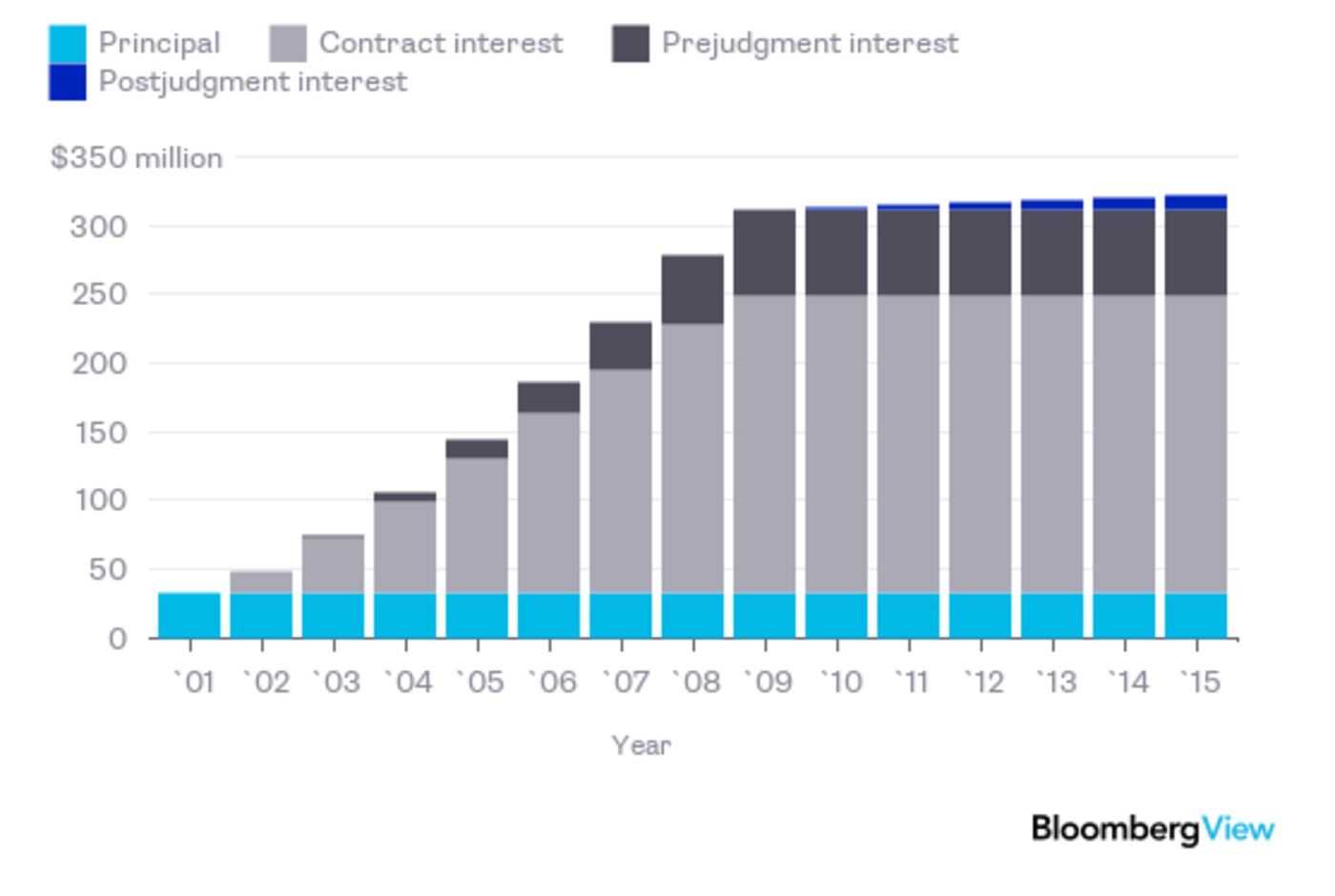

But suing turned out, for NML, to have two big problems. One was that Argentina wasn't paying the holdout bondholders in 2011 any more than it was in 2001, so NML's judgment didn't result in any actual money. The other, smaller problem was that, after the effective date of NML's judgment (2009, rather than 2011, because of all the appeals), it accrued interest at only about 0.5 percent a year. With post-judgment interest, NML's judgment should now be worth about $321.7 million, which on the one hand is just a bit more than 10 times as much as the original principal amount of the FRANs, but which on the other hand is barely more than it was back in 2011 (or 2009), and not much compensation for the risk and heartache of waiting all these extra years. 7 Here's a rough graph:

But NML had another plan. Its other plan -- I mean, you know it by now, right? We have talked about it a lot. 8 The barest gist of it is that NML, and some other holdout creditors, sued not for a money judgment on their bonds, but rather for enforcement of the "pari passu" clause in those bonds. In this clause, Argentina had promised to treat its pre-2001 bonds -- including the FRANs -- equally with all of its other bonds. NML interpreted this to mean that, if Argentina wasn't paying the FRANs, it couldn't pay any of the new, post-2005 exchange bonds, which it had been paying, and which it wanted to keep paying to re-establish its international credibility and gain access to the international capital markets. This was a rather radical interpretation of the clause, but NML convinced Judge Griesa, and ultimately the U.S. Supreme Court, that it was right.

This was important because, while Argentina could ignore an order from Judge Griesa to pay NML $311.2 million, or whatever, it couldn't ignore Judge Griesa's order not to pay its exchange bondholders. Believe me, it tried. 9 But those payments had to be routed through intermediaries in the U.S. who were very much subject to Judge Griesa's jurisdiction, and those intermediaries were not interested in going to prison to help pay Argentina's debts. So Argentina defaulted on its exchange bonds in the summer of 2014 and hasn't been able to pay its creditors ever since.

The pari passu litigation had two big advantages for the holdouts, compared to suing for money. First of all: It worked. Argentina could have gone on ignoring the money judgments forever, and it pretty much did, though there was some unpleasantness with a frigate. But without the ability to pay its post-2005 bondholders, Argentina will have a tough time ever returning to the capital markets. It took an election and years of acrimony, but now Argentina seems very interested in settling with the holdout bondholders. It recently agreed to pay $1.35 billion to a collection of Italian holdout bondholders to settle their claims at 150 cents on the dollar, and on Friday it made NML and its fellow hedge-fund holdouts a similar offerto "pay as much as $6.5 billion on $9 billion of holdout claims."

The second, subtler advantage is that, on the bonds where NML didn't get a judgment, it presumably just ... accrues interest at 101 percent a year? Here are Bloomberg's Katia Porzecanski and Chiara Vasarri:

Once a New York court awards a judgment to an investor, the bonds start accruing interest equal to the average for a one-year Treasury note. Bonds that aren’t attached to a judgment accrue interest at a faster rate based on the securities’ original coupon as well as a statutory rate of 9 percent.

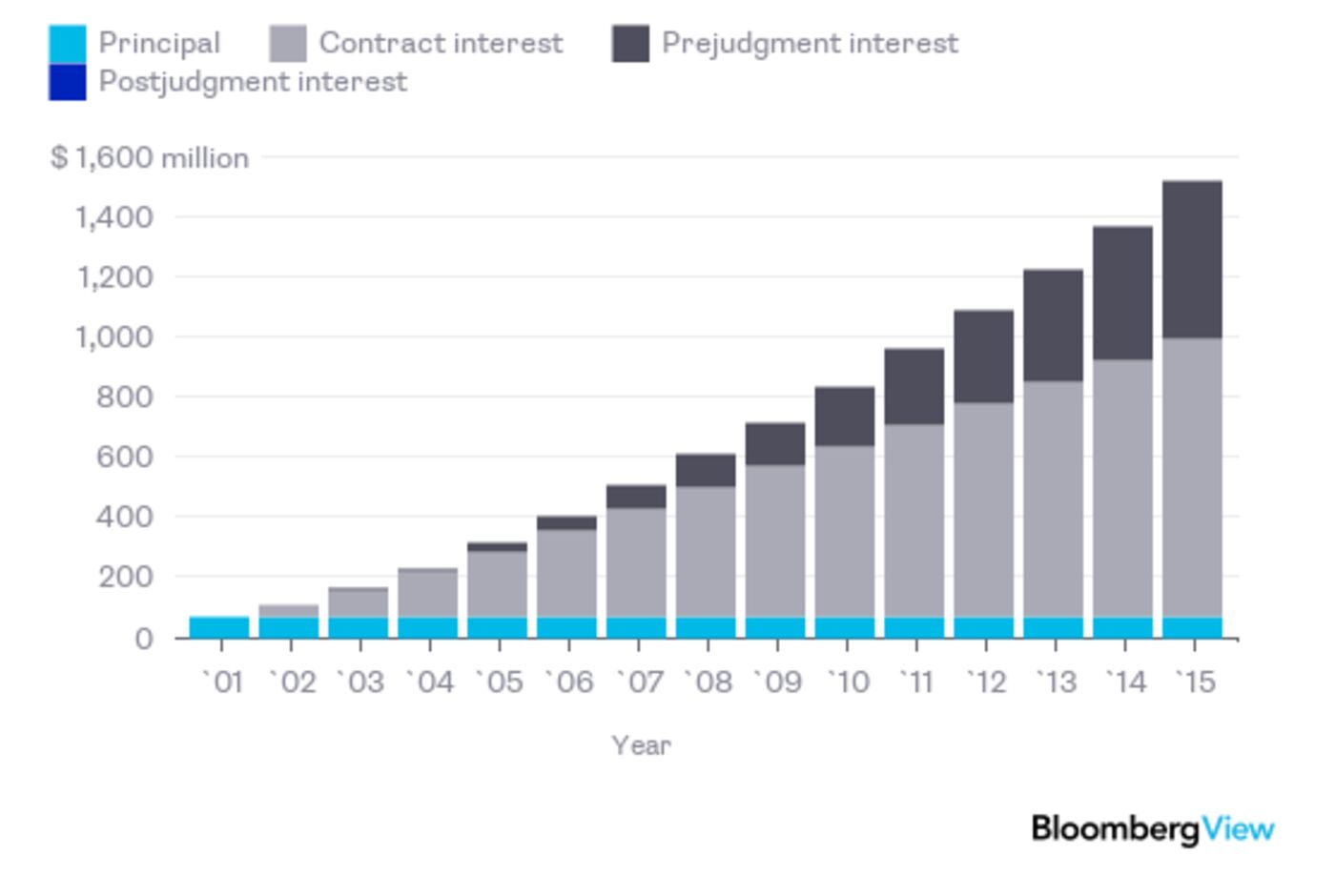

Remember, on the FRANs, that coupon rate was 101 percent a year. By my rough dumb math, $1 million original principal amount of FRANs should right now represent a claim for $1 million in principal, $13.5 million in interest at 101 percent a year, and $7.9 million in interest on interest. 10 That's 22.4 times the original principal amount -- as opposed to Elliott's judgment claim for a mere 10 times the principal amount.

There is a bit less than $300 million of FRANs in the holdouts' hands; Elliott owned $102 million at one point, of which it got a judgment on $32 million. Assuming that it kept the other $70 million and never got a judgment on them, they would keep growing at 101 percent a year, and would represent a claim for about $1.57 billion today. A rough graph:

The point is that there are roughly four types of interest rates on defaulted Argentine bonds 11 :

The differences matter for Argentina's creditors. Some holdout creditors are mostly in the first basket: They sued for judgments quickly, their judgments are mostly for the principal amount of their bonds (plus a little bit of interest), and 150 cents on the dollar is a windfall for them. Other holdout creditors were more -- savvy? ruthless? far-sighted? -- and have a lot of their eggs in basket four, where their 101-percent-a-year interest swamps the principal amount of their bonds. Every year that Argentina didn't pay, they got to add the full face amount of their bonds (and then some) to their claim. And they want to be rewarded for their foresight.

So here is the current state of Argentina's offer, from Porzecanski and Vasarri:

The terms offered by Argentina vary depending on whether the bondholders have an equal-treatment ruling against the government and if they have a court judgment that specifies how much they’re owed. Investors with the ruling who lack a judgment were offered as much as 72.5 percent on their claim, while those with a judgment would be paid 72.5 percent of the amount awarded by the court. Bondholders without an equal-treatment injunction were offered 150 percent of the face value of the bonds they own.

That offer, the story says, has already been "accepted by two funds -- billionaire foam-cup magnate Kenneth Dart’s Dart Management Inc. and Montreux Partners," but so far Elliott, Aurelius Capital Management, Davidson Kempner Capital Management and Bracebridge Capital remain unmoved. What is the difference? Well, Dart is in basket one:

Argentina’s offer is more attractive for investors such as Dart -- who received a judgment on his $595 million of defaulted bonds in 2003 -- because less of the claim is composed of accrued interest, allowing him to be repaid in full, Aurelius’s Brodsky said in a statement on Sunday.Dart received a judgment for about $725 million, including interest, and by accepting 150 percent of the principal will be repaid about $890 million. His claim would currently be worth less than that, at about $850 million, according to data compiled by Bloomberg.“Argentina bought Dart’s support by agreeing to pay its claim in full,” Brodsky said. “Aurelius would gladly accept such generosity, though we have always been willing to take a haircut.”

Dart got a judgment for 122 cents on the dollar (for principal and missed interest) in 2003, when Treasury rates were about 1.3 percent, which has accrued interest slowly during the intervening 12 years. The claim now is for only about 143 cents on the dollar, so Argentina's offer of 150 cents on the dollar is better than it could have gotten in court.

The claims of the big holdouts like NML and Aurelius, meanwhile, are for ... more. 12 Most of the estimates that I see suggest that the claims are for 300 or so cents on the dollar, with accrued interest; for instance, Juan Cruces and Tim Samples write that "The bottom line is that the claim value of the portfolio is between 2.6 and 4.2 times the principal owed initially." But that portfolio value is a mix of bonds. If you look just at the FRANs, their claim value is somewhere between 10 and 22.4 times the initial principal -- as much as 2,240 cents on the dollar.

Argentina's offer of 72.5 percent of a judgment claim works out, for NML's judgment FRANs, to about 7.3 times par -- $233 million on its $32 million of FRANs, an $88 million haircut. On the nonjudgment FRANs, I have no idea what Argentina is offering. I mean, it's "as much as 72.5 percent on their claim," but I suspect the emphasis is on "as much as." I have trouble imagining that Argentina is doing the same math that I am, getting a claim of 22.4 times par, and haircutting that to 16.2 times par. (Which would be about $1.1 billion for NML, assuming it still has $70 million of non-judgment FRANs -- a $430 million haircut on just $70 million face amount of bonds.) That's still just so much money -- and it rewards NML so much for waiting. If Argentina is offering NML and Aurelius the same deal on the nonjudgment FRANs that it is on the judgment FRANs -- 730 cents on the dollar -- then that would be less than one-third of what the claims are arguably worth. On just $70 million worth of bonds, that offer would be for $510 million, or a haircut of more than $1 billion. And that might still be worth fighting over. 13

The previous battles in the Argentine debt saga have been fought mostly over broad principles: the power of U.S. courts over sovereign debtors, the meaning of equal treatment of creditors, the equities of a deadbeat debtor versus vulture creditors. The endgame -- and this does seem to be the endgame -- will be much more specific, about interest rates and judgment dates and the relative value of different instruments and tactics.

Still, you can ask about principles here. Is it fair for NML to get paid interest at 101 percent a year on bonds issued in 1998, while Argentina has long since moved on and improved its credit profile? On the one hand, I mean, 101 percent is a lot. It wasn't the market yield on Argentina's exchange bonds, back before those bonds defaulted in 2014; even now, Argentina's 8.28 percent dollar bonds trade well above par, and they aren't even paying a coupon. 14 It doesn't accurately reflect the market's perception of Argentina's creditworthiness for most of the last decade.

On the other hand, whose fault was that? Argentina designed these bonds perfectly to reward holdout creditors: They pay interest based on the worst period of creditworthiness in Argentina's recent history, just before it completed its 2005 exchange offer. And they give holdouts very little incentive to compromise: At 101 percent a year, the holdouts are amply rewarded for the risk and delay of continuing to fight. If you're going to wage a decade-long fight with a sovereign over its defaulted bonds, these are the bonds you'd want to own. If you're a sovereign who might default, try not to issue bonds like these.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

- I have written about it a lot; one fairly straightforward summary is in footnote 2 here, and if you are in the dark I recommend that you read it and come back. Robin Wigglesworth of the Financial Times has a summary of the story in GIF format, if you're into that sort of thing.

- Here is the prospectus, which has the formula, though it is not of too much interest now. Basically the rate was calculated every six months based on the yield of some 11 percent Argentine bonds due in 2006, adjusted based on the spread between some 2027 bonds and a U.S. Treasury. The adjustment was relatively small in the grand scheme of things, though; these basically floated with the market yield on those 11 percent bonds, and when those bonds defaulted, the yield went way up.

- The general rule is: Never sell a credit-default swap on yourself. Linking your own debt to your credit spreads often sounds like a good idea, but it kind of defeats the purpose of selling long-term debt.I know that people will disagree with this -- go ahead and e-mail me about it -- but the Argentine experience is not a great one.

- This story is taken mostly from this 2010 opinion from the U.S. Court of Appeals for the Second Circuit, affirming this 2009 opinion from Judge Thomas Griesa in the Southern District of New York.

- Strictly, Morgan Stanley was the Determination Agent for the bonds, and calculated the interest; it stopped in 2005 because "the Republic did not renew Morgan Stanley's appointment or appoint another Determination Agent." There is no obvious sensible way to calculate what the right rate of post-maturity interest should be, really: The reference bonds had both defaulted and (after 2006) matured, so any yield on them was pretty theoretical.

- "None of the FRAN holders accepted" the 2005 offer, but after the 2010 offer only $298 million seem to have been outstanding. See footnote 58 here; the New York Court of Appeals gives the par amount of FRANs held by plaintiffs as "approximately $290 million." See also page C-2 in Argentina's 2005 exchange offer (listing $383.47 million of FRANs outstanding), and page C-9 in the 2010 offer (listing $300.599 million of FRANs outstanding).

- The judgment was granted as of June 1, 2009. Post-judgment interest in federal cases"shall be calculated from the date of the entry of the judgment, at a rate equal to the weekly average 1-year constant maturity Treasury yield, as published by the Board of Governors of the Federal Reserve System, for the calendar week preceding the date of the judgment," compounded annually. In the week ending June 1, 2009, the one-year Treasury rate was about 0.50 percent, so I have compounded the $311.2 million at 0.50 percent for the 6 2/3 years from June 1, 2009 through Feb. 1, 2016.

- See footnote 1.

- There was a proposed exchange offer that didn't work, an effort to work through English-law bonds, an effort to sell more bonds in Argentina, and an effort to pay off Argentine-law bonds in Argentina. (I drew some maps.) None of these especially worked.

- The math is a little fuzzy because I don't know the interest rate on the bonds between April 2002 (when they paid, or rather didn't pay, a semiannual rate of 36.406 percent) and April 2005 (when that rate was 50.526 percent). But I know the accrued interest as of June 2009 (from Judge Griesa's judgment), so I just start from there, adding 50.526 percent of principal every six months (not compounded), and accruing interest on that interest at 9 percent a year (not compounded).

- For more on the interest-rate details, I recommend a recent paper called "Settling Sovereign Debt's 'Trial of the Century,'" by Juan Cruces and Tim Samples.

-

For investors such as Brodsky and Singer, most of their claim on their bonds that don’t have a judgment comes from the interest accrual. Some of the bonds Singer owns accrue interest at an annual rate of more than 100 percent, according to court documents.Brodsky is Mark Brodsky, chairman of Aurelius.

- I mean, it's a lot of money, and they've waited a long time. NML bought at least some of the FRANs after they were supposed to mature in 2005, meaning that it's held them for a bit more than 10 years. Even if it bought them at par -- and, when they were defaulted and non-paying in 2005, that seems generous -- then 7.3 times par is better than a 20 percent annualized return. But 22.4 times par is about a 35 percent return.

- Bloomberg shows a last trade at 117.45, for a "yield" of 6.377 percent, which requires some imagination since they haven't paid a coupon since 2014.