Argentina Agrees to Borrow $5 Billion From Wall Street Banks

Argentina’s central bank reached terms with seven Wall Street banks for $5 billion of loans as the government looks to bolster reserves ahead of talks with holdout creditors next week.

The one-year loan, finalized Friday, will be backed by sovereign bonds, according to an e-mailed statement from the central bank.

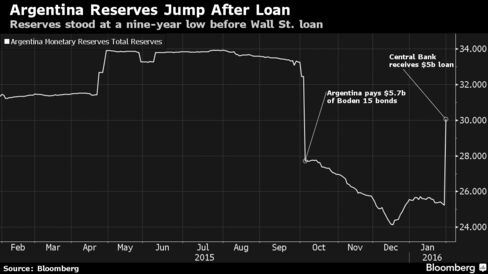

Argentina has been seeking to shore up its central bank reserves after years of currency controls and policies that discouraged investment and depleted the country’s supply of dollars. Unable to tap international bond markets because of a decade-long feud with creditors left over from the nation’s 2001 default, the country’s cash hoard dropped to a nine-year low last month. Next week, officials will begin settlement talks with holders of some defaulted bonds who won a U.S. court order requiring they be paid in full.

HSBC Holdings Plc, JPMorgan Chase & Co. and Banco Santander SA are each providing $1 billion in loans, according to three people familiar with the matter who asked not to be identified because the information is private. Deutsche Bank AG, Banco Bilbao Vizcaya Argentaria SA, Citigroup Inc. and UBS Group AG will each provide $500 million, the people said. The interest rate is Libor plus 6.15 percentage points, the people said.

Press officials for Citigroup, Santander, JPMorgan and HSBC declined to comment on the loan. Officials at BBVA, Deutsche Bank, UBS and Argentina’s Finance Ministry didn’t immediately reply to a request for comment. The central bank declined to comment beyond its statement.

Finance Secretary Luis Caputo will meet debt mediator Daniel Pollack Feb. 1 and Feb. 2 in New York to begin the process of opening negotiations with the holdout creditors, according to a ministry official. After bolstering reserves, Argentine authorities will have more bargaining power in the talks, according to Hernan Yellati, the head of research and strategy at BancTrust & Co.

“This is a good way of raising confidence and increasing reserves so that the government can negotiate with the holdouts without an urgency that might put Argentina in a situation where they need to accept worse terms,” Yellati said from Miami. "It’s a positive first step."

Argentina’s reserves rose by $4.8 billion Friday to $30 billion, the highest since Oct. 2, according to a central bank statement a few hours after the deal was finalized Friday.

In his first month in office, President Mauricio Macri has undone policies put in place by his predecessors that throttled foreign investment, moving to remove currency controls and being talks with the holdout creditors. In an interview with Bloomberg at the World Economic Forum in Davos, Switzerland, Macri said he aims for a "realistic, reasonable settlement" with the holdouts.

"We want to finish all our conflicts of the past," he said.

The holdouts, who are trying to limit the nation’s ability to raise money offshore to pressure Argentina to comply with a court order to repay their defaulted debt, subpoenaed HSBC in late December for information on Argentina’s efforts to raise cash, according to a person familiar with the matter. U.S. District Judge Thomas Griesa has prohibited Argentina from paying future overseas creditors before settling with the holdouts.

Keine Kommentare:

Kommentar veröffentlichen