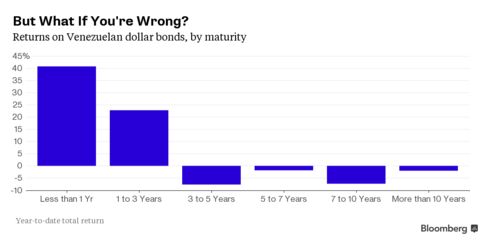

The Contrarian Venezuela Bond Trade That's Delivering 37% Return

- PDVSA's soon-to-mature bonds deliver the biggest gains

- Barclays, Jefferies says longer-dated debt still best bet

Want to make money in Venezuela’s bond market? Ignore the conventional wisdom.

Stone Harbor Investment Partners LP has done just that. The New York-based money manager has been buying up the country’s soon-to-mature notes as a bet the struggling oil-producing nation will scrounge up enough cash to continue making payments in the short-term. The move has paid off, with bonds maturing next month from Venezuela’s state-owned oil company returning 37 percent since the end of 2014. On average emerging-market bonds lost 0.5 percent this year.

Stone Harbor’s strategy is at odds with analyst recommendations at banks from Barclays Plc to Jefferies Group. With the likelihood of a Venezuela default high, they say investors are better off buying the country’s cheaper, longer-dated bonds as those securities will give them the best chance to recoup their money in the event of a restructuring.

“We think they will make payments over the next two to three years,” Stuart Sclater-Booth, who helps manage $56.5 billion at Stone Harbor, said in an e-mail. “Long-term it is very hard to know. We’re not marrying Venezuela, just dating.”

He said Stone Harbor has focused its Venezuelan investments on shorter-maturity debt since the fourth quarter of last year. Petroleos de Venezuela SA’s $1.4 billion of 5 percent bonds due next month traded at 100.1 cents on the dollar on Monday, up from 64 cents in January, according to Trace, the bond-price reporting system of the Financial Industry Regulatory Authority.

Stone Harbor estimates the government and PDVSA, as the oil producer is known, have already bought back close to $1 billion of the notes due next month and $750 million of the company’s bonds maturing in 2017.

Venezuela’s Information Ministry didn’t respond to an e-mailed request for comment on PDVSA’s plans to make bond payments next month or whether the state oil company has been repurchasing its debt.

To Barclays’s Alejandro Grisanti, betting on the short-dated securities remains a high-risk strategy. Instead, he recommends PDVSA’s bonds due in 2024 and 2037. In a Friday note to clients, the London-based bank said it expects Venezuela, which is mired in “the worst economic crisis in its history,” to make debt payments until at least the first quarter of next year.

“If PDVSA makes a payment on the October 2016 bonds, of course the return is very high,” Grisanti said. “But also, you could have a very strong risk of non-payments. These bonds are traded at a price near 80%, when the recovery value could be 40%. You could lose a lot of money if PDVSA were to default.”

Barclays estimates Venezuela’s economy may contract 9.1 percent this year and 4.2 percent next year, while inflation may end the year at 190 percent. The price PDVSA commands for its oil has plunged 53 percent in the past year to $40.51 last week. Venezuela depends on crude for 95 percent of its export revenue.

“Buying into the front end is high risk because if you’re wrong, you’re really wrong,” Siobhan Morden, head of Latin American fixed-income strategy at Jefferies, said from New York. “It’s much more aggressive and requires much more conviction on the timing of default. You’re making a decision about willingness and ability to pay based off very limited information. Most people trade the back end because it’s easier doing recovery-value analysis than trying to estimate willingness to pay.”

Swaps traders are betting there’s a 76 percent chance Venezuela will default by December 2016. That’s the highest for any sovereign in the world.

Still, Jorge Piedrahita, chief executive officer of brokerage Torino Capital LLC, says Venezuela’s short-term debt continues to make the most sense. He recommends buying PDVSA and Venezuela government bonds maturing in 2016.

“We still don’t see a default in Venezuela and the short-dated paper, over and over again, offers better returns than long-dated” notes, Piedrahita said from New York.

Keine Kommentare:

Kommentar veröffentlichen