Venezuela Credit Dashboard: Default Risk Spikes as Payment Looms

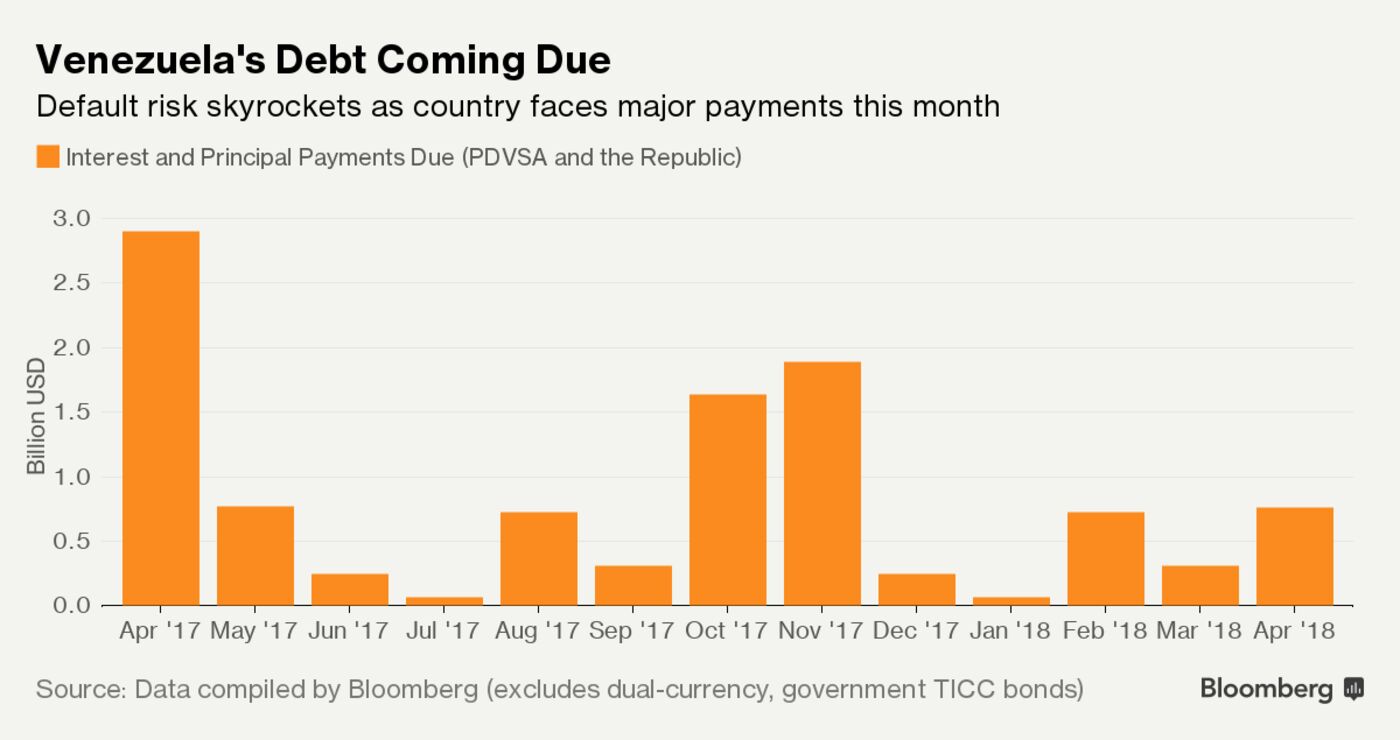

by- PDVSA faces a $2 billion bond payment due on April 12

- International reserves remain low as oil prices tumble

Why Venezuela's Many Crises Keep Getting Worse

Traders boosted their bets on a Venezuela default as state oil company known as PDVSA faces a $2 billion bond payment next week.

The implied probability of nonpayment in the next 12 months surged to 56 percent in March from 40 percent in February, according to credit-default swaps data compiled by Bloomberg. That’s the biggest jump in the perceived risk of a short-term default since November, when cash-strapped Petroleos de Venezuela SAmissed coupon payments due on its bonds and had to use a 30-day grace period as the opposition called for a national strike and protests.

The political turmoil just got worse. Venezuela’s sovereign bonds plunged after the Supreme Court said March 29 it would take over the duties of the opposition-controlled National Assembly -- a decision that was reversed on Saturday. If PDVSA manages to pay its debt on April 12, the company and Venezuela will get some breathing room before facing payments of $3.5 billion in October and November. The odds of a credit event over the next five years is 92 percent, according to CDS data.

Market Voices

- “I still think they’re going to pay. Things aren’t easy. They’re really pulling the coins out of the sofa to pay these bills. Do I think they have the entire $2 billion dollars right now? I think they have a little here, and a little there. I think they’ll be able to cobble it all together. Fighting a political war and defaulting at the same time would just open up too much for them. I still think that the willingness and ability to pay are there” -- Ray Zucaro, chief investment officer of Miami-based RVX Asset Management

- “Given our research and all the tells -- especially that they were already so broke that PDVSA was two weeks late and in technical default in November -- and that Venezuela and PDVSA must pay $3.7 billion over the next two months, I would not have my money in this credit at the moment. And I would certainly not be in the maturing PDVSA 17 where you risk 95 cents to make 5. Even Vegas gives you better odds than that!” -- Russ Dallen, managing partner at Caracas Capital

Venezuela Dashboard Indicators

- Venezuela’s dollar bonds had their worst month since January 2015, with benchmark $4 billion of notes due in 2027 falling 12 percent in March to 46.2 cents on the dollar; yields rose to 23.1 percent

- PDVSA’s oil export basket price slid 12 percent to $41.46 a barrel

- Venezuela’s international reserves were mostly flat in March, continuing to hover around a 15-year low of $10.4 billion

- The weakest official exchange-rate, used mostly for imports deemed non-essential, slumped 1.4 percent in March to end the month at 709 bolivars per dollar

- On the illegal black market, the U.S. currency costs more than five times as much. With the government saying they plan to re-launch the alternative market this week, investors will be watching to see if it actually does anything to help alleviate the country’s ongoing shortage of hard currency

Keine Kommentare:

Kommentar veröffentlichen