Ukraine Bonds Drop Before Sunday Payment Deadline Amid Deal Bets

Ukrainian bonds headed for a weekly decline before an interest payment comes due that will shed light on the government’s progress in negotiating a $19 billion debt-restructuring with creditors led by Franklin Templeton.

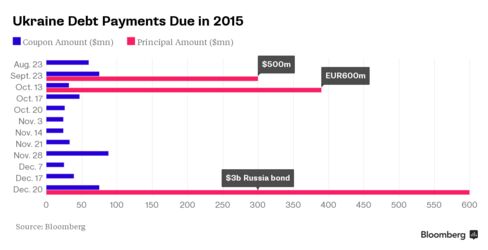

Speculation is growing that the eastern European nation is getting closer to bridging its differences with bondholders that own almost half of its external debt. The war-ravaged nation would need to make any restructuring offer within days to ensure it allows enough time for consideration by creditors before $500 million of notes fall due Sept. 23.

Ukraine has a $60 million interest payment due on Sunday toward a $1.5 billion note maturing in 2021. That security has fallen for five days to 55.77 cents on the dollar. Failure to pay could suggest the government is trying to put pressure on creditors to quicken the pace of talks. There is a 10-day grace period before default is declared and the country previously threatened to freeze Eurobond payments if a deal isn’t reached.

"Either a deal or a moratorium is likely next week," Pavel Mamai, who helps oversee $150 million in emerging-market assets, including Ukrainian bonds, as co-founder of Promeritum Investment Management LLP in London, said on Friday. "A deal is is more likely than a moratorium."

While bonds have fallen this week, they’ve handed investors thelargest returns in emerging markets in the past month, suggesting an agreement may be favorable to creditors. The main point of contention has been the amount of debt relief creditors will shoulder, with people familiar with the negotiations signaling that the two sides have eased their initial positions for a 40 percent writedown on the government side and no reduction from the creditor side.

The nation’s $2.6 billion of bonds due July 2017 climbed 0.6 cent by 1:28 p.m. in Kiev to 55.55 cents on the dollar, trimming the weekly loss to 2.49 cents.

“Quite a few people penciled in Wednesday as five weeks before the Sep. 23 maturity and get more nervous now in the absence of any news,” Fyodor Bagnenko, a Kiev-based bond trader at Dragon Capital, said by e-mail on Thursday.

Keine Kommentare:

Kommentar veröffentlichen