Like Chesapeake? Buy The Bonds, Not The Stock

Disclosure: I am/we are long CHESAPEAKE BONDS. (More...)

Summary

The better play is not the common shares.

The bonds have a better risk/reward.

Bondholders will be in better shape in the event of bankruptcy.

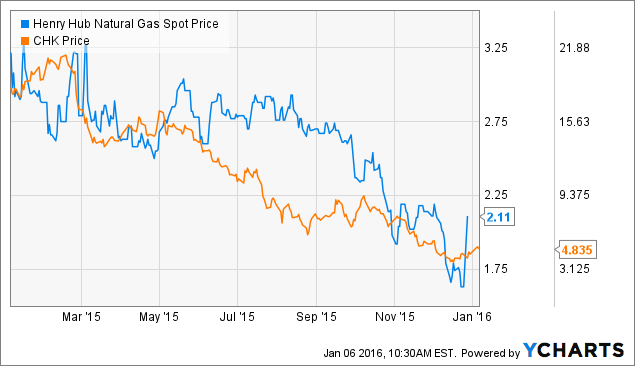

Chesapeake Energy Corp.'s (NYSE:CHK) stock price took a dive this past year down over 70%. They are the 2nd largest natural gas producer in the United States with billions in assets. Recovery of natural gas prices are still a distant dream for Chesapeake with storage well above the 5-year average and El Nino winter. Chesapeake did not hedge well against the drop in prices, which is hurting them in the intermediate term. Below is the correlation between natural gas prices and Chesapeake's common shares.

Chesapeake has a slew of problems with the worst being bankruptcy. Secured and unsecured bondholders would receive part of their money back in this case. I think Chesapeake will survive this downturn in natural gas prices, which is why I am investing. Where I am investing is not the common shares but the bonds.

Why should an investor put their money in the bonds? They offer a better risk/reward than the common shares. An investor buys $10,000 in the 2/2021 6.125% coupon bond. This currently trades at $0.32 on the dollar. An investor would buy $31,000 in face value with a 6.125% coupon for $9,920. Currently, the bonds have 10 more semiannual coupon payments.

Best Case

In the scenario Chesapeake never defaults, does not sell assets, and commodity prices rise back to a "normalized" level. The 2021 bondholder would collect about $10,000 in coupons plus their $31,000 in face value for a total of $41,000. That is a $31,080 gain on a $9,920 investment in only 5 years. The same person could buy about 2,000 shares of CHK. To break even, the common shares would need to rise to $20.50, which in this scenario is likely. In this case, the common shares would outperform the bonds. However, this scenario is rather overly optimistic.

Probable Case

Chesapeake begins to sell assets or dilute common shares to cover shortfalls in cash. This prevents default on bondholders. This case is very dangerous for shareholders as it limits future earnings. Bondholders would receive the same $41,000 as before, but it is highly unlikely the common stock returns above $15 for an extended period. This scenario has the common shares underperforming the bonds by a wide margin.

Worst Case

Chesapeake is unable to prevent bankruptcy and starts to liquidate the company. Bondholders would stop receiving coupon payments and the common shares are now worthless. Hypothetically, this event happens in late 2017. The bondholder would receive about $2,700 in coupon payments before the bankruptcy. So now, we would have to look at the assets to determine who receives what. Secured bondholders are first and would more than likely receive their full face value. For this worst case, I am going to devalue their assets in half. Even in this worst case, unsecured bondholders would receive about $0.35 for a dollar of face value. This means a 2021 bondholder would end up with $13,650 or a $3,730 gain. For a bondholder to lose money in this bankruptcy scenario, the payout would have to be less than $0.23 on the dollar. On the other hand, shareholders have nothing.

This all boils down to the risk-reward for an investor. The bondholder has nearly the same reward as a shareholder but way less risk. I like Chesapeake for the long run as natural gas is an important source of energy in the United States. The increase in demand for power generation and LNG exports are long-term positives. For someone who is bullish over the next 5 years for Chesapeake, sell the stock and buy the bonds.

Keine Kommentare:

Kommentar veröffentlichen