Samstag, 23. Juli 2016

Rothschild Said to Approach PDVSA Creditors to Form Group....und die Charts dazu....

Sonntag, 24. Juli 2016

Rothschild Said to Approach PDVSA Creditors to Form Group

Rothschild Said to Approach PDVSA Creditors to Form Group

othschild & Co. is approaching Petroleos de Venezuela SA bondholders in a bid to form a creditor group and draft a proposal for a voluntary swap of about $8 billion of the oil company’s short-term debt for notes with later maturities, according to people with knowledge of the matter.

The advisory firm has been in contact with some investors directly and held a group conference call Monday, said the people, who asked not to be identified because the talks are private.

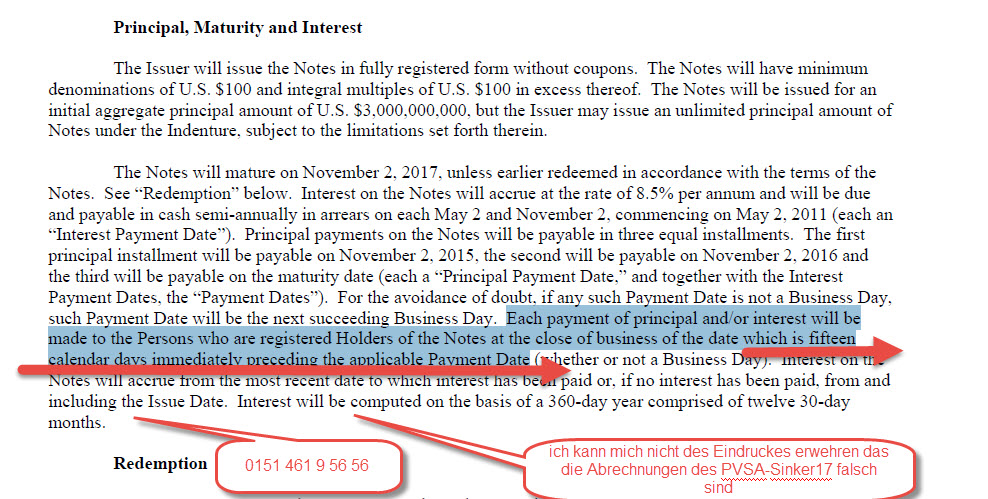

Rothschild discussed with investors a plan to swap PDVSA bonds due in October and in 2017 for a basket of five securities maturing in 2024 and beyond, said three of the people. Rothschild told investors that it believes management at Venezuela’s state-controlled oil company is open to increasing its debt load in order to get a swap done, the people said.

Rothschild is one of many firms proposing financing strategies and its plan hasn’t been approved by the oil producer, PDVSA said in an e-mailed statement. Claire Gorman, a spokeswoman for Rothschild, declined to comment.

On Saturday, Venezuelan Oil Minister and PDVSA President Eulogio Del Pino said that he had bad news for those waiting for the company to fail and that the next few days would bring important announcements from different parts of the industry. He also said PDVSA was working with drillers and service suppliers on a plan to convert commercial debt into financial debt, which would allow companies to continue operating in the country, according to a July 16 statement posted on PDVSA’s website.

The company’s revenue from oil sales slumped 46 percent in 2015 to $55.3 billion as crude prices collapsed, fueling speculation the producer may not have the cash to stay current on its debt. The company has about $11.5 billion due in interest and principal payments on dollar bonds due the rest of this year and next, according to data compiled by Bloomberg.

Einges

Keine Kommentare:

Kommentar veröffentlichen