Venezuelan Credit Dashboard: Bonds, Crude Export Prices Rebound

Venezuela, which has the largest crude reserves on the planet, has defied predictions of default since the oil collapse started in 2014 and analysts are split as to how long the nation of 30 million can hold out. With that in mind, Bloomberg is taking a close look each month at some of the key components that may determine its fate.

Debt Payments

The government and state oil company Petroleos de Venezuela SA only need to pay $70 million this month after $45 million in June, according to data compiled by Bloomberg. August is looming, though, and interest payments totaling $726 million are set to come due.

Venezuela’s economic crisis and heavy debt burden became front-page news in China last month, with official media paying close attention to the $65 billion the Asian country has loaned Caracas since 2005. Local newspaper El Nacional reported that China had agreed to relax the terms of some of its loans to Venezuela to help ease the country’s finances this year and next.

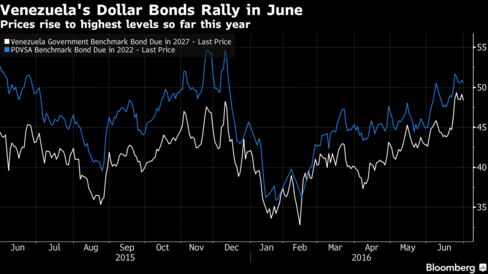

Bond Prices

Venezuela’s dollar bonds rallied in June to their highest levels of the year, as looting in some parts of the country and speculation about the political future of President Nicolas Maduro pushed traders to bet that change was coming. The government’s benchmark notes due 2027 are trading at 48.63 cents on the dollar and yielding 21.56 percent. The price rose 14 percent in June, demonstrating how the volatile political situation can create big winners - or losers - on Wall Street.

PDVSA’s $3 billion of bonds due in 2022 rose 12.7 percent in June to 50.3 cents on the dollar to yield 32.54 percent.

Credit-Default Swaps

Trading in credit-default swaps show that investors continue to lower short-term default expectations. While Venezuela is still by far the most likely country to default in the world, the implied probability that it happens over the next 12-months fell to 56 percent from 62 percent at the end of May and 82 percent earlier this year. The probability of a default in the next five years is 93 percent, according to credit-default swaps. Highlighting the still very real risk of nonpayment, Moody’s Investors Servicewarned on June 20 that it was “highly unlikely” that Venezuela would have enough hard currency to fully make its debt payments this year.

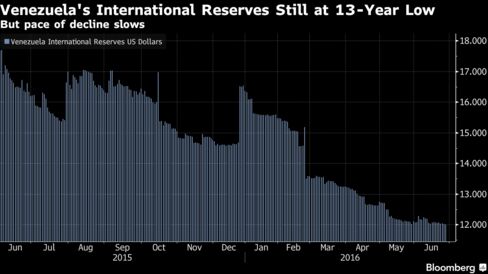

Central Bank Reserves

Venezuela’s international reserves held close to their 13-year low of $12 billion in June, but the good news is that the pace of decline decelerated. Reserves have only fallen about $103 million in June, after declining $637 million in May and $502 million in April, according to data compiled by Bloomberg. In Fact, June was the least volatile month in terms of the change in reserve levels since last September.

Currency Rates

Venezuela’s weakest official exchange rate, used mostly for imports deemed non-essential, slid 15 percent in June to 627.6 bolivars per dollar after plunging 29 percent in May and has tumbled 68 percent so far this year. The complementary system, known as DICOM, accounts for about 8 percent of the government’s hard currency sales. It sells the rest at the priority rate of only 10 bolivars per dollar.

The devaluation of the currency decelerated to the slowest monthly pace since February, giving credence to economy Vice President Miguel Perez Abad’s comments in a May interview that the DICOM exchange rate was close to reaching “equilibrium.” It’s still got a ways to fall before catching up with the illegal, black-market rate, though.

Crude Prices

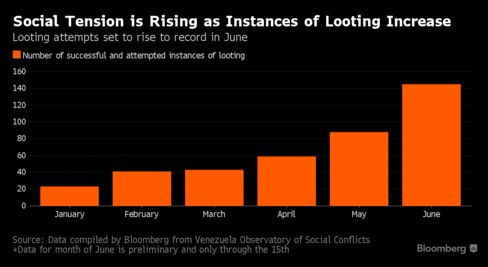

Social Tension

Social tensions are rising as the country, with its limited access to dollars, tightens restrictions on imports. In June, the number of attempted and successful looting incidents is set to rise to a record, according to preliminary data from the Venezuela Observatory of Social Conflicts. Food riots and looting in the eastern city of Cumana left several dead and hundreds detained in mid-June.

Venezuela’s opposition is continuing to push for a referendum to recall President Maduro and says electoral authorities have verified more than double the amount of signatures needed to move to the next step. The government will try to delay any vote into next year which would allow the vice president to take over if Maduro is recalled, according to Eurasia Group.

An official dialogue between the opposition and the government, the recall referendum and potential actions by the Organization of American States don’t have to be “mutually exclusive,” U.S. Under Secretary for Political Affairs Thomas Shannon said on June 24 after holding talks with government and opposition officials in Caracas in an effort to deescalate tensions.

Keine Kommentare:

Kommentar veröffentlichen