Puerto Rico Will Default on Bank Debt as Crisis Intensifies

Puerto Rico will default on a $422 million bond payment for its Government Development Bank, escalating the pressure on investors to negotiate a broad debt restructuring and on Congress to act on legislation to help lessen the island’s financial crisis.

Governor Alejandro Garcia Padilla invoked a debt moratorium law approved last month, saying during a televised address Sunday that the commonwealth needs to focus on providing essential services. The bank, already operating under an emergency period, has until the end of Monday to make the payment. Garcia Padilla said during a press conference Monday that the commonwealth can’t afford to make its July bond payments.

“Faced with the inability to meet the demands of our creditors and the needs of our people, I had to make a choice,” Garcia Padilla said during his 10-minute speech. “I decided that essential services for the 3.5 million American citizens in Puerto Rico came first.”

GDB’s missed payment may open the door to larger and more consequential defaults on general-obligation bonds, which are protected by the island’s constitution. Puerto Rico and its agencies owe $2 billion on July 1, including $805 million for general obligations. It also could affect slow-moving efforts by U.S. lawmakers to resolve the biggest crisis ever in the tax-exempt, municipal bond market.

After announcing the default, the GDB said it reached a tentative agreement with a group of hedge funds who hold $900 million of its debt under which creditors would accept a potential haircut, leaving them 47 cents on the dollar of the face value of their original securities. The parties agreed to keep discussions out of court while they continue to negotiate. It reached a similar agreement Friday with credit unions holding about $33 million in debt.

Creditor Negotiations

Even with the debt-deferral agreements, credit-rating companies said a default was inevitable. Moody’s Investors Service analystssaid last week that any non-payment, even if creditors agree to it, constitutes a default in their eyes. S&P Global Ratings said a distressed debt exchange or temporarily withholding interest is synonymous to default.

“The holders of a portion of the GDB’s debt cannot negotiate for everybody,” said John Miller, co-head of fixed income in Chicago at Nuveen Asset Management, which oversees $110 billion in munis, including some Puerto Rico debt. “That’s one of the complications in coming to a resolution. If you expand that out across 18 types of bonds, these individual negotiations are very difficult.”

Record Default

A default on the general-obligation bonds would be the first by a state-level borrower since Arkansas missed payments on its debt in 1933. That would likely trigger a restructuring of the commonwealth’s $13 billion of general obligations, which would be the largest-ever in the tax-exempt market.

The non-payment by the GDB alone will push the amount of outstanding munis in default up by 44 percent, to $23.6 billion from $16.4 billion, according to a tally from Municipal Market Analytics. That would make 0.64 percent of the $3.7 trillion market in default, up from 0.44 percent.

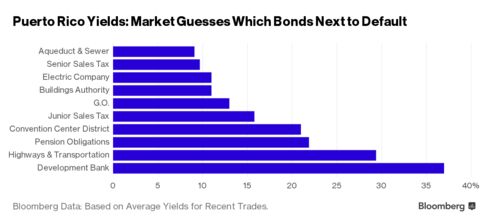

Puerto Rico racked up $70 billion of debt across more than a dozen issuers as it borrowed to paper over budget deficits. Garcia Padilla said 10 months ago that the obligations were unpayable. Yet, up until now, the commonwealth only missed $143 million of payments on appropriation bonds from the Public Finance Corp. and rum-tax securities from the Infrastructure Financing Authority.

Fiscal Agent

The development bank, in contrast to those borrowers, is a prominent, visible and well-known Puerto Rico entity set up after the Great Depression to chart a course out of poverty. It’s the fiscal agent of the commonwealth, lending to the island government and localities. For the past few weeks it has operated under a state of emergency to preserve cash.

The lender was designed to promote business investment with a long-term horizon, but in recent years politicians turned it into a piggy-bank that lent to the government and its agencies, helping keep them afloat as the island’s economy shrunk every year but one since 2006. About 45 percent of residents live in poverty. Puerto Ricans have been fleeing the island at record rates for work on the U.S. mainland.

Congressional Talks

The default comes as the House Natural Resources Committee is working on a bill that would establish a federal oversight board to manage any debt restructurings and weigh in on spending plans. It’s set to file a new draft after lawmakers return from recess on May 10. The committee last month postponed a vote on the measure as lawmakers from both sides and the U.S. Treasury Department sought to make changes to the bill.

“We can’t wait longer. We need this restructuring mechanism now,” Garcia Padilla said about the federal bill. “We do not want and we haven’t been offered a bailout. A restructuring process will cost nothing to American taxpayers. We simply want the legal tools needed to address our insolvency crisis and ensure the sustainability of Puerto Rico.”

Other Payments

The island owes $470 million in total to bond investors in May, including a $1.6 million general-obligation payment. Puerto Rico will pay everything Monday except for the GDB principal, according to Barbara Morgan, a spokeswoman for the GDB at SKDKnickerbocker in New York.

The GDB bond in question, which matured May 1, is a $400 million taxable security issued in 2011 with a 4.7 percent interest rate. It last traded in March at about 32 cents on the dollar.

Those with the largest positions, according to the latest disclosure filings compiled by Bloomberg: Thompson Investment Management, $24 million; Frost Investment Advisors, $11.2 million; Baird Financial Group, $5.1 million; Texas Mutual Insurance Co., $2 million; Merchants Mutual Group, $1.5 million; and UBS Asset Managers of Puerto Rico, $1 million.

The tentative accord with investors holding $900 million of debt involves bondholders swapping their securities in the near term at a 56.25 percent recovery rate, the bank said in a statement. If Puerto Rico at a later date reduces most of its debts through a broader restructuring, then the final recovery rate on GDB bonds would be 47 percent of the original value. The GDB will pay May 1 interest on the bonds in full.

Members of the so-called Ad Hoc Group of bondholders include Avenue Capital Management, Brigade Capital Management, Claren Road Asset Management, Fir Tree Partners, Fore Research & Management and Solus Alternative Asset Management.

Keine Kommentare:

Kommentar veröffentlichen