After Historic Singer Deal, Argentina Eyes $15 Billion Bond Sale

Argentina’s deal to put a bitter 15-year creditor saga behind it won’t come cheap.

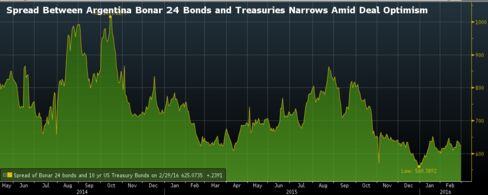

On Sunday, the country agreed to terms with bondholders led by hedge fund billionaire Paul Singer over unpaid debts from its record $95 billion default in 2001. The settlement, which will let Argentina regain access to overseas bond markets, is the biggest, and arguably the most significant, in a string of creditor accords struck by President Mauricio Macri since he took office Dec. 10.

The tab for all these deals? As much as $15 billion -- which will be all raised from two or three bond sales in April, Finance Minister Alfonso Prat-Gay said Monday.

While Argentina’s notes have been in high demand on optimism Macri will restore confidence and get the economy moving again, the government will need to borrow money just at a time when there’s little appetite for risky emerging-market debt. In the face of tepid global growth, Argentina may have to pay a half-percentage point above its prevailing borrowing costs to entice bond buyers, according to Seaport Global Holdings LLC strategist Michael Roche.

“Now comes the interesting part,” said Kevin Daly, a London-based money manager at Aberdeen Asset Management, which oversees about $11 billion of emerging-market debt. “There’s potentially a lot of supply that’s going to hit the market, which could lead to some market volatility. There are rocky challenges ahead, but I think they will be able to deal with those.”

The deal calls for Argentina to pay $4.65 billion in cash to Singer’s Elliott Management and fellow hedge funds Aurelius Capital Management, Davidson Kempner and Bracebridge Capital, according to a court-appointed mediator. The amount is equal to 75 percent of almost $5.9 billion in claims on unpaid principal and interest, plus $235 million in other claims and some of the holdouts’ legal fees, the mediator, Daniel Pollack, told reporters Monday in New York. The agreement has an April 14 deadline that could be extended if necessary, Prat-Gay said Monday.

Terms of the agreement are better than the previous offer of 72.5 percent of creditors’ claims and mark a significant improvement from earlier restructurings that imposed losses of about 70 percent on debt holders. About 7 percent of creditors, including Elliott, rejected those initial terms -- which were offered in 2005 and then again in 2010 -- and pursued repayment in court.

The agreement with Singer came weeks after Argentina agreed to pay more than $3 billion to other so-called holdout creditors, including 50,000 Italian bondholders. All the deals are subject to congressional approval.

“All the banks we’ve spoken with are confident that we can raise the money we need in the market,” Finance Secretary Luis Caputo told reporters Feb. 22. “We’re optimistic.”

Alejo Costa, the head of strategy at Buenos Aires-based brokerage Puente, estimates Argentina will need to sell about $11 billion to pay the holdout deals and an additional $8 billion to fund its fiscal needs. He expects that kind of issuance to push average yields on Argentina’s longer-dated bonds closer to 8 percent.

Sergio Trigo Paz, head of BlackRock Inc.’s emerging markets fixed income, agrees. Trigo Paz said at a press conference in London on Tuesday that Argentina may have to pay more than 8 percent on new debt and that he’s “not that excited” about the country’s return to bond markets as there are other countries with more favorable technicals paying higher yields.

But for the government, the deal is a long-term investment. Prat-Gay said Monday that once the holdouts agreement is fully resolved, Argentina expects to be able to issue debt at rates of 4.5 percent, similar to Uruguay.

The nation’s dollar notes due in 2024, that were issued under local legislation, yield 7.92 percent, data compiled by Bloomberg show. Foreign law bonds remain in default.

Sebastian Loketek, the Buenos Aires-based managing director and head of Bank of America Corp.’s Argentina unit, isn’t particularly concerned about the nation’s ability to drum up buyers.

“Argentina is becoming a hot topic,” he said. “We expect there will be strong demand.”

The government isn’t the only potential issuer. Pent-up financing needs among provinces and companies will mean they will also look to tap the bond market. But they will likely have to wait their turn, said Aberdeen’s Daly.

“Investors want to see how the new sovereign benchmark settles in the market,” he said. “I don’t think they need to jump ahead of the queue of the government.”

Keine Kommentare:

Kommentar veröffentlichen