PDVSA Needs A Reorg - Goldman Sachs Can Help... And So Could You

Summary

Senior unsecured creditors should declare Venezuela's national oil company in default.

Sending PDVSA a default notice can move forward a restructuring.

A restructuring raises a really big question - who should represent the sovereign equity owner.?

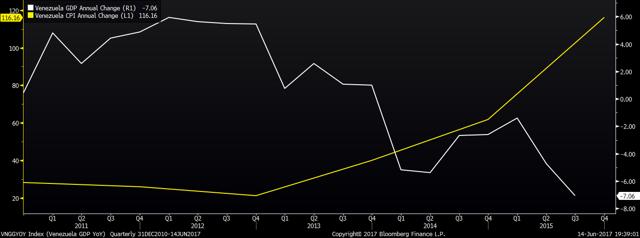

Venezuela is in the final throes of an economic, political and social collapse on the order of the Great Depression in the 1930s and not seen in an advanced economy since Russia's implosion in the early 1990s. Low level tremors first felt 5 years ago have since cracked loudly into a full-scale seismic catastrophe. Its economy over the past 5 years has lost more than a quarter of its size, yet still ranks 42nd in the world by nominal GDP. Last year, real GDP declined 10% and consumer price inflation rose 400%. Economists expect an even larger contraction in real GDP this year and an addition 555% hike in its CPI. Venezuelan currency is basically worthless. If you want to buy a US Dollar in the Caracas black market, it will cost you 6,000 Bolivars. A picture of the annual changes in GDP and CPI below sums up the situation:

The implosion has been stunning. A member of OPEC, Venezuela has the world's largest oil reserves, ranks 8 th in terms of natural gas reserves and consistently ranks among the world's top 10 crude oil producers. Its economy and politics are deeply correlated with and enmeshed in the energy business, the result of a long history of intermingling government with the oil business. In 1973, Venezuela voted to nationalize its oil industry and, in 1976, the national oil company Petróleos de Venezuela (or PDVSA) executed that plan by taking control of multiple foreign owned holding companies. It then built a vast refining and marketing system in the U.S. and Europe. The economy of Venezuela became highly dependent on petroleum revenues.

The average sale export price of crude oil was $88.92 per barrel in 2014 and then dropped to $44.65 per barrel in 2015. With each downtick in the price of oil, PDVSA's - and hence Venezuela's - revenues decline. The pattern is nothing new. For example, from 2006 through 2010, petroleum sector products accounted for an average 91% of Venezuela's total exports, its revenues were about 45% of Central Government revenues, and 12% of the country's GDP. However, the nation's troubles were already deeply underway even before the major crash in oil prices began in mid-2014 because of corruption and socialist government mismanagement of Venezuela's national energy assets.

At the epicenter of the present economic cataclysm are almost daily, often lethal political protests against President Nicolás Maduro and the repugnant, creeping authoritarianism he has pressed on Venezuela's citizens solely to maintain his grasp on power. Maduro's obsession with crushing dissent has included the use of military tribunals to jail some 1,500 activists and, when that proved insufficient, an attempt to replace Venezuela's democratically elected legislature wholesale via a judiciary still largely under his thumb. A brief Venezuela political history lesson - or reminder - in case you haven't had one recently should help. From December 2005 to January 2016 the Partido Socialista Unido de Venezuela, or PSUV, the political party then led by President Hugo Chávez, held a majority of seats in the Asamblea Nacional (or National Assembly). The PSUV, with support across most of Venezuela, also ran most of its state governments. In the National Assembly elections of September 2010, the PSUV won 98 seats and opposing parties won 67 seats. In October 2012, Chávez was re-elected for a new 6-year term but died in March 2013, leaving then vice-president Maduro as the incumbent until the next election. In April 2013, Maduro was elected president for a 6-year term when he narrowly defeated his opponent Henrique Capriles. Six months later, he began ruling by decree.

In December 2015, the opposition group known as Mesa de la Unidad Democrática, (or MUD) won 112 seats and PSUV won 55 seats. Although MUD controls a majority in Venezuela's National Assembly, Maduro has pushed to re-write the country's constitution without any legal authority to do so. In May 2016, opposition leaders petitioned the National Electoral Council (or CNE) to permit a referendum to recall Maduro. In response, Maduro's intelligence service arrested seven activists involved in filing the referendum. Demonstrations against Maduro's government have since left 67 people dead and about 13,000 more injured. In March 2017, the National Assembly sought help from the Organization of American States. The legislature approved a formal measure of support for the application of the OAS's democratic charter to Venezuela in an effort to push Maduro to set a date for regional elections, release political prisoners, and offer solutions to the economic crisis. Maduro accused the National Assembly of treason.

These assaults on Venezuela's democracy are difficult enough to read about, but anyone with a moral conscience has been thoroughly disgusted by the televised video footage showing Venezuela's national guard shooting Venezuela's citizen protesters, starving Venezuelans on hunger rampages, riots in its working-class districts, tear gas blowing through dilapidated slums, hospitals emptied out of critical medications, and people dying in desperate escape attempts. Hugo Chavez became Venezuela's president in 1999 and, since then, about 2 million of its citizens have fled to Chile or other countries, a figure which includes many of Venezuela's doctors. Last year, Venezuela's overall mortality rate soared by 66% and the infant death rate exceeds Syria's.

And what should you do about this…?

This article provides retail investors with a look at the financial incentive to indirectly help ameliorate the crisis via investment in specific mutual funds holding major positions in PDVSA senior unsecured notes. Those positions should increase in value, but only if fund managers are pressed by activist shareholders to preserve and upgrade the key underlying energy assets which pay the interest and principal on the senior notes. Eyes need to be opened up to the need for an immediate, albeit temporary, suspension of debt service payments in order to redirect cash back into energy-related capex. Failing to do so will permanently impair those assets, which is not in the interest of PDVSA creditors. In addition, as described below, at least one of Venezuela's biggest lenders - Russia - is actively negotiating to obtain additional secured liens from the Maduro government against PDVSA's CITGO Holding subsidiary. Should Venezuela default on payment of those loans, not only would senior unsecured noteholders lose significant collateral supporting the payment of their interest and principal, but under certain circumstances Russia would take control of one of America's top ten refiners.

Retail investors should target their investments into funds with the highest exposure to PDVSA senior unsecured notes issued by the national oil company is a potential cudgel that can be used to accelerate the political outcome and thereby create a better financial return. Fidelity has the biggest aggregate exposure to PDVSA and the specific Fidelity funds which own the bonds include these: Fidelity Advisor Emerging Markets Income Fund (MUTF:FAEMX), Fidelity New Markets Income Fund (MUTF:FNMIX), Fidelity Advisor Strategic Income Fund (MUTF:FSIAX), and Fidelity Strategic Income Fund (MUTF:FSICX). The fund managements should be pressed to act.

That's an indirect and conscientious way to help ease Venezuela's misery and likely helps a retail investor's wallet in the process. As discussed in greater detail below, Institutional investors positioned in Venezuela securities should be pressed to organize a restructuring process which engages with and works to the advantage of the democratic political opposition. Managed correctly, it would be doing the right thing and, more likely than not, profitable. It would create an opportunity to address Venezuela's bankruptcy directly and arrange a more reasonable outcome than continuing to deal with a Maduro government that hasn't a clue how to resolve the economic debacle created by two decades of fiscal mismanagement. This is in the senior noteholders own interest. But they have to be more proactive.

Who should lead that effort…?

So far, much of what's happened at the institutional investor level has been either inadvertent or purposely ignorant. For years, most of the bad news coming from Venezuela had little impact on American political or economic centers, despite the fact that even through last year, Venezuela supplied 9.4% of America's daily crude oil imports. Venezuela's misery was largely hidden from view or confined to a few minutes of televised talking heads discussing its disaster and then conveniently ignored. That changed for the investment community when a report surfaced about Goldman Sachs (NYSE:GS) buying $2.8 billion bonds from Venezuela's central bank. A Wall Street Journal report on the $865 million transaction published May 28 th specified the buyer as two distressed fund managers working for the Goldman Sachs Asset Management (or GSAM) affiliate and identified the bonds purchased as Petróleos de Venezuela SA (or PDVSA) notes due in 2022. Also included in the report was a reference to an issuance date of 2014 and that the bonds were purchased from a broker, not directly.

The only bonds meeting those specific maturity and issue date criteria are the PDVSA 6 Senior Notes due October 28, 2022. The implication is that GSAM bought almost an entire $3.0 billion senior note issue for 31 cents on the dollar. It was not the size of the transaction nor the specific securities that mattered. In fact, senior GS management was likely surprised they needed to about this transaction. They were likely more surprised to read about it in their morning newspaper. Just think about it from a GSAM perspective. The trade likely met most of the required elements on their checklist. First, the job of a distressed management team is to, well, invest in distressed situations. Check. Second, even sizable trades like this in the secondary markets don't usually attract that much media attention. Check. And third, while the purchase gave GSAM a significant position in PDVSA debt, it still left GSAM far behind other major holders in percentage ownership terms. Fidelity, PIMCO, TCW, T Rowe Price, and BlackRock are far and away the largest investors in Venezuela debt. Check.

GSAM's error was the decision to negotiate in the secondary market with an identifiable but ethically dubious counterparty, even if it wasn't the first or only fund to do so - in April, Fintech Advisory Inc., a New York-based investment fund, bought $1.3 billion PDVSA bonds in a repo trade which sent $300 million cash to Maduro. At those transaction sizes, an institutional portfolio manager almost assuredly knows who is on the other side of the trade. You don't plunk down $865 million for bonds without understanding who the seller is and why they are on offer. Like Fintech, by purchasing securities from Venezuela's central bank, GSAM monetized a Maduro government asset, effectively providing the regime with new monies to keep itself in power. That is what generated the great hue and cry - and street protests in front of GS headquarters in New York - about financing a dictatorship. The opposition is worried Maduro might try to sell another $5 billion of securities owned by the central bank or maybe sell Venezuela's remaining $7.6 billion of gold reserves. The government seems desperate to do so after failing to repay a $1 billion loan from Russia. That loan was arranged to finance weapons purchases, had been renegotiated once last year, and its renegotiation this year might end up as the pretext for giving Russia the majority stake in other Venezuela state-owned assets (e.g., PDVSA and its subsidiaries).

Assuming GSAM still owns the PDVSA 6 Senior Notes due '22 - and after all the media hubbub, it may not - Goldman's management will continue to face a bunch of knotty issues that it needs to address. The same applies to any of the other creditors of Venezuela, PDVSA or affiliated entities like CITGO Holding Inc. or its subsidiary CITGO Petroleum Corp. (collectively, CITGO). These issues fall into one of two major categories: moral and financial. As proposed below, the solution to one major category doesn't preclude a solution to the other. So, while GS may have inadvertently landed in a Venezuelan crevasse, there are ways it can climb back out, including ways that might ameliorate the situation, help restore its corporate image and even book a profit.

Why does halting PDVSA debt service payments now make sense…?

Let's simplify the moral issues by citing two "lessons learned" (as they are known in military parlance). One of the biggest lessons of the 20th Century was that, when your neighbor's house is burning down, you don't ignore it or, worse, throw gasoline on the fire. Even if you are prone to complete selfishness, as it turns out, that same fire can easily spread and burn your own house down. Another really big but simple lesson from last century - one reiterated by this century's Great Recession - is that when your neighbor loses his job in a major economic downturn, the solution is not to immediately throw him out of his house. Blaming the fellow for borrowing too much money to buy a home when he previously held a job and earned enough to pay for it is not sensible. Nor should his bank be eager to foreclose on his home just when there is a vast and growing pool of homeless people unable to ever repay their mortgages. That's no way to improve the value of your home or the other homes in your neighborhood. A better strategy is to arrange loan modifications to permit time for your stressed neighbors to find new jobs so they can start repaying their mortgages again.

Goldman Sachs management might consider these simple lessons when it decides what to do with its Venezuela bond position. No one wants to be known as a "trafficker in tragedy". Aside from decreasing the direct threat to its reputation, GS management has other reasons to think through what can be done post GSAM's decision to send $856 million in cash to Maduro's government. This is true even if GSAM is not nearly the largest holder of PDVSA debt because unlike some of the other bondholders, GS now has the means and reasons to make a positive difference. Some of the larger fund holders are more reactive than proactive, may have purchased their securities at issuance, hold their positions in passive ETFs, or may be otherwise disinclined to address the kind of knotty issues Venezuela presents. But GSAM paid for a large distressed bond position for a distressed fund, fully intending to maximize profits from within a contentious situation. Intentions matter and if GS wants to convince the public that it is not merely seeking maximum profits from Venezuela's maximum misery, there are some steps it can take to reverse that impression. There are specific actions Goldman Sachs can take going forward and good reasons why it should take them. They might give GS a morally acceptable approach that also happens to be in its own financial interest. The first step is this: GS should use its PDVSA bond position as the basis for organizing a bondholder committee stocked with reorganization professionals who can fully represent the senior unsecured noteholders. Nearly all of Venezuela's debt has been issued has senior unsecured notes. GS should do this sooner rather than later.

How should a PDVSA restructuring process work…?

Bondholder committees are typically formed when a borrower is facing bankruptcy. That is certainly the case with Venezuela. What is unusual about this situation is that the borrower continues to deplete the assets within its estate in order to continue making payments on its debt. That has to stop. A bondholder committee is typically formed to negotiate with a crisis management team at a corporate entity. PDVSA and CITGO are corporate entities with corporate debt outstanding but their controlling shareholder is a sovereign government entity. The Venezuela opposition has been assuming that a default by any of Venezuela's debt holders will result in transfer of ownership in major state properties to bondholders. That isn't necessarily true, particularly when the assets require refurbishment and the sovereign can expropriate them anyway - something that's happened repeatedly in Venezuela. In this case, the main objective of a committee representing much of Venezuela's outstanding debt would be to replace existing management with new management drawn from the opposition. The committee would have two very good reasons for focusing on switching management teams. First, there are questions about whether Maduro's administration can legitimately represent the sovereign state in restructuring discussions based on the delaying of presidential elections. Second, there is ample proof that the Maduro administration has squandered PDVSA assets. As described in greater detail below, PDVSA is being drained of value via confiscatory taxation, asset transfers and, more recently, the placement of first lien security interests in its property. Cash needed by these entities for capex has been redirected toward graft and buying votes, despite the "social program" title assigned to them.

A bondholder committee organized by Goldman Sachs can hire legal counsel. The committee can investigate the feasibility of declaring one or more borrowers bankrupt. After selecting the target entities, the committee can instruct the relevant indenture trustees to submit notices of default on those entities. The notices would simply declare what has become obvious over the past 5 years, namely, that the Bolivarian Republic of Venezuela and PDVSA are in default under the terms of the senior secured note indentures. The reasons for moving forward the start date are both moral and financial. A restructuring committee, armed with legal counsel, can seek to:

- Stop payments on debt used by Maduro as an excuse to cut food and medicine imports (moral),

- Reach out to the democratic opposition with a debt restructuring plan for PDVSA (financial, moral)

- Make PDVSA principal concessions contingent on completion of free and fair elections within the next 12 months, increasing support for a change in administration (moral, financial)

- Make PDVSA interest concessions contingent on application of cash saved toward capex, preserving its underlying cash flow generation abilities (financial) and

- Block any transfer to third parties of equity ownership or security interests in the equity of PDVSA or its subsidiaries (financial, moral, and the only realistic negotiating position for unsecured creditors).

Why hasn't a Venezuela sovereign default been declared already…?

The Maduro government has not stopped paying principal or interest on Venezuela's sovereign bonds yet. Failure to pay is the main way an event of default would be triggered. There are other ways but they haven't led to a default thus far. For example, the majority of Venezuela's sovereign bonds include in their indentures an event of default provision that would be triggered if Venezuela were to cease at a future date to maintain its membership in the International Monetary Fund (or IMF) or cease to be eligible to use the general resources of the IMF. Since Venezuela has not yet lost membership in or access to resources from the IMF, no default has been triggered under the indentures. There are potentially other justifiable grounds on which holders of sovereign debt might submit a notice of default that would not require any failure to pay interest or principal. For example, Venezuela could trigger a default if, in the course of its renegotiation of a recently restructured loan from Russia, any lien (other than a Permitted Lien) is placed by the Republic on Oil or Accounts Receivable to secure External Public Debt without equally and ratably securing the other senior unsecured notes (all capitalized terms as defined in the indentures). However, that's a matter for attorneys representing sovereign debt holders to pursue.

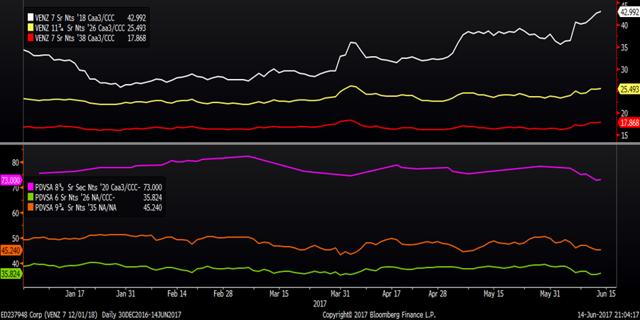

The absence of a default at the sovereign level doesn't mean the sovereign bonds - or the bonds of the national oil company it controls - are seen as money good. The securities and CDS markets have understood for some time now that both Venezuela sovereign and PDVSA corporate senior unsecured notes will be restructured, even if they technically have not triggered an actual event of default in the indentures. As shown in the top part of the graph below, the 2-year, 10-year and 30-year sovereign senior unsecured notes trade in the low 40s, mid 20s and high teens. As shown in the bottom part of the graph, the new 8½ Senior Secured Notes due 2020 - despite their purported 1st lien status - only garner prices in the low 70s while senior unsecured notes due 2026 and 2035 are priced in the mid-30s to mid-40s, depending on the coupon:

How can bondholders claim that PDVSA has defaulted on its debt…?

The PDVSA senior unsecured note indentures might allow noteholders to claim that PDVSA is already in default on their bonds. The indentures require the holders of 25% or more of the principal amount of a senior unsecured note to specify in writing exactly what default has taken place that has not been cured for 60 or more days. Clearly, PDVSA would already be in default if it failed to pay principal or interest on one or more of the senior unsecured notes two months ago. That has not happened yet but there are other covenants which noteholders can argue PDVSA has breached for more than 60 days. For example, the Limitation on Liens. PDVSA agreed in its senior unsecured note indentures to equally and ratably secure the senior unsecured notes if it incurs liens on property other than Permitted Liens (which is defined as mostly relating to existing liens). Senior noteholder counsel can argue that the granting of first liens on equity in CITGO via the September 2016 exchange offer that created the new PDVSA 8½ Senior Secured Notes due 2020 violated that covenant.

The strategy outlined above is just one way a default notice might be sent out but there are multiple caveats that come with it. Here's one - enforcement. The governing law for senior unsecured notes is New York law, but it likely will not be enforceable without first being reviewed and interpreted in Venezuela's court system. As the prospectus for the notes state, a foreign court's judgment viz the senior unsecured notes is enforceable in Venezuela's courts only after obtaining a confirmatory judgment ( exequatur) from the Supreme Court of Justice ( Tribunal Supremo de Justicia) in Venezuela, in accordance with the provisions and conditions of the Venezuelan Private International Law ( Ley deDerecho Internacional Privado), without a review of the merits of the judgment. Lawyers for the senior unsecured noteholders will obviously not be getting much more justice from a Maduro controlled Supreme Court of Justice than Venezuelan citizens do right now. No doubt, PDVSA senior unsecured noteholders would prefer a U.S. bankruptcy court venue if at all possible.

The legal landscape is murky and there's no point in sending anyone out on a bombing mission with no place to return to. But senior noteholders - like the political opposition - have every incentive to prevent further transfers of value out of PDVSA, more mortgaging of assets and greater threats to PDVSA's revenue generating capabilities. They should use every legal tool at their disposal to accomplish that goal up to and including the date on which the Maduro government is replaced by its democratic opposition. Based on recent bond price histories, the major bondholders already know they will not be receiving full payment. As it stands now, the expected haircuts are indicated by the price ranges of their bonds in the secondary market. But the committee can decide not only what the size of the concessions will be but also who it will make those concessions to, how they will be delivered and when. Throwing PDVSA into bankruptcy will raise the question of who represents the existing equity owner in any subsequent debt negotiations. A bankruptcy court can decide whether, without elections, the Maduro government has the legal authority to represent the sovereign or its corporate assets.

By setting up a bondholder restructuring committee and pressing for a new set of borrower representatives with whom to negotiate, bondholders would not just be doing the right thing. It would set up some legal roadblocks to keep other parties, particularly lenders or third-party litigants, from taking possession of key energy assets (e.g., Russia, Crystallex - more on these situations below). Assets left in saner sovereign hands will have time and an easier path toward greater profitability if they are can be provided with an appropriate level of capex. It would give creditors relying on future production a better chance to be repaid:

Why does the Maduro government continue to pay principal and interest to foreign creditors…?

This is one of the imbroglio's biggest mysteries. The Maduro government has ardently avoided entering into any restructuring negotiations. Throughout all the rioting and hunger strikes, it has continued to pay interest, principal and amortization payments, save one $954 million loan owed to the Russian government last month, a loan originally made in 2011 which was renegotiated and restructured once already in September of last year. There are multiple theories about why an avowedly hard-left government would continue to pay debts owed to huge U.S. based mutual funds while its own people starve. The Venezuela political opposition is mystified by Maduro's assertion that there is no connection - hence the nickname "hunger bonds" applied to the securities. They have their theories - Maduro is hoping for a rebound in oil prices, Maduro's friends own a bunch of the debt themselves, Maduro fears a default will trigger creditor lawsuits further limiting oil exports. I suspect the answer is simpler. This fellow's no original thinker. Until cash stops coming out of PDVSA that can be used to pay off a corrupt military or keep a graft-riddled administration in place or just buy the votes needed to keep him on as president, he will continue doing what his predecessor did. Keep in mind, Maduro began his political career as a Caracas bus driver and union rep who campaigned in support of Hugo Chavez. Chavez died in 2013 but Maduro keeps driving his bus in the same direction because he is far too suspicious of the opposition yelling outside and waving new maps to stop and ask them for different directions.

Would declaring a PDVSA default help or hinder Venezuela's political opposition…?

Some members of the political opposition see any default notice as equivalent to a demand for immediate transfer of Venezuela's energy assets to U.S., Canadian, or Russian hands. But it depends upon who files the notice and what their plans for resolving the situation may be. For example, without a plan to fund capex and improvements at PDVSA, it's hard to see what advantage there might be in transferring the equity interest and then facing the threat of outright expropriation. A better approach is to leave ownership with a more competent, sovereign government in place. The good news is that bondholders may soon have a new government with which to do business anyway - including the business of debt renegotiations. Better to reach out early to members of the political opposition since Maduro's hold on the state is evaporating. One week ago, Defense Minister Vladimir Padrino Lopez demanded that the National Guard cease abusing protesters after video footage was broadcast on social media showing security forces dragging a demonstrator through the street on a motorcycle and guardsmen in Caracas shamelessly stealing phones, purses, and watches from the people they're paid to protect. Last Thursday, Public Prosecutor Luisa Ortega Diaz, a long-time Maduro and Chavez loyalist, followed with a more stinging rebuke to Maduro. Speaking from the steps the nation's Supreme Court, the public prosecutor decried Maduro's "brutal repression" of dissidents, his effort to redraft the constitution, and his attempt to replace the National Assembly with a constituent assembly of cronies. The public prosecutor has become one of the president's harshest critics. A good shove from international creditors might just push him out the door.

What is Venezuela's financial position…?

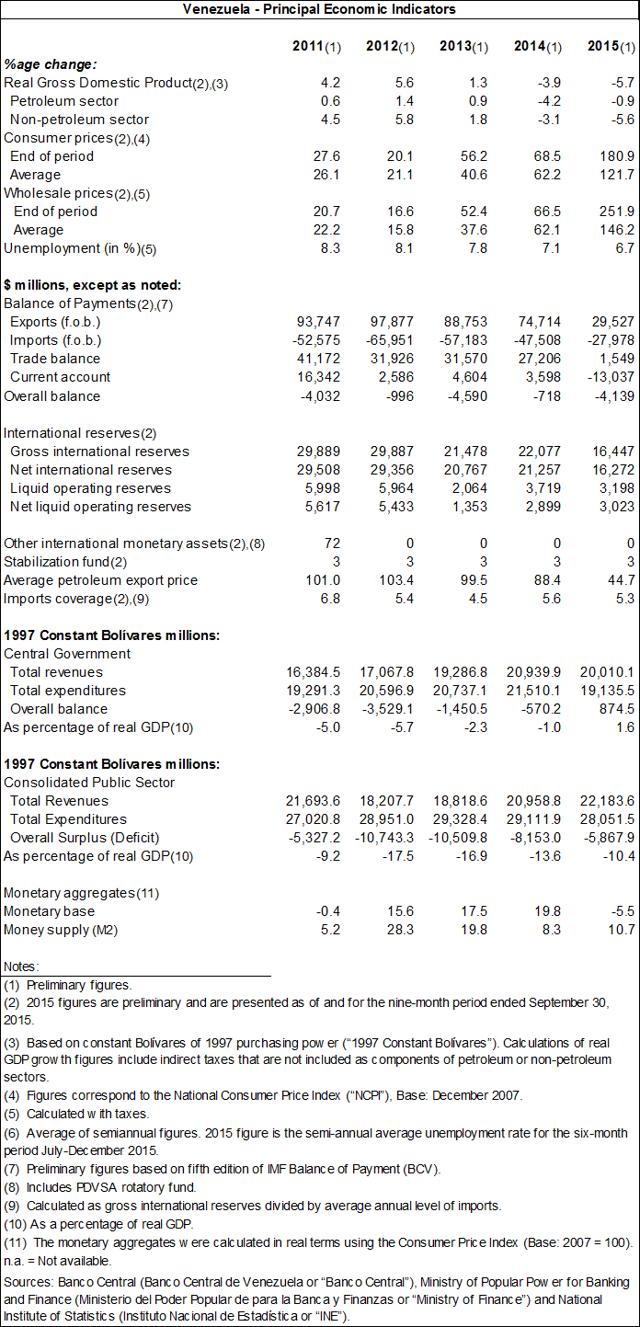

You don't need a PhD in economics to see what's been happening to Venezuela's economy but you may need some assistance to see why it is running out of funds to pay its debts as they come due. Start with the deterioration of Venezuela's economy. The graph at the top of this article compared just two of the most pertinent statistics through the end of last year, namely, the annual change in Venezuela's real GDP and the annual change in its consumer price index. Per that graph and the comments above it, the former has dropped severely while the latter has skyrocketed but just to fill out the rest of the picture, I've reprinted below a summary of the other key economic indicators from the preceding 5-year period 2011 through 2015. As you can readily see, wholesale prices have also shot up, trade collapsed, and international reserves deteriorated dramatically. The $16.7 billion of international reserves shown below at the end of 2015 have since deteriorated further to around $10.4 billion this year:

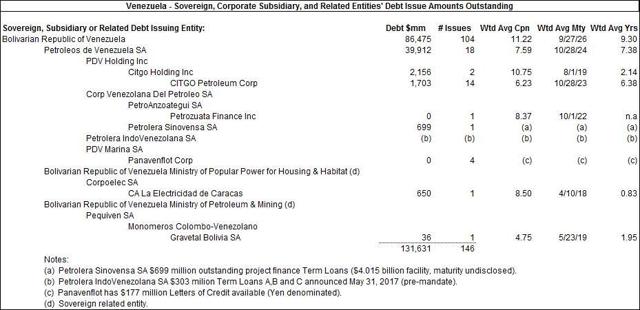

What does Venezuela owe and when are those debts coming due…?

At the sovereign level, the state has $86.5 billion total debt outstanding, issued by multiple state entities and denominated in both Venezuelan Bolivars and US Dollars. About 92% of the outstanding debt is senior unsecured and only 8% of it is in the form of term loans. Certain Venezuela government notes have payments linked to the price of oil and none of the loans listed on Bloomberg appear to be secured by liens. Per the table below, this year, principal and interest due on those debts amounts to nearly $7.0 billion, or not much less than the $10.4 billion Venezuela's remaining international reserves (of which $7.6 billion is in gold). Next year, debt service at the sovereign level increases to $11.8 billion and, unless there's a major change in the cash flows coming from PDVSA or Venezuela finds some other source of funding (e.g., the capital markets suddenly re-open to Venezuela credit or monetizing more hunger bonds), it's not at all clear how that debt service gets paid:

Standard & Poor's has rated Venezuela CCC with a negative outlook since February 2015. Moody's affirmed Venezuela's Caa3 credit rating in March 2016 but also changed the outlook from stable, to negative, citing "increased uncertainty surrounding economic and political events in Venezuela which could increase the loss severity bondholders could face in the event of a default," a development to which Moody's assigns a high probability of occurrence.

How does Russia fit in this picture…?

Russia is a long-time ally of Venezuela's anti-democratic government, a friendship which included lending the Chavez regime $4 billion in 2011 for arms purchases. Per Bloomberg, the money was borrowed in the form of a delayed draw unsecured term loan. Its other terms are otherwise undisclosed, including the maturity. The two countries had restructured the loan once last September at which time they stipulated that Venezuela's total remaining debt to Russia would be capped at $2.84 billion, an amount that was then scheduled to be repaid by 2021. The Russian Finance Ministry hosted talks last week at which Venezuelan envoy Carlos Faria stated that his country has the capacity to repay its debt to Russia. That may have factored into this past week's decision by ISDA not to declare an event of default with respect to the sovereign loan.

The question for both the Venezuela political opposition - and bondholders - is whether, in the minds of Maduro's representatives in Moscow, the capacity to repay that loan will include a new transfer of assets to Russia, equity in PDVSA and/or its subsidiaries, the granting of any lien or security interest, or any other arrangement which moves assets away from PDVSA's unsecured senior noteholders. This puts the senior unsecured noteholders in alignment with Maduro's democratic opposition - neither group wants to see assets disappear in a fire-sale to help keep Maduro in power. The longer he stays, the more resources and cash he drains from PDVSA.

The Maduro government has already shown its willingness to mortgage key energy assets in order to obtain new funds. In September 2016, PDVSA pledged a 50.1% ownership stake in its U.S. refining subsidiary CITGO Holding when it swapped $2.8 billion of maturing unsecured senior notes for $3.4 billion new 8½ Senior Secured 1 st Lien Notes due 2020. Two months later, in exchange for a loan from Rosneft PJSC, Russia's state-owned oil company, PDVSA pledged as collateral the other 49.9% interest in CITGO Holding. Although the actual loan size was not disclosed, one clue is that Venezuela's foreign currency reserves spiked up by $891 million in November.

This hasn't gone unnoticed in the U.S. Putting two and two together, should Rosneft PJSC decide it really wants majority control of CITGO Holding - the 9 th largest American refinery company by capacity - all it has to do is buy enough of the new 8½ Senior Secured Notes in the secondary. That shouldn't be that tough - the notes trade around 72 cents on the dollar. In April, members of Congress sent a letter about this situation to Treasury Secretary Steve Mnuchin and the Committee on Foreign Investment in the U.S. (or CFIUS) has been called in to investigate. One piece of good information for PDVSA's senior unsecured noteholders who didn't buy and don't own 8½ Senior Secured Notes but are interested in protecting their position is this: the CITGO collateral may not be enforceable in the event PDVSA is subject to bankruptcy or reorganization proceedings. Per the exchange offer documents, if PDVSA were to commence a bankruptcy or reorganization proceeding, or one were to be commenced against PDVSA, the competent bankruptcy court may prevent the indenture trustee and collateral agent from foreclosing. In other words, a bankruptcy court judge can stop the newly secured creditors from foreclosing and disposing.

Russia is not the Maduro government's last source of financing and not even the latest. Maduro's finance ministry has resorted to seeking out other highly unconventional sources of funds. A few weeks ago, it tapped a U.S. unit of China's Haitong Securities to re-market $5 billion sovereign debt with U.S. hedge funds focused on distressed emerging-market securities. In December 2016, Haitong, underwrote the same $5 billion 6.5% Senior Unsecured Pro Rata Sinking Fund Notes due 2036, by placing the entire issue with a Venezuela state-owned bank. But reselling them now to parties outside Venezuela will not be easy. They are unregistered bonds which can't be transferred other than via physical delivery. Oh, yeah. There's also no event of default if Venezuela ceases to be a member of the IMF. One wonders whether the Caa3/CCC sovereign rating is just a bit too optimistic - they are marked at a price of $35.875 which implies a yield to average life of 18.33%. Anyone looking seriously at those bonds will be asking how big the hit will be if there's ever a redemption date. Good luck with that, wada pengyo.

What debt is owed by PDVSA, CITGO and other related entities…?

In the chart below, I've pulled together the sovereign debt, PDVSA debt, and the other debt issuing subsidiaries and/or affiliates. The $86.5 billion aggregate sovereign debt is just one component of Venezuela's debt picture and it's the first figure that appears in the table. Below that line I've listed the subsidiaries (indented) and subsidiaries of subsidiaries (indented further each time). On the right are each entity's total debt amount outstanding, the number of bonds and loans the total figure represents along with their weighted average coupon, maturity and number of years to maturity. As you can see, PDVSA adds about $40.0 billion of indebtedness to the overall picture. It is by far the most significant addition. CITGO Holding has borrowed $2.2 billion and its subsidiary CITGO Petroleum another $1.7 billion. There are some smaller issues elsewhere but that's the bulk of the aggregate $133.6 billion outstanding Venezuela-related debt:

How risky is PDVSA credit…?

There is an underlying, fundamental relationship which exists between the PDVSA's credit quality (as expressed by its CDS prices) and its cash flow generation abilities (as expressed by oil prices) is one of the most salient feature of its financial statements. That should be obvious but because PDVSA is a national oil company, it has some additional implications about what creditors need to be looking at when they look at PDVSA's financial statements. There is a high correlation between the value of PDVSA debt and the price PDVSA receives for the oil it sells. You can see this in the graph below showing the price (in basis points) of PDVSA 5-year credit default swaps and the PDVSA Oil Basket index price (in US Dollars). For good measure, I've also graphed the price of Venezuela sovereign CDS. Given the close connection between PDVSA and the Republic of Venezuela, their CDS price levels basically move together. They go up when the oil index price is down and vice versa:

What is PDVSA's financial condition…?

PDVSA is the holding company for a group of oil and gas companies. It has the world's largest proven crude oil reserves with 300.878 billion barrels and daily crude oil production of 2.8 thousand bpd as measured by operational data, including volume of reserves, production, refining and sales. PDVSA carries out upstream exploration, development and production operations in Venezuela and downstream sales, marketing, refining, transportation, infrastructure, storage and shipping in Venezuela, the Caribbean, North America, South America, Europe and Asia. PDVSA owns 6 domestic refineries which processed 863 mbd of crude oil in 2015 and its international refinery operations processed another 1,089 mbd of crude oil in 2015.

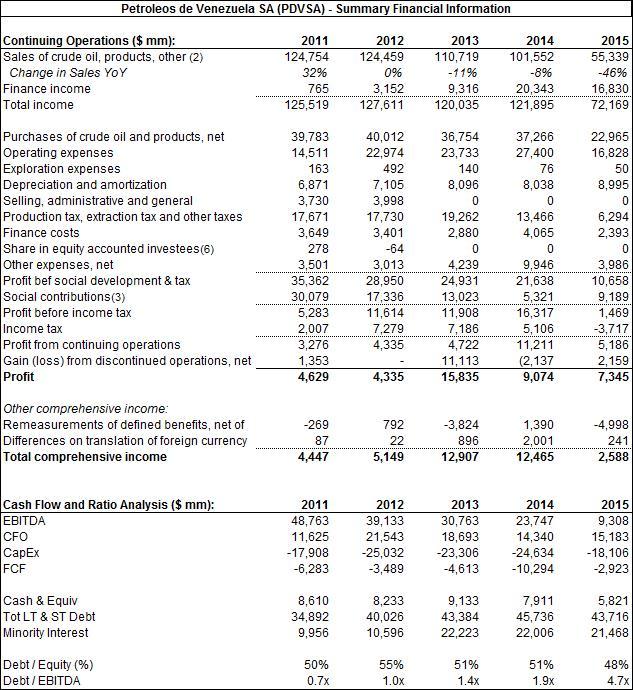

PDVSA's revenue was already beginning to drop in 2013, one year before Saudi Arabia began cutting oil prices in an attempt to remove higher cost producers competing with it in Asia. The higher cost producers included countries like Venezuela but the price cuts were also targeted at U.S. shale producers. The year over year revenue and EBITDA declines at PDVSA accelerated after 2014. What's also noteworthy is the huge increase in PDVSA debt as free cash flow ran negative pre-2014, deeply negative in 2014, and still negative in 2016 despite a dramatic 26.5% cut in capex spending. The takeaway is that cash flow kept deteriorating, even with very sharp reductions in capex even as PDVSA borrowed more money and leverage reached 4.7x. PDVSA didn't issue its annual financial report for 2015 until July 2016 and I wouldn't expect the 2016 annual report to come out until June or July this year. The table below summarizes the published financial information through 2015. The top of the table is an edited, reformatted version of what appears in the most recent prospectus from PDVSA and the bottom is a cash flow, debt and ratio analysis drawn from the annual statements:

The majority of PDVSA's revenue comes from its exploration and production segment. In most years its refining segment revenues trail E&P by about 10%. Regardless, E&P and refining shed 51% and 44% of their segment revenues between 2014 and 2015 and the company's operating margin collapsed. The response at most other major integrated oil and gas concerns during that period was to cut operating costs as quickly as possible, reposition into the most productive fields, and preserve cash. PDVSA's statements don't indicate success at reducing operating costs. To conserve space for the rest of this article, I've not reprinted the full table of its reserves and production statistics but, let's put it this way: PDVSA's average production cost including service agreements rose from $7.53 per boe in 2011, peaked at $18.05 per boe in 2014 but only returned to $10.85 per boe in 2016. That's about where it was in 2012 and 2013. Cash was preserved via a reduction in capex and development spend. Its taxes were lower on lower revenues, but the tax rate barely budged. PDVSA will need to become a lower cost, more efficient operator if it is to weather a long period of reduced oil prices. Without that, creditors can expect PDVSA to produce less cash flow and have a lower valuation.

PDVSA's valuation has also been subjected to reduction via direct transfers to the sovereign ordered by the Maduro government. In December 2015, Venezuela, as sole shareholder of the company, approved a plan to transfer within one year PDVSA's ownership of certain non-oil subsidiaries directly to the sovereign at their $2.3 billion book value, placing those subsidiaries entirely outside of PDVSA's corporate structure.

Are PDVSA's bonds worth buying based on the company's valuation…?

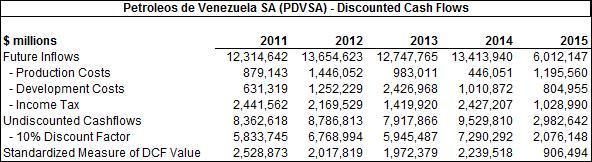

There is no public market for PDVSA's equity but there are ways to get a handle on the value of its business and the changes in that valuation. It's also possible to compare a theoretical business value to either the face amount or market value of outstanding debt. That should give you an idea of whether owning its bonds is a worthwhile investment. One way of measuring the valuation is to use a discounted cash flow analysis and then you can track it over a multi-year period. There is a standardized measure of discounted future net cash flows after tax that can be calculated for a company's oil and gas reserves which is published in the footnotes to PDVSA's financial statements. The formula is as follows: Future Cash Inflows - Future Production Costs - Future Development Costs - Future Income Taxes + Other Revenue with the sum discounted at 10% per year. Using figures from PDVSA's annual reports, the table below shows the company's standardized DCF valuation. Note that between 2014 and 2015, the company's estimate for Future Inflows dropped 55% while its production costs rose 168%. That'll do it. Net, net you are looking at a DCF valuation drop of 60%:

You can see why a portfolio manager, say, a portfolio manager for a distressed investment fund at Goldman Sachs, might reach the conclusion that buying PDVSA notes priced in the 30s - some of the lowest prices within the Venezuela-related debt complex - how that might be a good trade. Let's see. Judging by the numbers for 2015, at a minimum you are looking at a DCF valuation of about $906.5 billion versus debt with a face value of about $43.7 billion. All you'd need to do from there is prevent a further drastic deterioration based on oil prices - or the transfer of assets to third parties in a fire-sale or via new liens which prime your position.

What are PDVSA's strategic plans and are they achievable…?

Venezuela has proven crude oil reserves that should last more than 300 years at current rates of production rates, leaving ample resources for management to work with and the time needed to improve on their ability to extract the product more efficiently. Management intends to focus on previously explored areas with current production of light and medium crude oil with plans to achieve 1,221 mbpd capacity by 2025 (767 mbpd from areas where PDVSA is the sole operator and 454 mbpd from JVs producing light, medium and heavy oil).

In September 2016, PDVSA announced a U.S.$3.2 billion project to drill 480 wells in the Orinoco Belt, as part of a public tender where it awarded contracts to Schlumberger (NYSE:SLB), Horizontal Well Drillers and Venezuela's Y&V. The area holds an estimated 287,096 million barrels of recoverable reserves and management's goal is to raise production from I,320 mbpd in 2015 to 1,949 mbpd in 2025, an increase of 629 mbpd. Added to existing production in the Orinoco Belt, PDVSA total production from the area would rise to 3,180 mbpd. The project will require development of extra-heavy crude reserves, a new upgrading facility for that purpose, and pipelines. The expected cost between 2016 and 2025 is $71.6 billion. PDVSA plans to expand its refinery capacity from 2.5 mmbpd in 2015 to 2.7 mmbpd in 2025 This will increase production of petroleum products, upgrade the product slate towards higher-margin products, and improve the efficiency of existing refining capacity. PDVSA needs to expand its ability to refine the heavier crude that will be coming from the Orinoco Oil Belt expansion. It already has a major upgrade project at its Puerto La Cruz Refinery and previous plans to upgrade Paraguaná and El Palito - but those plans were shelved with the decline in oil revenue.

PDVSA wants to maintain its natural gas production levels, moving from 7.756 mmcfd in 2015 down to 7,699 mmcfd in 2025, by focusing on development of the Delta Caribe in western offshore Venezuela. It wants to add 8.0 million barrels of oil storage capacity, increase its ship transport capacity to 9,122 twdt, and increase its tanker fleet from 26 to 75 by 2025. Adding a 260 mbpd naphtha stripper will cost $725 million. PDVSA has dialed back its exploration program but still plans to acquire 7,258 km 2 of seismic 2D and 4,065 km 2 of seismic 3D between 2016 and 2025, drill 131 exploratory wells, and add 1,047 mbpd of oil and 2.3 bcf of new natural gas reserves. In all, PDVSA contemplates spending plans $132 billion through 2025 on production and refining projects in Venezuela, the Caribbean, Latin America and Asia, but without much, if any, access to the capital markets, those plans are unlikely to advance very far. A restructuring, however, might be one way to reopen those doors.

What is CITGO's financial status…?

CITGO refines and markets transportation fuels, petrochemicals and other industrial oil-based products in the U.S. where it owns and operate three large-scale, highly complex petroleum refineries with a total rated crude oil refining capacity of approximately 749 mbpd. The refineries are located in Lake Charles, LA (425 Mbpd capacity), Corpus Christi, TX (157 Mbpd capacity) and Lemont, IL (167 Mbpd). CITGO has an extensive distribution network providing reliable access to its end-markets, including 33 terminals with a total storage capacity of 8.9 million barrels. CITGO also has an equity stake in an additional 3.9 million barrels of refined product storage capacity via joint ownership of another 10 terminals, spread across 21 states, plus access to over 125 third-party and related-party terminals via exchange, terminaling and similar arrangements. Between 2014 and 2016, an average of 52% of the crude oils processed through the refineries was heavy sour crude oils. In 2016, the total yield of high-value products, including gasoline, jet fuel, diesel, No. 2 fuel oil and petrochemicals, was 89%. Last, CITGO runs a retail gas station network with 5,300 independently owned and operated CITGO-branded retail outlets located east of the Rocky Mountains (plus one company-owned concept outlet in Houston). CITGO has had a recognized brand presence in the U.S. for over 100 years.

CITGO's earnings and cash flows depend on refined product prices, which impact net sales, and crude oil and other feedstock prices, which impact cost of sales. Crude oil and other feedstocks like naphtha and catalytic feed, and refined products are all commodities whose prices move with their supply and demand. CITGO's results are sensitive to domestic and foreign economies, weather conditions, domestic and foreign political affairs, energy commodity investment activity, refinery capacities and utilization rates, imports, alternative fuels and government regulation.

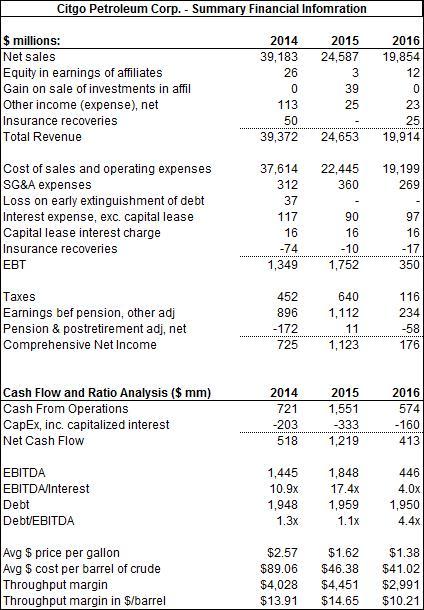

CITGO Petroleum's financial statements (including its 2016 results) are summarized in the table below. As shown in the top part of the table, revenues fell between 2015 and 2016 by 19.2% while cost of product sales only contracted by 14.5%. The bulk of these changes were driven by gasoline sale prices relative crude oil prices since gasoline accounted for $10.8 billion of last year's $20.2 billion total refined product sales. Cost of sales and operating expenses decreased $3.2 billion in 2016 due to a 12% decrease in crude oil costs (from $46.38 per barrel in 2015 to $41.02 per barrel in 2016). Refined products costs also decreased with lower refined product prices and volume. Intermediate feedstock costs decreased on lower volume, partly offset by higher prices. Other operating expenses increased mostly from accruals for litigation and derivative costs. In the cash flow and ratio analysis section at the bottom part of the table, you will find a concomitant unadjusted EBITDA drop of 75.8%. Throughput margin declined 33% to $3.0 billion in 2016 from $4.5 billion in 2015 and throughput margin per barrel fell 30% to $10.21 from $14.65. The drop reflects significant declines in both gasoline and distillate crack spreads in both the U.S. Gulf Coast and Midwest regions and also reflects lower throughput volumes (down 4% from 2015):

Clearly, CITGO did not have a particularly good 2016 with cash flow down and leverage moving up from 1.1x to 4.4x at the opco. But an analyst looking solely at CITGO's loans and bond prices might be forgiven that was not the case and that there were no credit problems further up the corporate org chart at the PDVSA level. All of the CITGO debt is priced north of par. As shown in the top part of the graph below, the holdco's CITHOL L+850 1 st Lien Term Loan B due 2018 are marked at 101.625 and the CITHOL 10¾ Senior Secured Notes due 2020 last traded at 109.875 where they yield 6.62% to maturity, a roughly 510 basis point Z-spread which is right in line with comparable high yield bonds. The bottom part of the graph shows the opco's CITPET 6¼ Senior Secured 1 st Lien Notes due 2022 last printed at 102.25 where they yield 5.46%, or a +383 basis point Z-spread. That's relatively rich to comparable high yield energy bonds which average +628 basis points Z-spread:

PDVSA assessed the market value of its equity stakes in CITGO by looking at holdco and opco projected future free cash flows. It then made certain assumptions about growth and taxes and took into consideration the $2.0 billion debt at the opco level and $4.2 billion debt at the holdco level. PDVSA concluded that the market value of the equity (before taxes) as of FYE 2015 was $9.3 billion for the opco and $8.3 billion for the holdco, in each case net of debt. It determined that the opco enterprise valuation was $11.3 billion by using an implied EBITDA multiple of 4.7x of $2.4 billion 2015 EBITDA. PDVSA concluded that the holdco enterprise valuation was $12.5 billion with an implied EBITDA multiple of 5.0x.

A small, but instructive mathematical digression. Take the unadjusted EBITDA figure above for 2016 ($446 million) and gross it up by about the same percentage as the adjustments used in 2015 (roughly 33%). The implication is an adjusted $600 million EBITDA in 2016 and the resulting valuation, using the same 4.7x multiple on the opco used by PDVSA - who am I to argue - would drop from PDVSA's $11.3 billion to a revised $2.8 billion.

One implication is that the equity owners of CITGO should be very careful about which year gets used for valuation purposes. Another is that senior unsecured creditors should not want Maduro's government arranging more asset transfers or using, say, a 2016 valuation when handing over a 1st lien in exchange for some quick cash. Credit quality is not just a function of debt to cash flow leverage ratios, debt to equity percentages, or the number of times EBITDA covers the annual interest payments. Transferring key energy holdings at low valuations - just so Maduro can live to fight another day - reduces unencumbered asset coverage of the unsecured outstanding debt.

Who else is trying to seize PDVSA or CITGO assets…?

Crystallex International Corp. is a Canadian mining company which filed for bankruptcy in 2011 after Chavez's government expropriated a large gold reserve it owned in Venezuela. The company has been trying to collect on a $1.4 billion international arbitration award re-confirmed by a U.S. District Court this past March. Last week, the judge in the case ruled that, absent payment, Cyrstallex can move forward with legal claims to seize Venezuelan assets. The ruling also allows other companies whose properties were similarly expropriated to seek redress via legal claims to seize state assets.

The issue for PDVSA and CITGO bond holders is that the judge's ruling doesn't specify which Venezuelan assets can be seized. That leaves open the possibility that Crystallex (or other litigants) will seize assets held by PDVSA and, in particular, CITGO. The litigants would clearly prefer to seize a set of US Dollar-denominated refinery assets rather than Bolivar-denominated Venezuelan reserves or infrastructure. That doesn't mean the litigants won't seek to get hold of PDVSA's assets or any other related assets. In that sense, they would merely be following the same strategy that hedge funds recently pursued following a default by Argentina on its debt. The hedge funds in that case successfully argued that there was no real difference between Argentina's central bank and its state-controlled oil company.

The Crystallex case also should serve as a reminder to PDVSA senior unsecured noteholders that the time to press forward with a court-ordered restructuring is now, not later after other parties have already staked their claim and transferred away much of PDVSA's underlying value.

What's the upshot…?

PDVSA's senior unsecured noteholders can play a positive role during the final push to remove Maduro and his administration from power. In a number of ways, the interests of the PDVSA bondholders and the opposition are art least temporarily aligned. Both want to end Maduro's access to PDVSA, CITGO and other state assets. Both want to preserve and improve PDVSA's long term cash flow generating capabilities - the bondholders in their role as creditors and the opposition in its role as the true representatives of PDVSA's sovereign equity owner. Organizing a restructuring committee and filing a notice of default in order to put the matter in front of a bankruptcy court could help accelerate each group's plans and improve their prospects for completing them.

The common goal of both groups should be to oust Maduro for a combination of financial and moral reasons. There are voices within the Venezuela opposition that are of two minds: on the one hand, they would like to prevent creditors from asserting claims to state property but on the other hand they also want the cessation of payments to creditors. That's too broad because it misses the differences between secured and unsecured creditors. The proposed alternative strategy in which unsecured senior note holders seek a restructuring of PDVSA will temporarily halt debt payments, place the noteholders' financial and legal clout squarely in support of the opposition as it seeks to oust Maduro, stop the further pillaging of energy assets by Maduro, and provide a path forward to a better-managed, better-financed, more productive PDVSA.

The underlying, shared aim of senior unsecured note holders and Venezuelans is to maintain the value of PDVSA for the long term. PDVSA is the source of payments to noteholders and a source of public funds for Venezuelans. Bringing Maduro's mismanagement to an abrupt end helps both groups. It is understood, however, that this alignment of interests will not be a permanent one. No one should expect the bondholders and the opposition to be in complete agreement about PDVSA's future after Maduro exits the scene.

Once Maduro is gone, there will assuredly be arguments over how much cash that's saved via restructuring can be redirected back into PDVSA (for Venezueians' future benefit) and how much needs to be spent on food and medicine imports (for Venezuelans' immediate benefit). That's a predictably contentious negotiation, but it's a negotiation that's far more likely to yield positive results once the sovereign equity holder is represented by a legitimate, democratically elected leadership.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Hello Everybody,

AntwortenLöschenMy name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Hello Everybody,

My name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com