Ukraine Bonds Slide With Writedown Said to Be More Than Expected

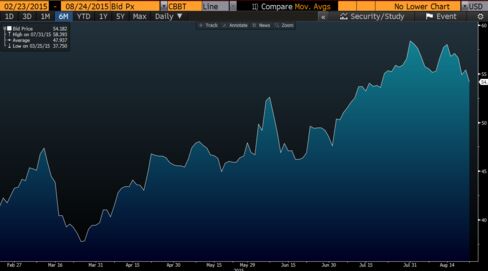

Ukrainian Eurobonds fell to a one-month low after the nation was said to be discussing a larger principal writedown with creditors than expected by some investors.

Ukraine and bondholders are considering a 20 percent cut to face value as part of a restructuring deal with bondholders, according to a person with knowledge of the negotiations who declined to be identified because the details are private. The country’s $2.6 billion of notes due July 2017 slid 1.39 cents to 54 cents on the dollar at 5:01 p.m. in Kiev, the lowest level since July 21. They have rallied from as low as 42 cents in March.

An agreement would end six weeks of direct negotiations that followed a two-month standoff over whether a so-called haircut would be included in the restructuring of about $19 billion of bonds, something that a Franklin Templeton-led creditor group had said wasn’t necessary. Ukraine needs a deal to secure the next tranche of a $17.5 billion International Monetary Fund loan as a pro-Russia insurgency threatens to reignite in its easternmost regions.

“The market was probably hoping for something better,” saidSimon Quijano-Evans, the chief emerging-market strategist at Commerzbank AG in London. “Prices may settle somewhere along the lines of 50-55 cents. It would mean a compromise from both sides compared to what was originally put on the table from both sides.”

Ukraine 2017 Eurobond price graph

Talks are ongoing and nothing has been agreed, according to a spokesman for the Ukrainian Finance Ministry, who declined to comment on the size of the writedown being discussed, as did a spokesman for the Franklin Templeton-led creditor committee.

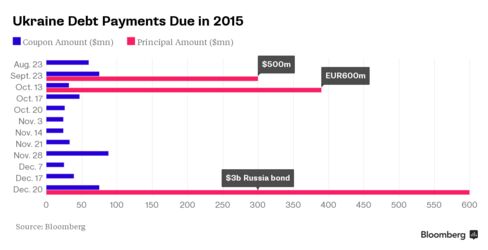

A deal will also involve adjustments to interest rates on the $19 billion of bonds being restructured and delays to repayment dates. Ukraine needs to save $15.3 billion from debt-servicing costs and reduce its burden to below 71 percent of gross domestic product to meet the conditions of the IMF bailout.

Ukraine made a $60 million coupon payments on a $1.5 billion Eurobond due February 2021, according to three traders, who asked not to be identified because they weren’t authorized to speak publicly.

Dow Jones reported earlier that Ukraine is close to agreeing a so-called haircut of 20 percent and a deal is expected to be signed this week, citing unidentified people familiar with the matter.

Keine Kommentare:

Kommentar veröffentlichen