Oil Falls to Two-Month Low as U.S. Rig Count Rises, Dollar Firms

Crude fell to a two-month low as a strengthening dollar reduced investor appetite and the rising U.S. oil rig count signaled the output decline may slow.

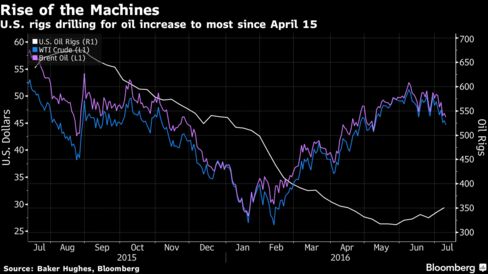

Futures dropped 1.4 percent in New York. Rigs targeting oil in the U.S. rose by 10 to 351 last week, Baker Hughes Inc. said on its website on June 8. Oil prices swung between gains and losses earlier Monday as the global equity rally and a strengthening dollar gave crude traders conflicting signals. A stronger greenback reduces the appeal of commodities priced in the currency.

"We were whipsawed today," said Phil Flynn, senior market analyst at Price Futures Group in Chicago. "We came in lower on concern about further supply then moved higher as stocks rallied before resuming the move lower. The dollar’s strength is adding to bearish pressure."

West Texas Intermediate crude for August delivery fell 65 cents to settle at $44.76 a barrel on the New York Mercantile Exchange, the lowest close since May 10. Total volume traded was 5 percent above the 100-day average at 2:50 p.m.

Dollar Index

Brent for September settlement dropped 51 cents, or 1.1 percent, to $46.25 a barrel on the London-based ICE Futures Europe exchange. It’s the lowest close since May 10. The global benchmark oil ended the session at a 73-cent premium to WTI for September delivery.

The S&P 500 Index climbed to an all-time high while the dollar strengthened. The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, rose as much as 0.6 percent.

"You have the dollar index moving higher along with equities, which is giving mixed signals," said Bob Yawger, director of the futures division at Mizuho Securities USA in New York. "The market will probably dance around $45 in the near term unless we get dramatic news or Wednesday’s data shows a U.S. production gain."

Rig Activity

The number of active oil rigs in the U.S. has increased in five of the last six weeks, according to Baker Hughes. The count is still down by more than 1,000 from the beginning of last year.

While U.S. crude production fell to the lowest since May 2014 in the week ended July 1, inventories remain at the highest seasonal level in at least a decade, Energy Information Administration data show.

"If domestic production climbs in Wednesday’s report, it would be the final nail in the coffin for this market," Yawger said.

Money managers cut net long wagers on WTI to the lowest since March in the week ended July 5, Commodity Futures Trading Commission data show. Hedge funds’ net-long position in WTI fell by 9,931 futures and options combined to 169,499, CFTC data showed. Speculators cut their net-long position in Brent in the period by 14,787 contracts to 312,270, ICE Futures Europe data showed.

Oil-market news:

Keine Kommentare:

Kommentar veröffentlichen