Traders Scramble as Clock Keeps Ticking: Venezuela Default Watch

By- Five-year implied probability of PDVSA default climbs to 99.5%

- State oil company faces $1.2 billion payment on Thursday

The Hurdles Facing Venezuela as It Seeks to Avoid Default

Investors are getting mixed signals as Venezuela stares down billions of dollars in debt obligations over the next few weeks.

The Situation

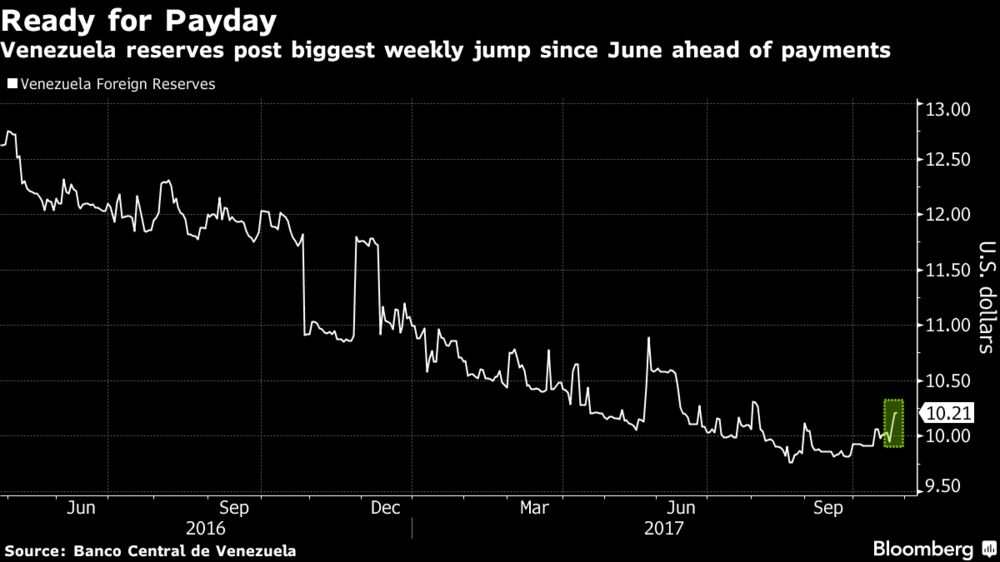

Although PDVSA said it paid an $842 million principal payment on its 2020 bonds due last Friday, the money has yet to materialize in the accounts of bondholders. Another $1.2 billion payment looms on Thursday. And to top it off, the clock is ticking on more than half a billion dollars in debt from the state oil firm and Nicolas Maduro’s government that are in a 30-day grace period. That said, if Venezuela can survive the next two weeks, it will be smoother sailing until the next big chunk of payments come due in April.

The Bonds

Debtor | Due Date | Amount Due | CUSIP | Cross Default | Grace Period |

| ELECAR 18s | Oct. 10 | $27,625,000 | EH2888749 | Yes | 30 Days |

| PDVSA 27s | Oct. 12 | $80,625,000 | EG3110533 | Yes | 30 Days |

| VENZ 19s | Oct. 13 | $96,718,566 | EH9901297 | Yes | 30 Days |

| VENZ 24s | Oct. 13 | $102,958,473 | EH9901214 | Yes | 30 Days |

| VENZ 25s | Oct. 21 | $61,193,000.25 | ED8955574 | Yes | 30 Days |

| VENZ 26s | Oct. 21 | $176,250,000 | EI8410553 | Yes | 30 Days |

| PDVSA 20s | Oct. 27 | $984,998,482.50 ($841,878,500 in principal) | QZ9940003 | Yes | 30 Days (for interest payment) |

| PDVSA 22s | Oct. 28 | $90,000,000 | JV9618804 | Yes | 30 Days |

| PDVSA 17s | Nov. 2 | $1,169,075,523.22 ($1,121,415,370 in principal) | EI4173619 | Yes | 30 Days (for interest payment) |

The Investors

| Holder Name | Percent of Reported Total | Last Filing |

| Goldman Sachs Group Inc | 12.5% | 08/31/17 |

| BlackRock | 10.8% | 10/27/17 |

| Fidelity Management & Research | 9.9% | 10/27/17 |

| T Rowe Price Group Inc | 5.7% | 09/30/17 |

| Ashmore Group Plc | 5.4% | 09/30/17 |

| Allianz SE | 4.1% | 10/27/17 |

| Grantham Mayo Van Otterloo & Co | 2.7% | 05/31/17 |

| Alliance Bernstein | 2.5% | 08/31/17 |

| Sun Life Financial Inc. | 2.5% | 09/30/17 |

| HSBC | 2.3% | 06/30/17 |

* Based on public filings reported by investment firms and reviewed by Bloomberg.

Keine Kommentare:

Kommentar veröffentlichen