U.S. production will limit how far oil prices can climb.

by

Workers on a rig outside of Midland, Texas.

Photographer: Brittany Sowacke/Bloomberg

OPEC's decision to cut output for the first time in eight years has put a rocket under oil prices. They've gained almost 20 percent since Nov. 30 when OPEC officials convened in Vienna. It's not all sunny uplands for the oil dignitaries, however, because the rally will spur production in the U.S. and limit how far prices can climb.

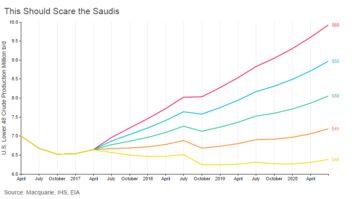

Lower 48 U.S. crude output could rise by almost 500,000 barrels a day by the end of 2017 to 7.45 million barrels a day if the price of WTI climbs to $60 a barrel, according to Macquarie. Other analysts hold similar views. "Give it six to nine months at $60 and you are going to start to see U.S. onshore production ramping hard and ramping fast," said Citigroup's global head energy strategy Seth Kleinman, speaking at a Bloomberg webinar in late November.

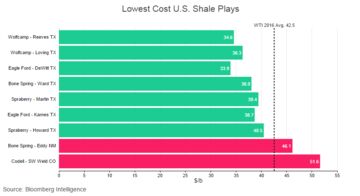

OPEC's control over global supply is challenged by U.S. drillers whose costs have plummeted.

"The cost curve for U.S. shale has fallen dramatically," said Kleinman. "In 2012 $50 oil would get you 500,000 barrels a day. Now you are looking at well above 5 million barrels a day."

The latest figures from Bloomberg Intelligence show breakevens at some plays in the Eagle Ford and the Permian are several dollars below the 2016 WTI average of $42.50 a barrel.

U.S. production has stabilized over the last six months at about 8.5 to 8.6 million barrels a day, as oil prices have averaged $46.54 a barrel. Low-cost production has grown in the Permian Basin, while output has declined in the Bakken and Eagle Ford regions.

The key question for OPEC, is what lessons learnt from the Permian can be applied to other plays, Kleinman said.

Keine Kommentare:

Kommentar veröffentlichen