Ukraine Bonds Show Higher Risks Than Peers Post-Restructuring

- Eurobonds trade 1.5 pecentage point above Egypt, Pakistan

- Trading of notes marks end to 8-month restructuring process

A day after bondholders were handed new debt marking the end of Ukraine’s $15 billion sovereign overhaul, investors demanded higher yields than like-rated peers.

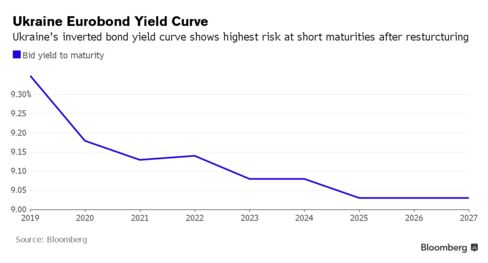

The yield on the eastern European nation’s dollar-denominated bond maturing 2025 was 9.03 percent at 3:03 p.m. in Kiev, about 1.5 percentage points higher than similar-maturity notes of Pakistan and Egypt, and 2.4 percentage points above Lebanon’s debt. All four nations are rated at B- at Standard & Poor’s, six levels below investment-grade.

Thirteen bonds were freed to trade Friday after a debt exchange that moves Ukraine one step closer to complying with conditions in a $40 billion International Monetary Fund bailout needed to revive the war-torn country. Russia’s annexation of the Crimean peninsula and a separatist insurgency in its eastern industrial heartland drained foreign-currency reserves, shrinking the economy by 6.9 percent last year.

"Investors want to see the will to reform the economy, which would help increase appetite for the country’s sovereign risk," said Vitaliy Sivach, a trader at Investment Capital Ukraine in Kiev, who sees the bond yields falling to the 7.5-8 percent range if the IMF program remains on track. "The yield level well cover all the risks Ukraine’s economy faces in the near future as there are no immediate threats to the country’s solvency."

Before the restructuring, Ukraine’s foreign-currency debt handed investors a 47 percent return this year, the best performance among 60 countries in the Bloomberg Emerging Market Sovereign Bond Index. The outperformance reflects a rally of as much as 42 cents on previous notes to 79 cents on the dollar in September as a committee of creditors negotiated more favorable terms in the debt deal than investors expected.

Russian Rejection

Holders in 13 of Ukraine’s 14 Eurobonds accepted therestructuring terms that included a 20 percent reduction to face value, a four-year average maturity extension and raising average interest payments to 7.75 percent on the new bonds. Bondholders will also receive securities that tie payments to the country’s economic performance.

Russia, which owns a $3 billion bond sold by former President Viktor Yanukovych before his ousting, has rejected participation in the overhaul and has called for full repayment of the note at its maturity next month. Officials in Moscow are preparing a "concrete plan of action" in case of default, including taking Ukraine to court, Russian Finance Minister Anton Siluanov said Oct. 13.

Speaking to reporters in Kiev on Friday, U.S. Treasury Secretary Jack Lew urged Russia to join the restructuring, saying Ukraine has shown it worked fairly with other creditors. Ukraine will impose a moratorium on the Russia bond if there’s no agreement on a restructuring, Prime Minister Arseniy Yatsenyuk said at the same meeting.

"The successful conclusion of our debt restructuring process, completed while avoiding default, leaves Ukraine’s economy in a much stronger position and is an important prerequisite for our return to growth,” Finance Minister Natalie Jaresko said in an e-mailed statement late Thursday.

Keine Kommentare:

Kommentar veröffentlichen