Summary

The current political environment has been extremely difficult and has limited the economic growth over the past decade.

From a fundamental perspective, the country's resource base could provide opportunities in the energy space; however, policy controls have limited the industry investment.

With inflation reported at 40% in the past year, it is difficult to project any long-term investments in the current market.

With new leadership coming into power in the following year, it is unlikely that the country will see growth in the medium term.

After completing my article on Italy, I continue my journey to Argentina, the third largest economy in South America. While the past year has been full with news articles relating to the Greek debt crisis and collapse in the Chinese economy, a year ago, Argentina was in the center of attention with several issues regarding its debt restructuring. In addition to the nation's debt problems, the recent tension between the country's political leaders and HSBC(NYSE:HSBC) illustrates the difficult political environment that many businesses have faced in the past few years. Thus, while investors may have turned their attention away from Argentina for the time being, the current deficiencies in the economy, in addition to the tension between the government and multinational organizations, has created a unique environment which affects South America as a whole. Looking at the bigger picture, the purpose of my analysis is to determine whether the Argentine market can provide opportunities in order to diversify international holdings and reduce exposure to the overvalued North American market. While investors may disagree with the overall sentiment, Argentina is still considered an emerging market with a lot of untapped potential. Overall, looking at the size of the country, the nation is second to Brazil, third population wise, and remains amongst the main drivers of the continent's growth as the nation's resource base offers incredible long-term opportunities.

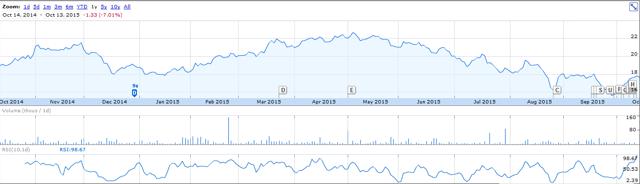

(click to enlarge)

Sourced from Google Finance

For investors considering exposure to the Argentine economy, ETFs like the Global X MSCI Argentina ETF (NYSEARCA:ARGT) offer an accessible way to gain diversified exposure. Looking at the fund's holdings, the top five sectors are energy (38.46%), financials (15.51%), technology (13.28%), consumer non-cyclicals (10.17%), and consumer cyclicals (5.92%). Looking at the fund's investment strategy, the high exposure to the energy and financial sector creates vulnerabilities in the current environment where economic stability and oil prices continue to remain uncertain. While the fund has declined by 16.97% in the last year, I suggest that any investors considering exposure should wait for a more stable investment environment to make a purchasing decision. In addition to the commodity price fluctuations, looking at the longer-term chart, investors are able to pinpoint select times when a fallout between the country and a foreign business hits global media channels as the ETF's price quickly drops. For this reason, while in the short term investors face commodity pressures from the price of oil, the medium term also looks difficult as the current political environment has become incredibly difficult to deal with from a foreign business perspective. Therefore, in the following article, I will cover different aspects of the economy to determine whether this fund and other select equities offer any opportunities for investors.

Political Environment

The political environment is arguably one of the most important considerations that an investor should make when analyzing the investment opportunities in the Argentine markets. From a foreign investor perspective, the lack of respect for international rules and constant shift in political agendas have made Argentina one of the most politically unstable business environments in the world. The current president of Argentina is Christina Kirchner, the first democratically elected president of the country who assumed office in 2007 and was reelected on October 23, 2011, for her second four-year term in office. Looking at her political successes, many cite her universal child benefit plan, which was launched in 2009 as a way to fight poverty with the goal to reach approximately five million children and youths. Since its creation, the program has been lauded for having boosted school attendance rates and reduced poverty rates among families. The problem in considering these programs and any other media reports is determining whether they truly exist and represent unbiased opinions. The Kirchner administration currently owns around 80% of the media industry in the country, which illustrates the difficulty in defining whether these reports on social programs are valid or not.

For this reason, when investors are conducting their research, the validity of domestic reports is an important consideration. The largest non-state-owned media group is the Clarin Group, a company that is frequently cited for publishing numerous reports revealing false statements made by the government in the past decade. The recent legal charges against Christina Kirchner were covered by the Clarin Group and provide an ideal example of the immunity and lack of transparency that exists with Argentine political leaders. After the case was mysteriously dismissed, the company ended up facing over 450 legal and administrative charges which stated that the company had violated media and competition acts.

Many investors have become accustomed to this lack of transparency in the political environment as local reports coming from the country are frequently considered government propaganda in support of the current administration. Looking at the World Bank Governance Indicators, which considers factors like accountability, political stability, government effectiveness, regulatory quality, rule of law, and control of corruption, Argentina performs extremely poorly compared to its Latin American peers. I will be using Brazil as a benchmark due to the familiarity that investors may have with the recent political conflict in the country. Looking at the statistics, Brazil's governance score (scale of -2.5 to 2.5) is 0.4 with a percentile rank of 60.6%, quite low compared to the global average. However, when looking at Argentina's governance score of 0.3 and percentile rank of 58.6%, we can see how poor the nation's political environment ranks in the region. Out of four categories, Argentina ranks the lowest in three; government effectiveness, regulatory quality, and rule of law.

Sourced from the World Bank

The two major political parties in the country are the Justicialist Party and the Broad Progressive Front. The Justicialist Party is the political majority in both the Senate and the Chambers of Deputies, with 122 out of the 257 seats in the Chambers and 43 out of the 72 in the Senate. The party's ideology is geared towards a socialist and left-wing nationalism perspective which has been a problem for investors as protective capital controls have limited the investment opportunities available to financially support deprived industries. The important faction within the Justicialist Party is the Front for Victory (FPV) which has led the majority of support for the party. During the 2003 election, the Justicialist Party experienced a power struggle which resulted in political leader Nestor Kirchner, husband to current president Cristina Kirchner, to form the FPV in an effort to win political leadership. The party followed a socialist and left-wing nationalist political ideology that encouraged the Argentine economy to shut its economic borders and internally develop established resources.

With a successful victory, Mr. Kirchner led the country from 2003-2007 and was known for leading an era of economic growth after the 2001 recession that saw poverty and unemployment fall significantly. After his term, his wife, Cristina Fernandez, succeeded him and oversaw the current era of political leadership, which is arguably less successful than Mr. Kirchner's own time in office. While Nelson Kirchner passed away in 2010 due to a heart attack, the FPV continues to be a major fraction of the Justicialist Party with the group holding around 87 of the 122 seats in the Chambers, in addition to 37 of the 43 seats in the Senate. While some investors may confuse the Justicialist Party as the dominating force in the political environment, it is actually the FPV faction that has led efforts in the past decade. Conversely, the Broad Progressive Front is a centre left party led by Hermes Binner. While the party only received 16.8% of the votes in the 2013 elections, with 22 seats in the Chambers of Deputies, political resistance and tension has mainly originated from these parties fighting for the interest of the Argentine people. Looking at the political environment from a party perspective, the current groups holding a majority in parliament have been limiting from a business perspective as socialist ideologies and nationalistic behaviour have resulted in FDI being limited due to severe capital controls.

Overall, the political environment in the country is extremely unstable and has not shown any adaptability in regards to reacting to macroeconomic pressures affecting the economy. Looking at the lack of transparency that exists in state and public media, investors should not rely on local reports as statistics coming from the country continue to remain manipulated in the face of severe economic pressure. In my opinion, the political environment is extremely unstable and anyone considering an investment in the country must be comfortable with the level of inconsistency in the political circuit. In my opinion, the best tactic is to gain exposure to state-owned companies that have long histories and established political relationships that could provide protection against the volatility that comes with changes in regimes.

How Is The Economy Doing?

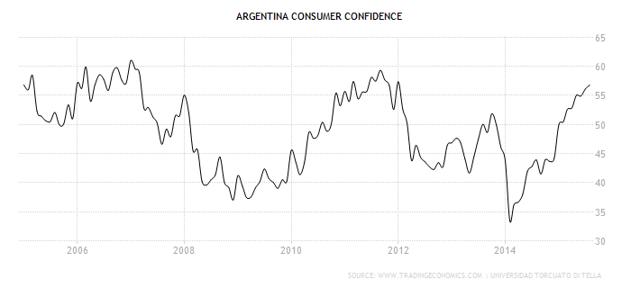

From a statistical perspective, Argentina reported GDP growth of 0.2% in Q1 of 2015 due to a strong increase in retail sales and consumer confidence. Looking at the medium term, in Q1 of 2014, the country reported a decline of 0.7% in GDP as weaker demand and a lower outlook on the Brazilian economy impacted economic performance. Analyzing the economy from a sector perspective, services and manufacturing make up majority of the economic output with a 20.5% and 26.2% contribution to GDP in the last quarter. While these sectors offer stability in the short term, the cyclicality of the manufacturing sector signals that as the economy becomes more modern, Argentina must move towards increasing the contribution of the service sector to GDP. Looking at the past quarter, the reason behind the strong 0.2% increase is due to two factors; (1) strong consumer confidence and (2) relatively stable retail sales.

The increase in consumer confidence is primarily due to the relative stability of the market in the past few months as attention has shifted from the Argentine government to global occurrences in China and Greece. Compared to early 2014, when issues relating to debt repayment and multinational complaints caught global attention, the past few months have been relatively stable for a market that has constantly faced criticism from foreign investors. With this being said, consumer confidence increased by over 36.82% (see below) as the market adjusts to lowering volatility and limited backlash from media. Conversely looking at the 1.6% increase in retail sales mom, the performance shows stability in the economy's consumption. With inflation coming in at an official 14% in the last month, this positive increase in retail sales shows that the economy has been able to deal with the pricing growth in the short term.

Looking at the longer term chart, from a yearly perspective, retail sales have shown an upwards trajectory in the past two years, thus showing maturity in the economy and more stability relative to previous political leaderships. In addition to this increase in retail sales, the housing index (permits per floor space) increased by 11% in the last 4 months supporting claims that consumption growth has become more unhealthy. While the short term has been better for the economy, the longer-term performance of these indicators reveals major deficiencies in output. The housing index yoy has seen a decline of 11.2%, thus solidifying that the stability of consumer spending (Q1, -2.3%) has not been strong enough to deal with the external macroeconomic pressures relating to the poor economic sentiment and output. A Thomson Reuters release highlights the market's overall sentiment; the article says:

"The country is struggling with low foreign reserves and one of the world's highest inflation rates. Interventionist policies such as trade and currency controls have further put a brake on business as has recession in top trading partner, Brazil. While those state controls on the economy helped maintain a trade surplus last year, Argentina's overall current account deficit widened 7.9 percent due to the volume of debt payment, profit and dividend outflows, data showed."

Therefore, while I would suggest that the last quarter provided some strength in some indicators, the systemic deficiencies relating to the lack of social inclusion and accessibility to further education for many has limited the economy. In addition, the debt burden faced by the government as funds continue to decline due to limited foreign investment and reserves has been worrying for regulators. Recent changes to the tax laws have continued to reduce the percentage of tax evaders as researchers estimate around 25% of eligible earners evade taxes, a significant amount that further limits the mobility of the government. Overall, looking at the economy from an output perspective, the medium term provides several challenges which could limit market returns as both the country and continent recover from the current slump.

Sourced from Trading Economics

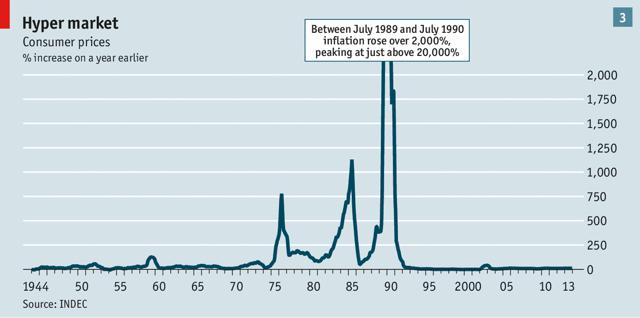

From an inflation perspective, Argentina reported a 14.8% increase in July as the country continues to see a devaluation of the Argentine peso relative to global markets. As previously mentioned, the Argentine government currently has several strict capital controls that limit the transfer of funds and most importantly the nation's currency. The central bank currently controls the exchange rate of the peso and has been against any move towards allowing the currency to freely float, a move that would drastically devalue the currency. With the currency controls in place, many small businesses have been unable to cope with the price increases and overvaluation of the currency as the cost of living continues to increase. For many businesses, being able to purchase inputs from the international market becomes incredibly expensive as inflation, taxes, currency controls, and tariffs almost double the price of the input. This not only limits businesses from having access to produce for production, but also forces the firms to raise prices in order to cope with these higher expenses relative to the global market.

Sourced from the Economist

Therefore, looking at the current environment, Argentina is facing stagflation, one of the most difficult economic scenarios where economic growth is slow, inflation is high, and the unemployment rate also is relatively high (6.6%). In this environment, the decline is primarily due to tariffs on imports, currency controls which have limited the supply/demand movement of the peso, and higher taxes which have lowered the number of transactions and consumption in the economy. With this decrease in supply, prices go up which directly impacts the inverse relationship with demand, thus lowering the amount of these goods that consumers purchase. With this decrease in demand, the utilization, investment, and profit rates all fall, which translates to a slower economy and a scenario where the Argentine government continues to limit the potential output of the economy. The government has constantly printed money to finance projects and support spending in order to protect reserves, a futile attempt that cannot be sustainable in the long term. Rob Dwyer, economic writer for Euromoney, covered the strategy. He writes:

"In the short term, many observers expect a new round of controls, moves to ease credit conditions and efforts to boost the dollar supply from the agricultural sector. However, the IIF warns that a policy response to worsening conditions that includes tighter currency controls, further fiscal deficit monetization and increased state intervention in the economy fuels inflation, deepens the recession and adds to peso depreciation pressures. Inflation will be in the 40% to 45% range in December and real GDP is set to decline by 2.5% this year."

Therefore, while the current environment has already been detrimental, the consistent stubbornness of the Argentine government and economic leadership has limited the country greatly. Any attempt to control reserves and protect any remaining economic growth through further controls is useless. From a logical perspective, a free market needs to interact with global markets in a fair and sometimes volatile way to remain sustainable in the long term. Unfortunately, by interfering through government policy, the free market cannot exist and only limits growth in the globalized economy of the modern world. Martin Castellano, Senior Latin America economist at the IIF, agreesthat:

"The government attempts to minimize international reserve losses while boosting growth. However, the policy instruments chosen to protect reserves harm growth while the measures aimed to boost activity add downward pressure on reserves. The effectiveness of controls and one-off measures aimed to boost reserves is bound to decline."

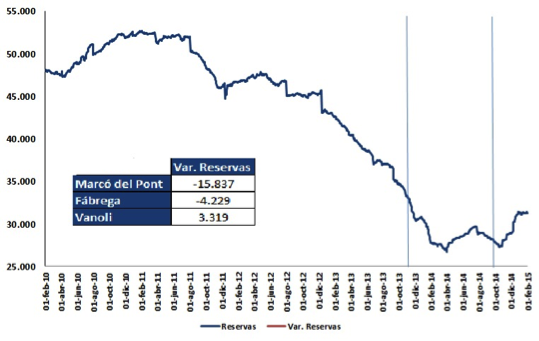

With these policy controls comes further support from the government which requires funding from the central bank or foreign reserves. Foreign USD reserves stand at $31.3 billion, a 39.8% decline since 2011 as the forex controls on the peso remains draining to the economy and potential government spending. I suggest that investors seriously consider the implications of these policies and understand that while in the short term, there are enough reserves to protect these currency controls, the eventual end to their supply will threaten both pricing growth and consumer sentiment as the economy is forced to revert to a free market dynamic.

Sourced from Panampost.com

Export Profile

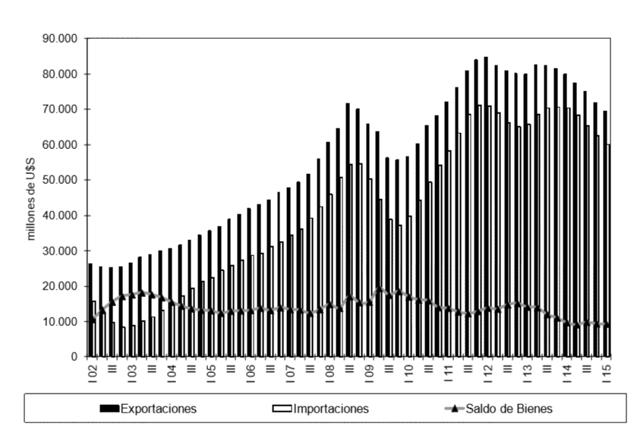

Sourced from mecon.gov.ar

Looking at the current trade profile, the country has underperformed in thelast three years as exports have declined by 12.3% while imports have dropped by 3.7%. Focusing on the export side of the trade portfolio, the past year was very difficult for the country's trade business as exports of goods significantly declined by 15.3% while service exports also dropped by 6.69%. The central reason behind this decline is short-term currency pressures relating to the Brazilian real and Chinese yuan. In addition, systemic limitations in regards to high sales taxes (21%) and additional trade tariffs has limited trade greatly in the past few years. The political mindset has been very limiting for a country that had been among the most successful economies in the world during the 1900s.

Looking at the country's trade account, the top five exported products are soybean meal (13%), corn (6.1%), soybean (5.4%), cars (5%), and delivery trucks (4.9%). With one of the more established middle classes in the South American region, many multinational manufacturers have built production plants in Argentina, which has benefited the country's trade balance. Unfortunately, with high labor costs and further progress in the Brazilian market, in the past decade, the auto manufacturing industry has moved away from Argentina, as the country's high corporate and sales tax added to the increasing costs that manufacturers faced. Conversely looking at the country's trade relationships, the nation's top five export destinations are Brazil (21%), China (6.3%), Chile (5.6%), the US (5.4%), and Spain (3.3%).

While the nation's focus on both the US and Spain offer international diversification, high exposure to Brazil is a vulnerability from an export perspective. Ideally, to remain hedged from potential macroeconomic events, a country should strive to build trade relationships with exposure in the 10% range. This can be seen in the past year where Argentina's high exposure to Brazil cost the country greatly as the Brazilian market underperformed and missed output projections. With the political and economic turmoil in the country, trade between the two countries continued to drop while the currency devaluation drastically impacted prices. In the past year, the Argentinian peso in regards to the Brazilian real has increased by over 48.52%, a currency translation that discouraged many Brazilian businesses from dealing with Argentina.

Sourced from Observatory of Economic Complexity

For investors to get a better understanding of the systemic deficiencies that Argentina has faced from a trade perspective, it is important for investors to understand the historical collapse of the nation's trade. During the early 1900s, Argentina was seen as a global superpower ranking among the top ten largest economies in the world. Looking at the nation's population during these times of great economic prosperity, half of Buenos Aires' population was foreign-born as international trade and FDI increased exponentially. The country was destined to be the leader in South America, and technological advancements increased the opportunities for success as the 1910s came around. Unfortunately, as WWI hit its peak and drove defense spending to record highs, Argentina was never able to recover from the financial burdens that the war brought on to the economy and its people. In addition, WWII increased pressure on the region as FDI stopped entering the economy and the political system collapsed entirely. While the country remains supportive of future growth, the lack of political direction and constant volatility in leadership created an environment where the economy was consistently misled. Nauro Campos, Professor of Economics at Brunel University, agrees:

"The political history of Argentina reveals an extraordinary pattern where democracy was created in 1912, undermined in 1930, recreated in 1946, undermined in 1955, fully recreated in 1973, undermined in 1976, and finally reestablished in 1983. The onset of widespread electoral fraud in the 1930s was the turning point and many argue that this erosion of the rule of law is a main reason for the decline."

Looking at the environment and collapse of both political and economic stability after two world wars and a decline in FDI, there is no respective event to blame for the overall decline in trade. The instability throughout the entire country was caused by several factors that unfortunately remain undealt with to this day. Politically, as covered in the section above, trade will not be a topic of discussion as nationalist behaviours have attempted to limit international trade in order to protect domestic businesses. In addition, short-term pressures in regards to the nation's trade relationships and currency pressures will only push the account lower. Therefore, while trade offers an avenue for growth and stability, the current business environment and culture is ill-equipped to survive in the competitive global market. These systemic deficiencies will take decades to heal, and I do not see Argentina's trade portfolio as a possible avenue of growth in the current environment.

Demographic Growth

Author's own work

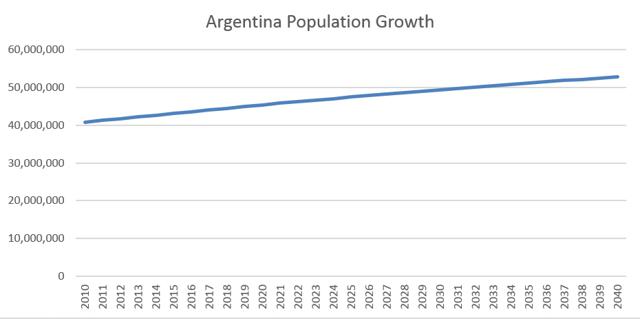

While many investors focus on the Asian region to profit off demographic growth, investors will be surprised to learn that Argentina's population in the past 5 years has grown by over 10.6%, which is incredible growth for an emerging market in the South American region. So what does this mean for investors? With higher population growth than neighbouring countries, the probability of a larger middle class increases as both economic development and modernization through technology will further the country's population.Projections estimate that Argentina's population will grow by 1.1% in 2015 and with a current population of 42,641,142 people, the country looks to benefit from a potential demographic dividend. While the growth rate has declined to a 1.02% average, comparing the country's growth to Brazil's 0.88% average illustrates the potential middle-class growth that could be seen in the Argentine economy.

In order to see a direct benefit from population growth, the economy must improve productivity through technology to leverage this expansion. With the generational increase in global productivity, incremental increases in the working population will drastically improve output, something the economists have banked on for years in regards to Asia and Africa. Looking at the current economy in Argentina, productivity has improved by 1.3% in the last year as the economy continues to deal with the competitive nature of global markets. Martin Neil Baily, a writer for the Japanese Times, covered the story of increasing productivity in emerging markets. He writes:

"Mexico and Saudi Arabia improved their productivity by less than 1 percent per year over this period; Argentina, Brazil, Russia and South Africa managed productivity growth of 1.2 to 1.5 percent. There is reason to believe that these economies can do much better. With a comprehensive approach, 11 emerging economies (Argentina, Brazil, China, India, Indonesia, Mexico, Nigeria, Russia, Saudi Arabia, South Africa and Turkey) could, on average, boost their annual productivity growth to as much as 6 percent by 2025. Four-fifths of that growth would be achieved through the adoption of approaches that have already been successful elsewhere, with new technological, operational and business innovations covering the rest."

The basis of the argument that Mr. Baily covers is very important for emerging markets to adopt; like the saying goes, "don't try to reinvent the wheel." Looking at the current economy, Argentine leaders and businesses need to realize that to survive in the current global economy, rejecting competition is unsustainable from a longer-term perspective. Therefore, while the population offers incredible growth, to leverage this expansion, the country needs to follow in the path of many other successful emerging markets and lower tariffs, allow foreign businesses to operate more freely, and utilize foreign investment to develop the growing population.

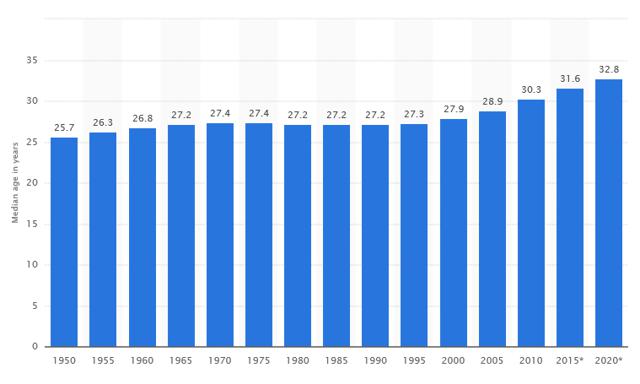

Another important development has been the increasing average age in the Argentine population from 27.9 years in 2000 to around 31.6 years in 2015. The country has been growing demographically, but the 4.3% growth in the average age of the nation has been a worrying factor in regards to long-term output. Consumption is proven to increase over time as a nation's population gets older; however, these individuals also hold jobs longer which could contribute to a lack of development for the future generation. I have covered countries like South Korea where an older population has dramatic effects on the younger generation and the amount of jobs available. Therefore, when looking at the increase in the country's average age, while the short term provides higher output in regards to a larger working class, the long term is threatening for the youth labor market and the future of the country. It will be important for long-term investors to realize the significance of this development over time and recognize that several decades from now, the youth labor market will be hindered by this demographic "dividend."

Sourced from Index Mundi

Labor Market

Looking at the current labor market in Argentina, the country reported an unemployment rate of 6.6% in Q2 of 2015, down from 7.1% in the last quarter. While the improvement may have been seen as a positive, the labor force participation rate declined by 1.33% in the last quarter, signaling that while official unemployment declined, the number of people leaving the workforce clearly contributed to this decline. In the past year, with inflation continuing to hit new yearly highs and some economists unofficially calling for 40% inflation in May, the country is dealing with unsustainable prices, which has left many without a job.

In the current economic environment, pricing growth needs to be controlled in order to actually improve the labor market in the short term. Conversely, looking at the market from a longer-term perspective, investors point to the decline in unemployment from 21% in 2002 to now, a significant improvement that has started to benefit both the culture and direction of the labor market in Argentina. However, investors need to realize that the political instability the country faced in the 90s caused much of the labor crisis in the following years. Thus, the improvement in the labor market was primarily due to the political environment calming down and reducing the amount of conflict internally. Unfortunately, with similar processes and systems in place since the early 2000s, the labor market has failed to adapt as the skill gap in the market has discouraged many manufacturers from operating in the country. Argentina's lack of skilled workers in several sectors of its economy such as education, automobile, new technologies, biology and IT industries has reduced the potential FDI inflows in the market.

Sourced from World Bank

Another important factor to consider is the current labor organizations that dominate the Argentine economy and political relations. With around 40% of the official workforce unionized, the culture surrounding the labor market has become extremely complacent as many foreign businesses have had problems in dealing with unions like Confederación General del Trabajo, the largest labor union in the country with significant influence on the political circuit. The problem arises when these labor unions begin to effectively "bully" foreign businesses that are considering the Argentine market. With limited negotiable options and extremely strict demands, many businesses have had difficulty dealing with the Confederación and its demands, thus driving potential business away from the country and economy.

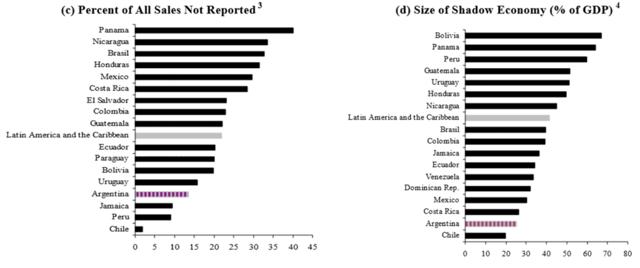

In addition to unionization, the informal labor market has been a major contributor to the uncertainty and instability in the labor market as government agencies are unable to accurately estimate the number of "black market" jobs supporting domestic families. The transition in the political environment in the past decade has had positive effects on poverty levels as the percentage of people in moderate and extreme poverty has decreased significantly. However, when comparing the improvement in the labor market to that of the income levels of the Argentine population, the mismatch is primarily due to this informal employment supporting many families.

Looking at the statistics, at least 61% of households have earned between 0 to 25% of their household income from informal sources. With such a major contribution to earnings, investors need to consider two things; (1) why has the black market grown so much in the past decade and (2) what should investors expect from this type of labor market. Looking at the reasons behind this increase, the report here provides an excellent summary of this change in the market and the numerous factors affecting the increase in informal income. The report concludes that the top reasons behind this change were privatization, trade liberalization, labor regulations, and tax evasion.

Touching upon market privatization, as the private industry continues to grow, many employers sought to reduce costs by limiting the amount of formal hires in order to avoid labor costs associated with employment. In addition, with these private businesses wanting to reduce hiring costs, the labor regulations enforced in the past decade have discouraged many from setting aside the money to pay for social security, severance pay, family allowances, and health insurance. The fees that the government enforced are much higher than many other countries in the South America region, thus putting more pressure on these industries that have continued to deal with other macroeconomic forces.

Regarding trade liberalization, due to increased competition on the international front, especially from other South America countries, Argentine businesses have been forced to reduce costs in order to see any increases in profits. With this lowering in costs, while labor productivity has increased incrementally, part of the reduction is due to lower labor costs through informal hiring. Finally, being employed in formal jobs means that income declarations prevent many families from evading government taxes or fees. With poverty levels in the 40% range, the current progressive tax system has encouraged many to seek undeclared income. For this reason, many unemployed workers have avoided the formal labor market in order to avoid tax payments to the government. A report by the World Bank on labor informality confirms:

"Compliance with labor regulations are a consequence of both social norms and the deterrence effect of enforcement mechanisms. Social norms for compliance may be eroded if the public loses confidence in government. Consequently, high levels of informality may be due to poor enforcement and low confidence in public institutions. Likewise, changes in enforcement or attitudes over time could lie at the root of increased levels of informality."

Overall, looking at the current informal labor market, like many other emerging markets that face tough macroeconomic pressures and high poverty levels, the increase in undeclared income has become prevalent in the current environment. With inflation projected in the 40% range in the past year, in addition to drastically lower imports, the cost of living in the country has increased significantly, thus forcing many families to turn to the informal labor market for higher sources of income. While these higher income levels will translate to more consumption from households, the lack of accountability and accuracy in labor market statistics makes Argentina less transparent for many international investors. For those considering exposure to the country, the current labor market is difficult to judge. On the one hand, there is a formal market protected by unions that limit foreign business growth. On the other, there is a black market that contributes to lower potential government revenue due to poor tax compliance in addition to a change in the culture of the labor market as informal jobs encourage illegal activities. I recommend that investors seriously consider the implications of informal labor when purchasing an equity in a specific industry as costs relating to that business can become difficult to forecast and interfere with assumptions regarding valuations and future projections.

Financial Services

In recent news, a US court ruled in late August that creditors owed billions by Argentina could not seize the assets of its central bank. This is a key decision as more than $80 billion USD has been overdue since the country's default in 2001. Unfortunately, Argentina's political ideologies have continued to spread to the banking sector as the nation's central banks remain unmoved by the continued efforts to repay bondholders in the past decade. This breach of trust has been taken to several courts over the past few years, and while the situation remains tepid at the moment, foreign investment has seen an incredible decline as investment funds continue to decrease. The question now becomes should investors consider any investment opportunities in the financial sector and what are the major factors to consider. Looking at the current environment, I would like to touch on two important factors that will affect the investment decision of anyone considering exposure to the Argentine financial sector; (1) risks and (2) rewards. A Moody's article covers the major risks involved in the sector here:

"Since 2011, the government has implemented a number of measures - such as foreign exchange controls and import restrictions, caps on lending rates and fees, mandated lending requirements to targeted economic sectors, and restrictions on lenders' dividend payments - that have exacerbated business conditions and weakened the banks' financial strength. What's more, the recent decline into an outright recession raises the risk of further government pressure on lenders to stimulate growth by making credit more easily available."

In addition to capital controls that limit the overall business model of major banks in the nation, the current 40% inflation faced by retail customers has become a serious problem which directly relates to the high 3.2% delinquency rate in the banking industry. With the purchasing power of consumers continuing to decline as inflation limits the amount of goods and services purchased by the average family in Argentina, majority of the loans taken out have not accounted for the pricing growth and decline in the ability of the borrower to make interest payments. For this reason, the larger loans taken out during these times of economic growth in the 1990s have remained a challenge as interest payments continue to become burdensome on these consumers who face extremely high inflation pressures. Overall, looking at the risks faced in the current banking environment, strict capital restrictions and a high inflation rate will limit the profitability of the current loan books held by institutions in addition to discouraging consumers from taking out future credit.

The money market rate remains at 24% for the central bank which lowers the net interest spread as banks continue to attempt lowering rates in order to encourage consumers to spend. While the years of 91% interest rates are gone, the residual effects of the previous decade and the inconsistent debt schedule followed by the Argentine government has set a precedent for majority of the nation's consumers. Therefore, not only is the market limiting itself from growing the banking sector, but also the precedent set by the government has encouraged poor consumer behaviours that will plague the market for generations to come.

Looking at the banking sector's strengths, while many investors may be afraid to consider an investment, several institutions have remained incredibly stable in the current emerging market. From a fundamental perspective, the current banking system is a double-edged sword that illustrates the uncertainty of government restrictions on the sector. While current economic growth has been slow and damaging for the bank's loan portfolio, this slowdown in lending has allowed it to build up liquidity and capitalization which should help these equities survive the current downturn. Conversely, regulatory limitations have restricted the amount of dividends banks are able to pay out, which makes these investments more of a growth play rather than an income opportunity.

Looking at the industry averages, non-performing loans are relatively low in addition to deposits which have remained stable in the face of a continued decline in the currency valuation. Unfortunately, these statistics remain useless when taking into account that strict capital controls limit large financial institutions from moving money outside of the country. Therefore, when investors are considering any of the nation's banks, majority of the statistics remain inaccurate from illustrating the current market in Argentina. While investors should be careful, there are opportunities to benefit from these capital controls which should allow these stocks to offer stability in the face of a market that remains in a state of constant volatility. Looking at the options available for the retail investor, while the projections for the market remain inaccurate in the current economic environment, anyone who is willing to gain exposure to the Argentine market should consider the major banks as an option to reduce volatility in holdings. Looking at the sector's strengths, stability through increased liquidity and regulatory support from the central bank will bode well for several institutions that have established market share in the country.

Any interested investors should consider BBVA Banco Frances (NYSE:BFR), Grupo Financiero (NASDAQ:GGAL), and Banco Macro (NYSE:BMA) as possible opportunities due to their size and established market share in the financial sector. As covered previously, investors need to make sure that when investing in the Argentine financial sector, established players with holdings across several sectors should provide the necessary stability to survive the current downturn in the economic performance of the country. BBVA Banco Frances is among the most diverse and expansive banks with over 51 million customers across 8,135 branches and 24,337 ATMs around the world. It has operations across South America, Mexico, the US, Turkey and Spain, which gives the company diversification in revenue streams.

Looking at the overall business model, BBVA primarily operates in the retail, corporate, and institutional baking segments in addition to offering insurance products in the Mexican and South American markets. With global rates on the decline, the fixed income options offered by BBVA in the insurance segment should take a hit in the long term as yields continue to decline and reduce the availability of high-paying bonds on the market that meet the company's risk tolerance. Looking at the balance sheet, this exposure to the insurance segment is the reason why the income/other expenses account declined by 8.2% yoy in addition to the operating expenses which increased by 13.4%. I see Mexico as a possible drag on earnings and the bottom line, with the market continuing to require larger investments to support market share and the implementation of new insurance products. Fortunately, the segment contributes only 3.1% to revenue and shouldn't be a major drag on top-line growth within the following years.

Looking at the past year, all global segments reported an increase in operating income and lending activity as global interest rates continue to decline. Unfortunately, looking at operations in South America, the recent struggles of the continent's economy due to lower commodity prices has resulted in the segment reporting an increase in the NPL ratio by 9.5% in addition to the coverage ratio declining by 10.45% yoy. Looking at the overall picture, with South American operations contributing only 16.6% to the company's net income, the recent decline in the coverage ratio shouldn't be too worrying in the following year. Overall, with net deposits increasing by an average of 14.86% across all segments in addition to Spain (10.8%), the US (12.9%), Turkey (21%), Mexico (13%), and South America (12.2%) all reporting increases in loan growth, the current performance of the bank looks to continue to remain strong. Compared to the domestic forecasts, the expansion of BBVA into international markets has saved the bank from feeling serious pressure from the South American market. With a yoy return of 28.54% and a P/E ratio of 8.98, the equity provides an attractive opportunity to enter the Argentine banking sector.

Banco Macro is the fifth largest bank from a loan perspective with over 7% of the nation's public and private loans being dealt through the bank. The organization's strategy is much different than the nation's general banks as its business model focuses on targeting the rural areas of the Argentine market. Looking at the bank from an overall perspective, with 435 branches and 1,314 ATMs, the company remains a middle-market competitor that services the lower to middle class market, the highest growing segment in the consumer space. In the current environment, while economic growth has been difficult to find in the concentrated province of Buenos Aires, the rural regions have offered growth as volatility in consumption is heavily reduced in these regions.

Looking at the current wealth gap in Argentina, the nation recently reported a wealth distribution gap not seen in over 30 years, a product of the underperformance of the nation and corruption in the political environment. While the future does not look bright from an income distribution perspective, many banks have leveraged their loan portfolios and deposit books towards this profitable upper class located in the suburbs of Buenos Aires. With a quarter of the Argentine population living in the Buenos Aires province, the concentration of banking competitors in the region has limited growth for many institutions as the market continues to target the concentration of wealth in that area. Banco Macro focuses on targeting the lower class and growing middle class through its network of branches that are 79% located outside of the Buenos Aires province. While this strategy may have limited the size of the institution from a deposit perspective, the growth rate achieved by Macro is much higher than its competitors focused on the Buenos Aires province.

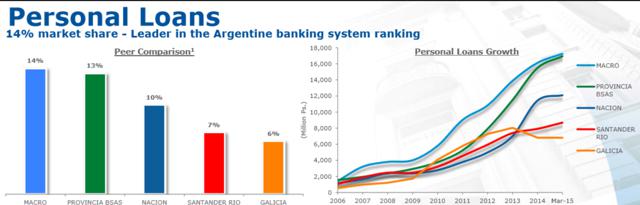

In addition, with the continued corruption that is occurring in the capital city, with only 7% exposure to Buenos Aires, the capital outflows seen in the last decade from foreign institutions will not affect Macro significantly. With 66% of loans made out to Argentine-based public and private banks, the threat of the continual decline in foreign investor confidence shouldn't be a concern for the company's business model. Taking into account the company's unique strategy, from a financial perspective, Macro has performed incredibly well compared to competitors through its market-leading position in the Personal Loan segment. With a market share of 14%, targeting the rural regions has become a profitable strategy that has ensured the company sees personal loan growth in the past 9 years.

One of the central reasons for this market performance has been due to the fact that 65% of loans are dealt to pension funds, a stable entity that ensures the company's repayment schedule remains relatively secure. This stability in Macro's loan strategy has ensured that the bank retains its top spot in net interest margin ranking with 11% in addition to being first in total capital ratio with 22%. While the fundamental stability of the bank will help the firm survive the continued underperformance of the economy, in the past year, the flat yoy performance of the stock illustrates the 26.16% decline in net income. Therefore, while the organization provides one of the best opportunities in the financial services market, with increasing pricing growth, investors shouldn't expect positive earnings growth in the near future.

Sourced from Banco Macro

Grupo Financiero is the fourth largest bank servicing the private sector with a market share in loans to the private sector and deposits to the private sector of 8.7% and 8.5%, respectively. The company's business model is heavily focused on servicing the private sector in order to avoid the troubles and volatility in repayment coming from the public sector. I agree that Grupo's emphasis on the private sector will bode well for the company in the long term as political instability will directly affect the public sector first. Looking at the market itself, deposits from the private sector in the last year have increased by 38% while loans to the private sector have increased by 28%, a positive sign that illustrates the growth coming from the private part of the market.

Looking at the corporate structure, Grupo Financiero Galicia manages four major subsidiaries focused on different lines of business; Galicia Seguros (insurance), Calicia (retail bank), Galicia Administradora de Fonds (Mutual Funds), and Compania Financiera Argentina (consumer lending). Many investors may recognize Compania Financiera Argentina as the division that AIG (NYSE:AIG) sold at the heart of the 2008 crisis, a very profitable acquisition that has helped Grupo establish a dominant position in the credit card segment of the market. The position of the bank and recent growth in the private market has resulted in Grupo's stock price to increase by 26.51%, the highest among its peers in the banking industry.

In addition, the bank has positioned itself in the Argentine market through a diversified network of branches that reach the rural area (29%), Buenos Aires province (42%), and Buenos Aires city (29%) in order to sustain its 8.37 million customers. The company's customer network represents about 42% of the economically-active population in Argentina and remains the main component of the bank's long-term growth. While adding new customers in this concentrated market has been difficult, the company's credit card business has been the main reason why Grupo has established such a presence in the financial services market.

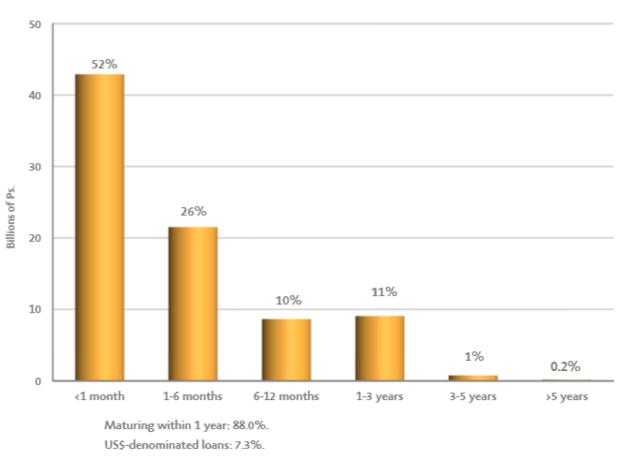

With the most diverse range of credit and debit products, the bank has over 12.6 million credit cards issued, almost three times as much as the second-ranked Banco Macro. From a financial perspective, with net income increasing by 36.9% yoy, the bank has been able to survive higher pricing growth primarily due to its focus on the more stable private sector. With only 9% of deposits in foreign currency, the drop in the peso has not affected the value of deposits relative to the domestic market. Thus, when looking at the 16.7% increase in administrative expenses, Grupo was able to protect the top-line growth through shorter loan length primarily handled in the peso, a strategy that protects against currency translations and ensures that interest income remains high.

I would like to draw investors' attention to the image below. One of the major contributors to the 17.67% increase in interest income is primarily due to the length of issued loans and maturity dates. It is incredibly rare for an institution with $14.4 billion USD to have over 88% of its loan portfolio maturing within the following 12 months. With that being said, the 7.3% of loans denominated in USD will also be beneficial for the company as positive currency translations will increase net interest income in the short term. Overall, with a large percentage of loans maturing in the following year, I am confident that the bank's incoming liquidity will help the firm survive the current downturn in the Argentine economy. Overall, when looking at Grupo Financiero and its business model, the focus on the private sector through short-term loans has benefited the company's liquidity while providing short- to medium-term growth in top-line income. I view this equity as both a long-term opportunity to get exposure to any potential increases in stability in the private sector in addition to being a tradable opportunity in the short term.

Sourced from Grupo Financiero

Energy

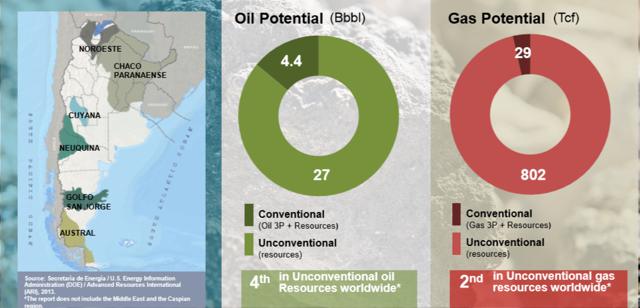

Argentina has the potential to be a global powerhouse in the energy industry with oil reserves totaling 1.2% of global reserves, ranking the country among the top 5 in Latin America comparable with the likes of Brazil, Venezuela, and Mexico. Unfortunately, while the potential is there, political nationalism and the stubbornness of domestic business leaders has threatened the relationship between many energy producers and international investors. Argentina needs to realize that while it lies atop an abundance of resources, relying on domestic funds is not enough to achieve the over $250 billion USD needed to build and expand operations in the country.

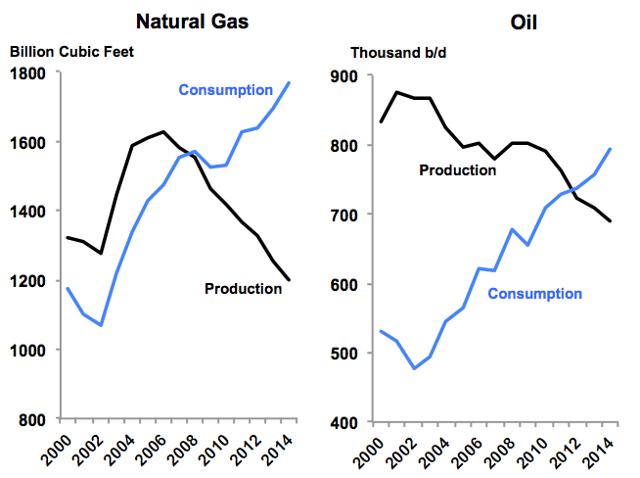

Looking at the nation's energy dependence, Argentina greatly relies on oil and natural gas, which combined constitute nearly 90% of the primary energy supply, compared to the global average of 60%. In 2012, the nation experienced its energy trade shift towards an import strategy for the first time in several decades as consumption outpaced production. The lack of investment in infrastructure has limited the nation's industry from keeping up with a growing population and the energy needs associated with that expansion. Importing energy is a problem that needs to be dealt with because it is unsustainable for a depleted economy like Argentina with its limited foreign currency reserves. Looking at the statistics, I suggest that readers read the KPMG report which summarizes the energy landscape in the country. Ironically, the country's largest shale is called "Vaca Muerta" which translates to dead cow and is considered the mother-lode with natural gas reserves reaching 800 trillion cubic feet. The government wanted to capitalize on this discovery and near the end of 2014, investors were surprised to hear that the government wanted to increase foreign investment by reducing tariffs and encouraging multinationals to invest in the country's energy reserves. Investors should take this with a grain of salt due to the fact that the government has a tendency to go back on its word and nationalize its reserves just as the money starts flowing. For this reason, Bernard Weinstein, associate director of the Maguire Energy Institute at Southern Methodist University, says:

"It's hard for me to believe that President Kirchner is going to do an about-face. Before we see any significant foreign investment in Argentina's energy sector, there has to be economic and financial reform under the new government to be elected next year. Presumably the new leadership will be more enlightened, more moderate, more cognizant of the fact that you can't develop your economy unless you have a functional government, rule of law, and sanctity of contracts."

I also agree that investors should be skeptical, and while the energy industry is seen as the potential avenue to spark growth in Argentina, the nation needs to see political changes in order to strengthen confidence in FDI. The $100 billion USD default in 2002 signaled to investors the instability that exists in Argentina, and for this reason, many foreign investors remain skeptical of whether they will be paid back or not. Therefore, while the current energy space remains among the most profitable from a fundamental perspective, the time and money needed to fully capitalize on reserves is almost unattainable. Argentina has a track record of going back on repayment agreements, something which has resulted in foreign investment declining by 83.3% in the past 3 years. Thus, while investors should point to the potential these reserves hold, an understanding of the industry's history is needed to ensure that investments remain profitable. I suggest that any interested investors distance themselves from the smaller industry players and remain exposed to companies like YPF (NYSE:YPF), Petrobras Argentina (NYSE:PZE), and Pampa Energia (NYSE:PAM) which have established market positions protected by political relationships that extend decades with the government.

Sourced from Forbes.com

YPF is historically one of Argentina's core companies to supporting economic growth and profiting off the nation's abundant resources in the oil and gas segment. The company is a vertically integrated Argentine energy company engaged in the exploration, production, transportation, refining, and marketing of oil and natural gas; however, with 90% of revenues coming from its downstream operations, it is best known for refining and marketing oil and gas. The 1973 Argentine dictatorship had privatized the company, which resulted in operations turning unprofitable as global oil prices fell in the following years. However, in 1999, the Madrid-based multinational corporation Repsol S.A. (OTCQX:REPYY) purchased 98% of YPF and turned the company around in an effort to leverage its large holdings in the Vaca Muerta shale, a move that would push the company towards public ownership and more regulatory transparency.

Looking at the stock, the past year has been unforgiving as the decline in the price of oil has resulted in a yoy decline of 56.96%. However, when looking at the financial results of the company, investors would be surprised to see that yoy, revenues increased by 12% as production in crude oil and gas increased by 3.7% and 2.3%, respectively. Unfortunately, as seen with many other investment-heavy companies, the nation's high inflation rate resulted in the increase of selling expenses and capital expenditures by 24.6% and 33.7%, respectively. Taking into account the market fundamentals, with the average price of oil declining by 8.5% and the price of gas increasing by 9.6% (primarily due to government subsidies), domestic demand has increased by 1.5%. I expect that in the long term, one of the most consistent statistics that investors will look for is domestic demand as the nation's population continues to see their energy needs grow. One of the serious problems that has come up in the past few years is the nationalization of 51% of the company in May 2012. This move was due to the constant blackouts the country experiences during the warmer seasons as energy infrastructure is very limited and underdeveloped. The government wanted to regain control of the company in order to oversee exploration and development of respective properties. The Economist posted an article covering the situation and how this move resulted in primary owner and Spanish giant Repsol to lose out on billions of dollars in payment. It says;

"Cristina Fernández, the president, found a scapegoat for the energy problem in Spain's Repsol, which owned 75% of YPF, the country's formerly state-owned oil and gas company. Repsol had announced huge discoveries of shale gas in the Vaca Muerta basin in Patagonia. But the government accused the company of funnelling profits towards dividends instead of to exploration and development. Last May the government nationalized 51% of YPF. It has yet to pay Repsol a penny of the $10.5 billion it is claiming in compensation."

Unfortunately, the move did not yield the results intended as the company didn't grow over the following year as the government continued to lead operations which resulted in exploration and cost inefficiencies. The nationalization of the company was a poor move that resulted in several political scandals as Repsol has yet to see a penny of the $10.5 billion it is claiming for compensation due to the nationalization of operations. Overall, while the financial results from a fundamental perspective continue to illustrate the potential the energy market holds, growing domestic demand was not enough to push up the bottom line as YPF reported a 6.3% decline in operating income. I expect that with the company being such an important producer of economic output for the country, the government will continue to limit any foreign control as the relationship with Repsol continues to deteriorate. In addition, with the price of oil stabilizing in the following years, foreign investment in the energy sector will dictate whether the company will grow in the long term. I suggest that investors watch at the moment and act when the outlook on foreign investment and political stability improves.

Sourced from YPF.com

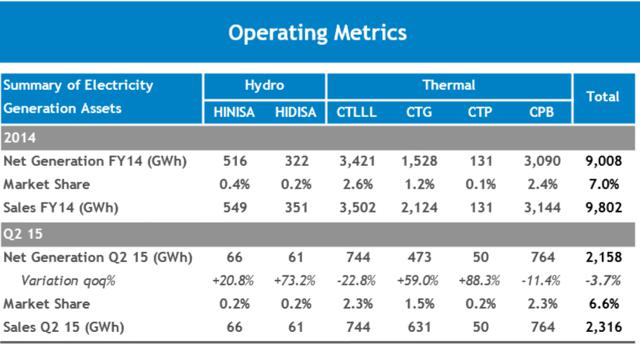

Pampa Energia is the largest fully-integrated electricity company in Argentina with subsidiaries engaged in generation, transmission, and the distribution of electricity as well as the production and transportation of natural gas fluids. The company generates approximately 2,217 megawatts, which accounts for 7.1% of energy production in Argentina in addition to a high voltage transmission network that extends over 12.3 thousand kms. This network transports over 90% of Argentina's annual electricity and has become a fundamental component of the nation's energy infrastructure. Similar to the financial services industry, the energy industry focuses on the higher consumption levels in Buenos Aires where Pampa services over 2.8 million customers (21% of the market). Looking at the financial results for the company in the past year, revenue increased by 18.4% with the generation, distribution, and oil/gas segments reporting increases of 25.2%, 6.5%, and 137.2%, respectively. While from a revenue perspective the company showed strength, the 37.39% decrease in net income was primarily due to the increase in expenses as cost of sales and administrative costs both increased by 17.85% and 35.48% respectively.

Looking at the oil and gas segment, the company has strategically utilized the low price of oil to sign deals with established players within the country like the previously discussed YPF. On May 27, 2015, Pampa Energia signed an addendum to the investment agreement with YPF which allows for increased production of its joint venture wells. For this reason, we see a 42.5% and 126.7% increase in oil and gas production in the past year. Focusing on the long-term fundamentals of the market, Argentina is the second largestconsumer of electricity in South America behind Brazil, however, pays less than a quarter for the energy. This is largely due to the over $10 billion USD spent every year to subsidize energy costs in Argentina as Argentina becomes a net importer of energy, something that hasn't happened since 1984. The strategy was originally to drop energy costs to help the middle and lower class recover from the 2001 collapse in the economy, which worked up until a certain point where the government failed to scale back these subsidies. This resulted in Argentina spending over 20% of the central banks' foreign currency reserves every year on energy imports to offset this inefficiency in generation and transmission.

In the last three years, another problem has arose as these subsidies become ineffective due to an increasing inflation rate that limits the amount of money residential consumers are able to spend on energy. The government has reacted by raising tariffs on imports in order to help make domestic energy more profitable, however, the government will need an additional $9 billion to stimulate investment and support the industry. Therefore, while Pampa Energia will benefit from market-leading positions, the necessary investment to support infrastructure will have to come from FDI which has been limited due to political conflict. I expect that the company will continue to survive and benefit from its own transmission network which reported revenue increases of 48.4% yoy. Overall, the past year has been strong for Pampa as its operations continue to leverage its high market share to remain profitable; however, with inflation increasing and pushing costs up, the profitability of operations remains threatened at the moment. In addition, the development of energy infrastructure is needed, and I expect that in the longer term, Pampa will have to seek out assistance from foreign support in order to upgrade transmission and distribution networks for electricity and oil/gas production.

Sourced from Pampa Energia

Petrobras Argentina is the Argentinian subsidiary of the Brazilian multinational energy company Petroleo Brasileiro S.A. (NYSE:PBR). The company is the second largest oil enterprise behind YPF and is focused on the exploration and production of oil and gas, as well as petrochemicals and electricity production. The unit was established in 1993, and originally the company owned around 700 service stations and focused on the distribution of oil and gas from Brazilian operations. After several acquisitions and an entry into the energy market through the purchase of a majority stake in Transener, the leading Argentine company in transmission, Petrobras Argentina has rapidly grown to over $1.6 billion USD in enterprise value.

The Argentine subsidiary remains the largest of Petrobras' international operations with 98% of crude oil sales, 97.2% of natural gas sales, and over 7,748 gigawatts of energy sold in South America (excluding Brazil). With the company contributing around 6% to Argentina's natural gas consumption, the recent report stating that YPF submitted a $900 million USD bid for a 67% stake in Petrobras Argentina illustrates the strength of the company's assets. The final bid has not been finalized and surprisingly the stock has not reacted to the news as yoy the equity has declined by 14.52%. Currently, the bid was rumored to be rejected as the company felt the sum was too little in regards to the value of its natural gas and oil assets in addition to the expansion of its distribution network. Micheal Kaufman, M&A author for bidnessetc.com, writes:

"The chief financial officer at YPF SA, Daniel Gonzalez stated at the Oil & Money conference in London, that his company recognizes the fair value of Argentina assets owned by Petroleo Brasileiro SA - Petrobras' subsidiary and will only acquire a stake in Petrobras Argentina, if the price demanded truly reflects its worth."

Currently, YPF has been focused on inorganic growth as it recently closed the 2014 $800 million bid for Apache's (NYSE:APA) natural gas assets in Argentina. The recent interest in Petrobras Argentina solidifies the strength seen in the market as consolidation among the major players ensures that the oil and gas market survives in the current downturn. Looking at Petrobras' valuation from YPF's perspective, if the company sees a 67% stake worth around $900 million USD, this estimate values the whole company at around $1.34 billion or at $6.65/per share, a premium of 30% from the current $5.12/share on the market. Therefore, looking at the current valuation competitors are placing on Petrobras Argentina, investors are already getting a bargain at the current price.

Conversely, when focusing on the alleged corruption scandal faced by Petrobras Brazil, the company is facing an almost insurmountable challenge of paying off over $125 billion in liabilities. In recent weeks, the company has cut production targets for 2020 from 2.8 million bpd to 2.6 million bpd as it will sell around $15.1 billion worth of assets by the end of 2017. It seems that the Argentine subsidiary is a possible stake the company can sell, so any investors considering a purchase in Petrobras Argentina should only approach the equity from a short-term, tradable opportunity. The $101 million sale in August was the first move as the company approved the sale of its assets in the Austral basin in Argentina, which saw the subsidiary give up a large portion of its assets in order to focus on the divestment program currently in place for 2017.

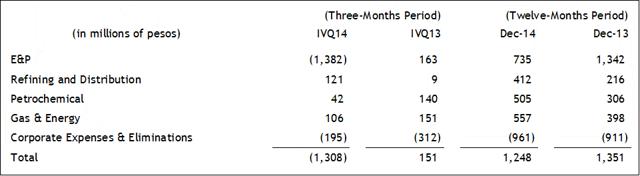

Before I analyze the financials, investors must be aware that all financial reports (excluding annual reports) are published in Spanish, which makes it difficult for foreign investors to learn about the company. Looking at the 2014 results, from a balance sheet perspective, the company is quite healthy with only $92 million in short-term debt and $2.5 billion in long-term debt. In relative terms, from a percentage of assets comparison, short-term debt makes up half a percent and long-term comes in at around 10.6%. These are extremely healthy levels for the subsidiary by itself. Looking at the operating income (see below), with the decline in oil and corruption scandals facing parent company Petrobras Brazil, exploration and production in the last quarter took a major 947% decline as capex was severely reduced and oil demand fluctuated in regional markets.

Revenue yoy increased by 35.19% while the profitability of assets declined as ROA and ROE both declined to around 2.37% and 4.58%, respectively. From a yoy perspective, the refining, petrochemical, and energy production divisions all reported increases of 90.7%, 65%, and 39.9%, respectively. In addition, when taking into account the corporate expenses segment, the company actually saw a reduction in the last quarter as Petrobras Argentina reacted to the decline in the price of oil. When considering the financial position of the subsidiary itself, I was generally surprised at the strength shown in assets and operational cash flows as all segments remained strong in the face of difficult commodity pressures. The company's business model is extremely diverse with exploration and production operations contributing 35.23% while refining, petrochemical, and energy production all contribute an additional 38.32%, 14.81%, and 11.64%, respectively.

With over 80% of assets in Argentina (the remaining in Brazil), the company is highly leveraged to the growth of the Argentine economy. In the past three years, as foreign currency reserves and trade continue to decline, the energy subsidies in the oil and gas sector have limited the growth seen by Petrobras Argentina. While this may be socially beneficial in the short term, capped pricing growth from the producer side and strict legislative pressure in regards to energy transmission have been unfavorable for the company. As stated earlier, the company should be seen as a "tradable" opportunity that investors should consider in the current volatile oil market.

In the long term, the fundamentals remain bleak, and I see the company being stripped of major assets as parent company Petrobras Brazil continues to manage the divestment program targeted for 2017. Overall, from an internal perspective, the company seems relatively strong with limited debt and a strong cost management system in an environment where both commodity and macroeconomic pressures have severely affected the market. Unfortunately, while parent company Petrobras Brazil was once a support for the subsidiary, the recent legal troubles and established divestment program will hurt Petrobras Argentina in the following years. Therefore, while I would be confident in the company if it was a stand-alone entity, the current legal troubles, in addition to further supply problems relating to the Argentine energy market, make this equity only a tradable opportunity.

Sourced from sec.gov

In Conclusion

After evaluating the current state of the Argentine economy, there are several deficiencies that make the market extremely unstable from a long-term perspective. Looking at the nation's political structure, the Christina Kirchner administration has been detrimental to the nation's economic future, as poor energy policies and strict capital controls have reduced international trade, depleted foreign currency reserves, and limited the transfer of wealth among domestic citizens. I do not expect this situation to improve in the future as the current president will remain in office for several more months and is expected to be succeeded by political ally Daniel Scioli, a business leader who is considered very close to Ms. Kirchner.

In addition to political pressure, the incoming president, regardless of who it will be, will be facing an incredible challenge in turning the economy around asinternational creditors have fallen out of favor with the country over the past decade. From an inflation perspective, the incredibly high pricing growth has also limited small businesses, the core of the economy, as exports continue to decline and domestic demand remains volatile. The country needs international help, however, opening the gates is not as easy as it seems due to damaged relationships with international economies and a reputation that has marked Argentina as unreliable.

Looking at the industries that investors could possibly invest in, the financial services and energy sectors remain the strongest due to abundant reserves across the country and a concentration of wealth that has forced money to stay in the country. While some may consider a longer-term entry in the market at current prices, looking at the market sentiment and future prospects of the country leads me to believe that there is no guaranteed growth in the medium term. For this reason, when considering exposure to the country, approaching equities as "tradable" opportunities is the best option for investors who are interested in the country.

For myself, after researching the nation and delving into the political, social, and economic aspects of the nation, I am weary about the future of the country. For decades, international investors have talked about the potential that exists in the country, and that remains true as many domestic companies do hold large reserves of natural resources that could make them profitable. Unfortunately, looking at these numbers isn't enough as political ideologies have denied any sustainable relationship with international investors. Thus, when looking at the overall future of the economy, I would give the market aSELL rating.

Keine Kommentare:

Kommentar veröffentlichen