Fears of a Big Venezuela Default Subside

By

Investors are gaining confidence that Venezuela will make its next big bond payments.

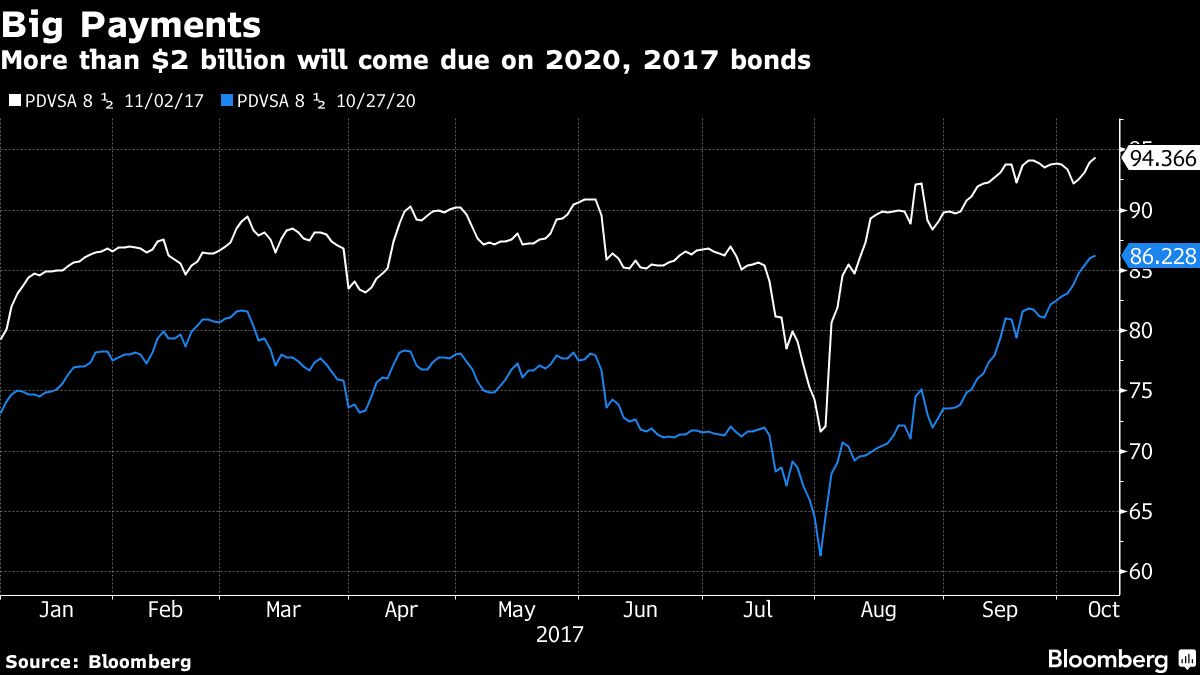

Notes from the state oil company that mature in November climbed to 94.5 cents on the dollar Wednesday, a three-year high, while amortizing bonds due in 2020 rose to their highest price since they were issued last year. There’s a $985 million payment due Oct. 27 for the 2020 bonds, and $1.2 billion due Nov. 2 on the securities maturing next month.

While investors assign a 99 percent probability to Petroleos de Venezuela SA defaulting sometime in the next five years, according to credit-default swaps trading, optimism on the near term has been growing as the government assures investors it will pay.

Francisco Rodriguez, the chief economist at brokerage Torino Capital, wrote in a report this week that during a trip to Caracas he talked to officials who reaffirmed that the country would continue to make good on its debt.

Keine Kommentare:

Kommentar veröffentlichen