Collapsing CDS Market Will Lead To Global Bond Market Margin Call

Submitted by Tyler Durden on 06/28/2015 16:00 -0400

As Zero Hedge previously noted, liquidity is there when you don't need it, and it promptly disappears once it is in demand. Consider it "cocktease capitalism." If liquidity lasts longer than 4 hours, call the CFTC because you may be experiencing a spoof. Right now, the ultimate spoof is setting up as the credit default swap market collapses, and a global bond market margin call is just around the corner.

The most serious risk at the moment is the lack of bond market liquidity. This problem was created by the Federal Reserve.By flooding the market with liquidity, the Federal Reserve paradoxically destroyed the liquidity it sought to create. Initially, the Federal Reserve's actions helped stem the panic selling when it stepped in as the buyer of last resort. However, the Fed is quickly becoming the buyer of first resort. The CME even has a Central Bank Incentive Program to encourage foreign central banks to buy S&P 500 futures. It's not a stretch of the imagination to presume the Federal Reserve is buying S&P 500 futures alongside the foreign banks.

As the Fed's balance sheet expanded ever larger, they transformed from being a mere market participant to becoming the market itself. The Federal Reserve, along with the rest of the world's central banks, are essentially engaging in a multi-year effort to corner the global bond market. As we have seen in every case, no one has ever successfully cornered a market indefinitely. From the Hunt Brothers in the 1980 silver market to the Saudi royal family in the modern fractured oil market to the Duke brothers in the frozen concentrated orange juice market, it simply has not worked. Running a monopoly is an uphill battle that eventually results in a spectacular blowup. Why would the central banks be any different?

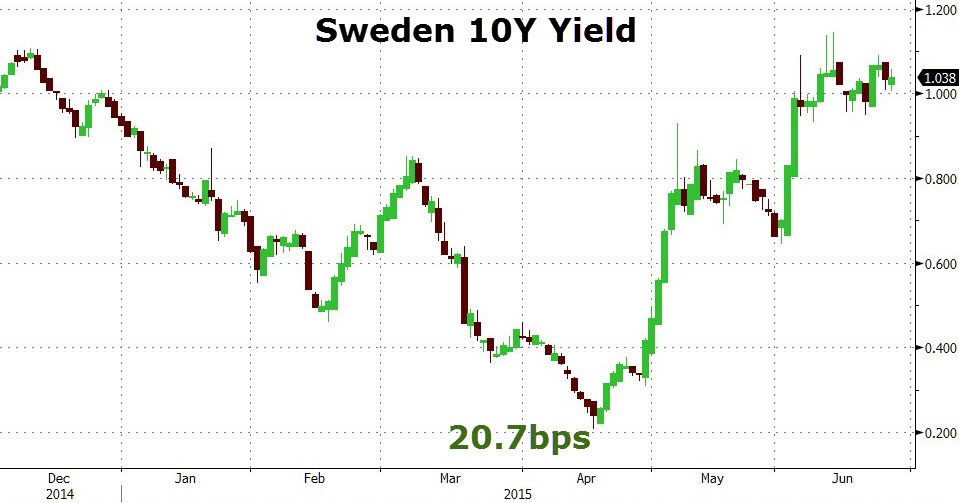

As Zero Hedge pointed out recently, the run on the central banks has already begun. For the first time ever, QE failed. The first casualty was the Riksbank in Sweden.

The Swedes have shown there is a limit on how low interest rates can go. The limit may be different for every country, but it does exist. Investors will eventually revolt against the post-crash Bizarro bond markets that dot the global landscape.

The same problem that brought Long-Term Capital Management to its knees is what will bring down the central bankers: liquidity. They seem to have forgotten that without liquidity, there are no markets. You can't be the only player in the game. It is often said that cash is king, but what that really means is liquidity is king. In the capital markets, investors will pay a premium for liquidity. Right now, liquidity trumps credit ratings in the bond market. As liquidity thins out dramatically, that premium is becoming smaller and smaller. One day, every central bank will have their Riksbank momentwhen, despite their best efforts, it all blows up.

In one of the largest ironies in regulatory history, the crackdown on the CDS market may ultimately exacerbate the inevitable bond market crash. A credit default swap allows someone to speculate on or hedge against the risk of a credit default. The outrage behind credit default swaps was not actually about the swaps themselves; it was about the leverage. AIG was just in over its head. Leverage is power, and like an amateur gun enthusiast, AIG couldn't handle the recoil on the trillion dollar caliber CDS market. However, used properly, credit default swaps can function effectively - particularly when the underlying markets have been squeezed dry of every last drop of liquidity by the bond market monopolists at the Fed. If the bonds themselves freeze up, perhaps the CDS market will continue trading.

This kind of derivative-driven salvation was one of the defining legacies of the stock market crash of 1987. When the market was at its lows and the stock exchanges considered closing, Karsten "Cash" Mahlmann, Chairman of the Chicago Board of Trade, decided to continue trading the Major Market Index (MMI) futures contract when virtually all other trading was at a standstill. A large rally in the MMI futures eventually led to a rally in the Dow Jones, proving once again that the futures market is the tail that wags the dog. In a moment of crisis, Wall Street took a back seat to Chicago.

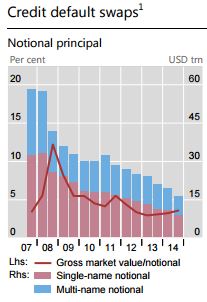

All of this points to the power of the derivative to bolster confidence during a crash. As we have seen, the derivative market is many times larger than the actual underlying securities they represent. This is due to the nearly infinite amount of side bets that can be created. Even a casual investor can see this aspect in the proliferation of ETFs. However, theCDS market has been in a state of deleveraging and decline since the 2008 crash as a result of risk mitigation and new regulations.

Initially, this was a positive development, but now, the CDS market is slowly disappearing altogether. Last year, Deutsche Bank dropped out of the "single name" CDS market, which means less liquidity for anyone who has a legitimate need to hedge risk in particular entities. Without "single name" credit default swaps, hedgers and speculators alike are left with imprecise index swaps, such as the 10-year Markit CDX North America Investment Grade Index Series 9, the contract that cost JPMorgan $5.8 billion in 2012.

The central bankers are already anticipating the collapse of quantitative easing. They meet in Basel every other month at the Bank for International Settlements. A year ago, they met to attend a workshop called "Re-thinking the lender of last resort." One of the papers discussed was written by Perry Mehrling. It is called "Why central banking should be re-imagined." Mehrling said,

A market-based credit system requires market pricing of capital assets as a prerequisite for market funding. The assets are collateral for the funding, and if the market does not believe the asset prices then it's going to be pretty hard to get the funding, and if the private sector won't fund private holding of the Fed's asset positions then exit is de facto impossible.

When the bond market collapses, no one will be able to sell. And if they can't hedge, their hands are tied.

Keine Kommentare:

Kommentar veröffentlichen