Argentina Seeks to Win Over Judge Viewed as Long-Time Nemesis

Two months after taking office, Argentine President Mauricio Macri is betting he’s earned enough goodwill to win over one of the country’s long-time nemeses: U.S. District Judge Thomas Griesa.

Last week, the government asked Griesa to drop orders that bar it from repaying foreign debt until the country reaches a settlement with disgruntled creditors from its 2001 default. The move came a week after the nation reached an agreement to resolve claims with billionaire Kenneth Dart’s EM Ltd. and Montreux Partners. Four hedge funds, including billionaire Paul Singer’s Elliott Management, have so far rejected the proposal that would pay about $6.5 billion for $9 billion of claims.

Griesa, 85, is now asking the bondholders who spurned the deal to explain why he shouldn’t lift the ban, a marked difference from times past when he dismissed similar requests. The move increases the chances Argentina will be able to resume debt payments and borrow the money it needs to pay its recent settlements, according to Anna Gelpern, a law professor at Georgetown University in Washington. Lifting the injunctions would significantly increase Argentina’s leverage in its negotiations with the remaining holdouts, she said.

“It’s clearly an order that says, ‘you as the remaining holdouts must tell me why I shouldn’t help Argentina,”’ Gelpern, who is also a senior fellow at the Peterson Institute for International Economics, said. “It’s a 180.”

Macri is seeking to resolve Argentina’s decade-long battle with creditors as part of his efforts to undo the policies of his predecessor, Cristina Fernandez de Kirchner. The country defaulted for the second time in 13 years in 2014 when Fernandez refused to abide by Griesa’s orders to settle with the so-called holdouts, vowing never to sweeten terms for investors who bought up the bonds after the default, dubbing them “vultures.” Fernandez also lashed out at Griesa, calling him “senile.”

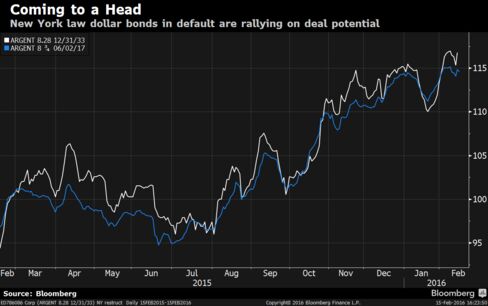

Argentina’s push to resolve its longstanding legal battles is boosting the country’s overseas bonds, which have jumped 4 percent this month. The gains on the notes compare with an average loss of 1.2 percent for junk-rated emerging-market debt. The nation’s benchmark 2033 notes traded at 116.84 cents on the dollar at 1:15 p.m. in New York.

“We thought a deal in the second quarter or the third quarter was more likely, but now it looks like it could happen in the first quarter,” said Kevin Daly, a money manager at Aberdeen Asset Management in London who helps oversee about $11 billion of emerging-market debt. Aberdeen owns Argentine bonds, according to data compiled by Bloomberg.

Griesa’s orders, which went into effect in 2014, bar Argentina from paying restructured bondholders unless it also pays holdout creditors at the same time. Argentina currently owes about $3.8 billion in past due interest to exchange bondholders, according to Nomura Securities International.

On Feb. 11, Griesa ordered the holdouts to explain why he shouldn’t lift the injunction by Feb. 16. On Tuesday, he extended that deadline to Feb. 18 following a request by the holdouts. Previous requests by Argentina to reinstate a stay on the order were dismissed by Griesa without seeking arguments from the holdouts.

Argentina is asking Griesa to drop his orders on the condition that Congress agrees to repeal two laws and the government pays creditors who agreed to a settlement by Feb. 29. If those conditions are met, Argentina argued, Griesa’s orders will no longer be justified and the nation should be able to resume paying its foreign law debt.

The government prefers to continue litigation rather than negotiate, Mark Brodsky, the chairman of Aurelius Capital Management, another one of the remaining holdout creditors, said last week in e-mailed comments. An Elliott spokesman declined to comment Friday on Argentina’s filing.

Daniel Pollack, the court-appointed mediator in the case, has also taken a different tone with Macri’s administration. In a statement issued Feb. 5, before Argentina asked for the ban to be lifted, he said he had spoken by telephone with Macri and Finance Minister Alfonso Prat-Gay and praised the “tireless and meaningful contributions of their team on the ground in New York City.”

“Both have shown courage and flexibility in stepping up to and dealing with this long-festering problem which was not of their making,” Pollack said in the statement.

Pollack recognized Argentina is taking steps to lift the injunction in a Feb. 12 statement and said that other parties with “substantial holdings” have recently come forward and expressed interest in settling.

Finance Secretary Luis Caputo, who has traveled back and forth between New York and Buenos Aires since December, is in Manhattan this week again for talks, a government official told reporters Monday. Santiago Bausili, undersecretary of finance and a former Deutsche Bank AG and JPMorgan Chase & Co. banker, has also been involved in the talks.

After the record $95 billion default in 2001, Argentina restructured about 93 percent of the debt in 2005 and 2010, imposing losses of about 70 percent on bondholders. Argentina’s new offer includes three proposals that depend on the legal steps creditors have taken on their claims.

Fernandez’s belligerence toward the courts was counterproductive, with the holdouts consistently winning judgments from Griesa, and the change of tone should help soften the judge’s attitude toward Argentina, Georgetown’s Gelpern said.

“There is a narrative that attributes much of this conflict to the sheer hostility that the government displayed,” Gelpern said. “Some people would say that if they had just said please and thank you they would have had a settlement a long time ago.”

Keine Kommentare:

Kommentar veröffentlichen