Summary

- Argentina is a rich country with bad policies.

- It has a sticky debt problem.

- Elections are coming in 2015 and things might improve.

©Elliott R. Morss All Rights Reserved

Introduction

Governance in Argentina leaves a lot to be desired. The country reels from crisis to crisis. This is nothing new. It has been going on for decades. According to Transparency International, citizens perceive considerable corruption (Argentina ranks 106th out of 177 countries) but put up with it. And despite the foolishness of its leaders' decisions, life goes on in-country with minor inconveniences.

At least it did until the January 60% currency devaluation and the resulting 20%+ inflation. Below, the future prospects of Argentina are considered. This is followed by comparing the Argentine debt default with what recently happened in Greece.

The Lady and Her Policies

In the past, I have defended at least some of President Kirchner's actions. In particular, I understood why she took over Repsol (Repsol was sitting on Argentina's energy sources, not developing them). I also sympathized with her taking over the pension funds (they were being poorly managed).

But recently, her approach and economic decisions remind me of how military leaders normally try to manage their economies: "command and it will happen". I am thinking specifically of experiences I had recently in Myanmar and in Ghana 45 years ago. The same patterns:

- If the exchange rate is not satisfactory, order the money changers to use a different one;

- If you don't like the inflation rate, order the government statisticians to change it;

- If you want smart phones to be produced in-country, ban their importation from other countries; and

- Strengthen the currency by requiring all real estate transactions to be done in the local currency.

Military leaders think that by ordering these things to happen, they will. That is not how things work. But in both Ghana and Myanmar, the leaders at least had a longer term plan of what they wanted to accomplish. It is not clear that Kirchner has such a plan.

Intimidation

For three years running, I spent a month teaching at the Business School of the University of Palermo in Buenos Aires. I can testify to the high caliber of Argentine economists. So where are the Argentine economists ridiculing her policies in public and calling for change? It appears the Lady does not like criticism and makes life pretty uncomfortable for anyone who criticizes her.

The Argentine Economy

Argentina has done quite well, even with Kirchner in charge. Argentina recovered from the global recession as well or better than most other Latin American countries. But growth slowed dramatically in 2012, and theFocusEconomics consensus forecast of 18 banks and other financial institutions is that GDP will decline by 0.6% in 2014. What is happening and why?

Argentina, while rich in natural resources, has an Achilles heel: borrowing on international markets is closed off because of unpaid debt. That means its ability to purchase foreign goods is limited to:

- The international currencies it collects via a positive trade balance;

- its international reserves minus

- its capital outflows.

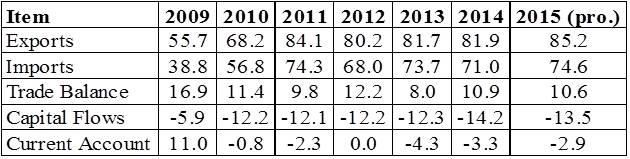

In recent years, the margins have become very thin. As Table 1 indicates, the trade balance surplus has narrowed while capital outflows have grown. Capital outflows include government debt payments (both principal and interest) and private sector flows of all sorts. And FocusEconomics' panelists believe international reserves have fallen to $25.6 billion this year and estimate they will fall further to $20 billion in 2015.

Table 1. - Argentina's International Balances

Source: FocusEconomics

And on top of this, the difference between the official and black market currency rates had become unworkably large. In hopes of stemming the tide, Argentina devalued its currency on January 23rd from 5 to 8 pesos to the dollar. That reduced the black market differential by half. Certainly, the devaluation was a step in the right direction. But the devaluation proved very upsetting to the local citizenry. Consumer confidence plummeted from 56 (optimistic) in May 2013 to 38 (pessimistic) today. And the immediate impact was a huge inflation: FocusEconomics' panelists estimate that prices will rise 36% this year and 31% next year.

The most important economic impact of higher prices is that it absorbs purchasing power: if you have to pay 38% more for food, you will have to cut expenditures somewhere else. And that signals a recession. AndFocusEconomics' panelists expect real GDP to fall this year (0.6%).

Default and Debt

In January 2005, Argentina hoped to reach a final settlement on its unsustainable $81.8 billion of debt plus $20.8 billion of past due interest (PDI). It was able to get $62.3 billion of its debt (77%) exchanged for $35.2 billion of new bonds. That means that those agreeing took a 43% loss in principal. Past due interest was not addressed. That left $19.5 of general debt untendered, along with $6.3 billion of Paris Club arrears, and $9.5 billion of IMF debt along with more than $21 billion in accrued interest.

In 2006, it repaid the IMF the $9.5 it owed.

So by 2010, it then owed roughly $29 billion of bond principal and interest to those not accepting the 2005 offer. In June, Argentina was able to get $12.4 billion of the outstanding bonds converted. Assuming those bondholders took the same "haircut" as those that accepted in 2005, the total principal of the new bonds was $42.3 billion.

It paid off the Paris Club debt in 2013, leaving approximately $17 billion of principal and accrued interest outstanding.

It is estimated that if the holdouts were willing to accept the same terms as the others have accepted (not likely), Argentina would have to pay them about $3 billion in accrued and current interest. Can Argentina afford such a payment? Barely. If FocusEconomics' panel data are accurate, it now has about $25 billion in international reserves. Paying the holdouts $3 billion would leave Argentina with a dangerously low level of reserves.

But getting the debt issue settled would be extremely beneficial for Argentina. It would allow it to start accessing international financial markets again. The other point to keep in mind is that Argentina does have one source it can probably borrow from if necessary: China imports over $5 billion from Argentina annually (mostly food) and Argentina could probably borrow from China against future food deliveries. Also, if it settled the debt issue, it could probably get some help from the IMF. And the "market discipline" the IMF would ask for in return would be beneficial for Argentina.

Legal Status of the Holdouts

American courts have steadfastly upheld the legal rights of those holding the original Argentine bonds. And this just happened again. In a one-line order, the US Supreme Court refused to hear Argentina's appeal of a lower court's decision requiring it to pay holdouts who did not participate in debt restructurings in 2005 and 2010. The courts have ruled that by not paying the holdouts as well as those accepting "haircuts" Argentina had violated a contractual promise to treat all bondholders equally.

This is of significance because the American bank Argentina has used to handle bond payments (BNY Mellon) said in a statement, "In our role as trustee, BNY Mellon will comply with any court order by which it is deemed bound." Argentina was scheduled to make payments on its exchange bonds on June 30. And Argentina dutifully deposited the money to make payments to the exchange bond holders in BNY Mellon. But on June 27th, District Judge Thomas Griesa told the bank to return the $539 million it received from Argentina for the payment: "This payment is illegal and will not be made."

This is a real mess.

Argentine and Greek Defaults

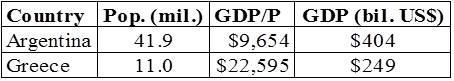

A comparison of the Argentine and Greek defaults is interesting. Table 2 offers a size perspective on the two countries. Argentina has almost four times as many people as Greece. Greece has a higher per capita income than Argentina while the latter's GDP is 60% higher.

Table 2. - Population and GDP, 2014

Source: IMF

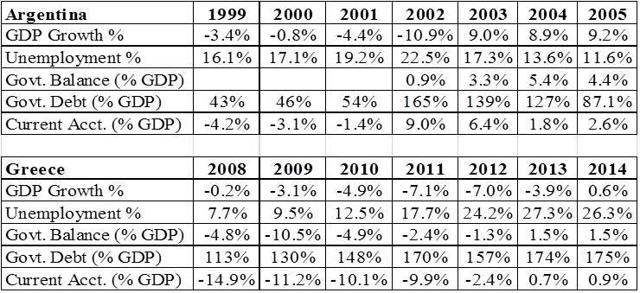

In Table 3, the "crisis" periods for both countries are presented. For Argentina, that period was 1999- 2005. For Greece, it started in 2008 and continues.

Table 3. - Argentina and Greece, Financial Crisis Periods

Source: IMF

Note that in 2002, Argentina's unemployment shot up, and ultimately got almost as high as Greece's. Similarly, Argentine debt at 165% also rivaled that of Greece. Greece remains in serious trouble with no end in sight. It has already had one "default/rollover" that will ultimately cost creditors 75% of their loans from the 53.3% "haircut", longer payback period, and lower interest rates.

Where Are The Greek Holdouts?

Given the problems Argentina continues to have with holdouts, it is interesting to understand how Greece dealt with this issue. First of all, much of the Greek debt was held by banks. Bank stockholders do not like to hear of loans defaulting, so what happened in Greece was not called a "default" but a "rollover" (for more on this, see this earlier article).

85% of Greek creditors agreed to the rollover (note that for Argentina, that percentage was 93% after the 2010 swap). The high number of volunteers enabled Greece to activate the so-called collective action clauses". The clauses, which the government retroactively added to its bond contractsjust before the swap in 2012, gave Greece the power to make the terms binding for all holders of Greek bonds issued under domestic law. Retroactively added?? Am I missing something here? Since when can one party to a loan agreement change the terms of the agreement ex post? How could Greece get away with this while Argentina could not? Interesting question…

In Conclusion - Argentina: What To Do?

Argentina is a rich country with bad economic policies. Economic reforms are needed. Elections are coming up in 2015. As mentioned earlier, Argentina has a cadre of excellent economists. This is the time for a group of them to come together and develop an economic reform plan for the country. The purpose would be to get a Presidential candidate to embrace the plan and get elected.

If this were done, the country's economic future would look a lot brighter… My guess is that limited funding and global support for this effort could be obtained from a prominent foundation -- like Ford or Rockefeller.

But until then, at least bumper food crops are expected this year…

Investment Implications

Do you like gambling? Then buy Global X FTSE Argentina 20 (ARGT). They might find a way to resolve the debt problem in the near future. But then again, they might not.

Keine Kommentare:

Kommentar veröffentlichen