With less than a fortnight until Argentina risks defaulting on its restructured debt, there will be another hearing in the pari passu saga later on Tuesday. After a look at Argentina’s position, now for what Judge Griesa’s hearing will focus on — restructured bondholders who argue that he has no jurisdiction over them…

Notably, local-law restructured bondholders.

______________

There was an easy way to tell when the darkest days had arrived in the eurozone sovereign debt crisis. Investors were paying up for bonds governed by laws other than the issuers’ own. If peripheral government paper was governed by local law (and most of it was), it could be restructured or redenominated at the stroke of a legislator’s pen.

Flash forward a couple of years, and the bizarro trading world created by Argentina’s pari passu defeats favoured doing the opposite, oddly enough.

Any payment on Argentina’s New York law restructured bonds now has to pass through Judge Griesa’s gauntlet. It made sense to trade out of these debts and into local-law bonds paid onshore. These would begin to fetch a premium despite the legislator’s-pen risk in lending, say, local-law US dollars to a country with wobbly FX reserves and a noted penchant for devaluation.

After all, Citibank, the payment agent, recently received clarification from Judge Griesa letting off US dollar and peso restructured bonds “governed by Argentine law and payable in Argentina”. So it all seemed fine.

Perhaps not.

Earlier this month, holdouts led by Elliott sought to add a clarification to Judge Griesa’s clarification.

Peso-denominated domestic-law bonds, they said, were indeed fine…

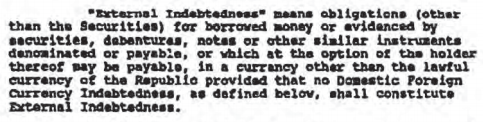

However, with respect to the U.S. Dollar-denominated Bonds, Plaintiffs believe that the Court may have overlooked the undisputed facts that such bonds are External Indebtedness within the meaning of the FAA, that they are covered by the pari passu provision in the FAA, and that they are Exchange Bonds covered by the Amended February 23 Orders. Citibank has not argued otherwise. The definition of External Indebtedness… makes clear that what matters is the currency in which a bond is paid, not the governing law. So, while the U.S. Dollar-denominated Bonds are governed by Argentine law, they fall squarely within the definition of External Indebtedness.

Citibank’s response (before it all gets discussed at Tuesday’s hearing) can be summarised as gobsmacked. Argentina’s was just plain furious:

Before now, throughout the more than three years that this action has been pending before the Court, plaintiffs did not once claim that payment on the Argentine Law Bonds… was improper. Plaintiffs never asked the Court to bar payments on the Argentine Law Bonds, and the Court accordingly never purported to do so.

Well, anyway, one important qualification there is “Exchange Bonds”. This means the debt that emerged from restructuring episodes in 2005 and 2010. So, Elliott is not going after Argentina’s Bonar securities here for example. These are also governed by Argentine law and pay out in US dollars, but have different origins.

The principle here is simple but powerful however. It was put even more peremptorily in a separate motion that the holdouts filed about the US dollar local-law bonds, this time aimed at Euroclear and Clearstream passing the payments received by Citibank on to bondholders worldwide:

External Indebtedness is based on the currency in which the bonds are paid, not the law under which they are issued.

Which, you might think, is a sign of exorbitant privilege going haywire again. “Arbitrary and capricious use of US financial leverage,” Barry Eichengreen has argued, could eventually “create widespread disaffection with the dollar”.

US dollar bonds are the issue here. In 2014, the US Treasury’s Office of Foreign Assets Control already has a compliance office within a French bank to watch how it clears dollars worldwide after sanctions violations. For future sanctions against Russia, one step may be to prevent access to dollar-clearing services. Blocking US dollar sovereign debt issued in Argentina’s own jurisdiction might seem part of the same Zeitgeist.

Except, exorbitant privilege is bit of a red herring. The holdouts’ case here actually relies on a more powerful force in the universe… contractual boilerplate.

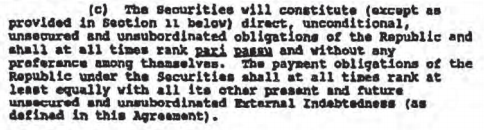

The pari passu clause which started this mess promises equal treatment with any “external indebtedness”, defined as debt in any “currency other than the lawful currency of the Republic”. In theory then, the Republic could be paying its debt in Disney dollars, and if holdouts weren’t also paid at the same time, it would still violate the injunction that was crafted from the clause.

If you allow that the injunction is global in scope, then perhaps that definition can logically be applied on a global basis too. The holdouts haven’t argued this, but would the definition cover the English-law and euro-denominated restructured bonds that have also been blocked?

After all, the Euro Bondholders are hopping mad already about this, as a jurisdictional issue:

The utter worldwide confusion and uncertainty exemplified by the eight motions before this Court is a sharp illustration of the changed circumstances facing this Court. If this Court determines that the Injunctions apply equally to the participants in the payment process for the English, Japanese, and Argentine law bonds, it necessarily will be forced to decide countless, discrete questions of foreign law, as well as whether particular foreign entities are subject to this court’s jurisdiction and should be bound in light of their conflicting foreign legal obligations.

And Euroclear, involved in paying both their bonds as well, also thinks jurisdiction matters more than the external indebtedness argument:

Euroclear Bank does not enter into the State of New York or conduct activities within the State of New York in the process of crediting those US Dollars to Euroclear Bank’s customer accounts. Euroclear Bank’s activities are conducted within Belgium where entries are made on the books and records of Euroclear Bank reflecting the crediting to its customers of the US Dollars to which they are entitled…An assertion of adjudicatory authority over Euroclear Bank would purport to expand the authority of the US courts beyond the borders of the US to activities carried out by governmental and other institutions in Europe. In the interest of comity, the Court should avoid such a result.

Over to Tuesday’s hearing then. Comity meanwhile is the idea that domestic courts may defer to foreign sovereignty elsewhere, out of courtesy.

So far, comity has not been having a good pari passu saga.

Keine Kommentare:

Kommentar veröffentlichen