“The recalcitrant scum of the earth, I believe?”

“Ah, the vultures of global usury, I presume?”

To commemorate the beginning of negotiations in New York later on Monday between Argentina and Elliott…

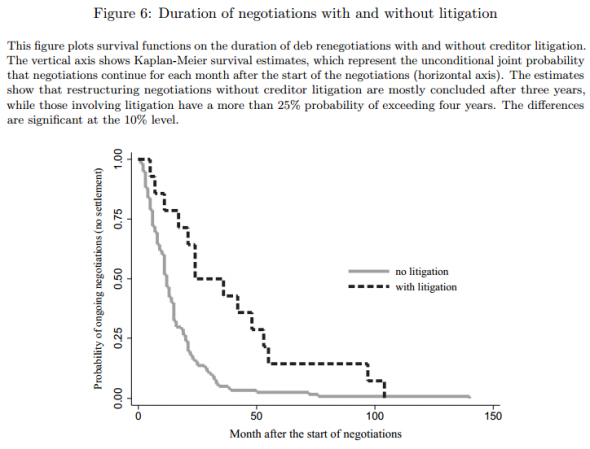

Click to enlarge. That’s a chart of how much longer it tends to take for sovereign debt to be restructured once creditors go to the courthouse rather than the negotiating table. Via this paper by Schumacher, Trebesch and Enderlein.

A negotiated end to Argentina’s default will have taken over a decade. This is even if a holdout settlement is reached soon.

You can blame Argentina’s early recalcitrance for this — it was a messy default — if you wish, or the holdouts’ bloody-mindedness in pursuit of returns.

Or you can note that this may be a structural trend. Pari passu enforcement exists as a matter of US law now. It could be used in court by creditors before they get a judgment on defaulted debt, as an injunction, or after one (confirmed in the Grenada copycat case), thus reviving holdout claims that might have lain dormant for years. Rights to go on litigating aren’t “merged” or extinguished by judgment debt — because any pari passu-violating payments to other creditors might happen later. Which allows the “me-too” claims to follow Elliott.

So ‘litigotiation’ — litigating for full recovery, to get a better negotiated amount on the dollar — may become a normal occurrence in sovereign debt restructuring. It need not actually blow up restructuring at all, as most governments don’t want to end up like Argentina.

But it will be messy. There is going to be plenty of litigotiation left to run in the Argentina-holdout talks.

In fact, given that a hostage in the talks is $539m of restructured bond payments stuck in limbo in a Bank of New York account in Buenos Aires, third parties (like BNY) are either going to be sucked in or (like some restructured holders) will demand redress.

So it may technically already be multicreditor litigotiation, increasingly concerned with an equitable resolution (balancing lots of claims in a situation where an actual bond contract is only the starting point).

Of what might this be a reminder?

US railroads going bust over a century ago. The approach then was “equity reorganisation”, negotiations between debtors and creditors under supervision of courts (the alternative was direct liquidation). They went on forever and were frequently interrupted though. Eventually, that led Congress to create the predecessor of Chapter 11 in bankruptcy law.

Sovereigns don’t go bankrupt, however. After the dust eventually settles on NML v Argentina, will the existing regime be considered just strong enough to survive the rise of litigotiation — or will we get something else?

Keine Kommentare:

Kommentar veröffentlichen