Venezuela’s PDVSA Sows Payment Doubts While Extending Swap

Petroleos de Venezuela SA extended for a third time a deadline for investors to swap as much as $5.325 billion of bonds, warning it will have a hard time avoiding default if it can’t complete the transaction.

PDVSA, the country’s state oil company, pushed the deadline to Oct. 21 for bondholders to agree to exchange their notes for longer-maturity securities, according to a statement issued after the previous offer expired Monday evening. The oil producer said it was “substantially” short of its goal to swap at least half the bonds that mature in 2017.

Venezuela’s economy and finances have been decimated by the collapse in oil prices, leaving the government struggling to find enough hard currency for imports of basic necessities and debt payments. The company’s president, Oil Minister Eulogio Del Pino, said in an interview last week that that the deal was critical for PDVSA and that officials would be “evaluating all options” if they couldn’t persuade enough investors to accept the terms.

“If the exchange offers are not successful, it could be difficult for the company to make scheduled payments on its existing debt,” PDVSA said in the statement.

PDVSA said it won’t improve the exchange ratio on the swap in a conference call with market participants on Tuesday, according to Jorge Piedrahita, the chief executive officer of brokerage Torino Capital LLC in New York.

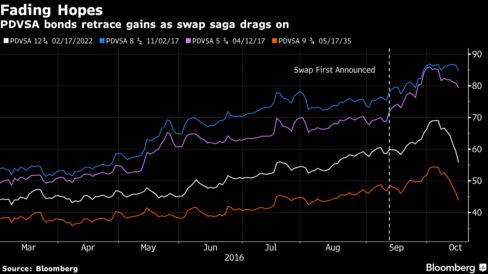

Government and PDVSA bonds fell after the call, with the biggest losses in longer-dated notes. The company’s $4.1 billion of bonds due in November 2017 slipped 1.58 cents to 84.23 cents on the dollar as of 3:05 p.m. in New York, while securities due in 2035 lost 2.66 cents to 43.11 cents. Venezuela’s $4 billion of bonds due in 2027 dropped 1.9 cent to 48.97 cents.

“They are clearly desperate to get a result that will provide some cash flow relief,” said Kevin Daly, a portfolio manager at Aberdeen Asset Management in London. “Price action suggests broad disappointment of an underwhelming exchange.”

The company said its offer is conditional on holders of at least 50 percent of the bonds agreeing to it. Other than the deadline, all other conditions of the offer were left unchanged. PDVSA, facing bond payments totaling $11 billion by the end of next year, is seeking to exchange notes due in April 2017 and November 2017 for new debt with annual payments between now and 2020. The company pledged 50.1 percent of its stake in the holding company of U.S. refining arm Citgo Petroleum Corp. as a guarantee for the bonds created in the exchange.

PDVSA pushed back the date for tendering bonds once, when it improved the terms, and has since extended the deadline a further three times.

PDVSA’s warning that it will struggle to make payments without the swap represents an escalation of rhetoric, according of Siobhan Morden, the head of Latin American fixed-income strategy at Nomura Holdings Inc.

“It’s too late to alter the terms,” Morden said in an e-mail. “The concern at this stage is the increasing debate about options on suspension of the exchange.”

Francisco Ghersi, a managing director of Knossos Asset Management in Caracas, and Patrik Kauffmann, who helps manage $11 billion in assets at Solitaire Aquila Ltd. in Zurich, said PDVSA might be overstating how dire the situation is in order to pressure more bondholders to go through with the swap. A default could be chaotic and imperil a government that’s already unpopular with voters.

"It’s like a poker game,” Ghersi said. “Are they bluffing or not?"

Bonds issued by the government and PDVSA surged after the company first announced the swap offer amid speculation the deal would smooth out an onerous debt repayment schedule and buy time for oil prices to recover.

After initially offering investors $1,000 of the new securities for every $1,000 of the old bonds offered, PDVSA on Sept. 26 sweetened the deal by pledging $1,170 for every $1,000 of the April 2017 securities tendered before the early deadline and $1,220 for the November 2017 bonds.

A successful swap may reassure holders of other Venezuelan debt. The company has $1 billion of bonds coming due next week.

Years of declining output and a crash in oil prices have pushed PDVSA and Venezuela, which relies on crude for almost all its hard currency income, to the brink of default. While some ratings companies have said they would treat the transaction as distressed exchange, investors had been betting that it will allow both the company and the country to keep making payments on the best-performing debt in emerging markets this year.

The price of Venezuela’s crude oil fell to a 13-year low of $21.63 a barrel in January, after being close to $100 a barrel for four years. It has since climbed to $43.09.

The country relies on oil revenue to fund imports as well as for hard currency to pay debt. Since the price crash, Venezuela has suffered crippling shortages of basic goods, including medicines. Prices of consumer goods have surged and shop-shelves emptied. The country’s currency reserves have fallen to $12 billion, the lowest since 2003.

Keine Kommentare:

Kommentar veröffentlichen