Could there finally be a limit to just how far around the world the pari passu saga goes?

No.

But for a longer answer, read on.

In an order released on Monday, Judge Griesa decided to let Citibank process payments on US-dollar, local-law Argentine paper for a few months while it’s busy working out how to offload the Argentine bond custodian business which is at the centre of its problem.

This problem has been a Hobson’s choice. The judge decided this month that whenever Citibank does process these payments, it’s helping Argentina to evade his injunction to pay holdouts alongside other relevant creditors. Argentina promptly decided that if Citibank doesn’t help it pay its bonds, it will be breaking its law, and that would make life very difficult for Citibank inside Argentina.

By giving the bank some room, Judge Griesa’s decision — citing “unique circumstances” — might seem like a reprieve; even something that the Argentine government (which is getting into the weirdest fights lately) could spin into a victory.

Except where it’s not.

1) First, Citibank has to turf over information to the holdouts while it’s making its retreat, which is of course also within a specific time. It feels a bit like medieval castle warfare where merchants could leave the city under the careful eyes of the besiegers.

2) There’s also the very large caveat within the permission granted by Judge Griesa.

If… Citibank Argentina receives a portion of such payment on behalf of its customers, Citibank Argentina may process that payment in the ordinary course. Such permission shall only apply to Citibank Argentina, and shall not apply to any other party or participant in the payment process on such bonds.

Who else might handle payments to local-law bondholders once Citibank’s released them?

According to the diagram Citibank itself once sent to Griesa trying to explain the difference between foreign-law and local-law bonds, Euroclear and Clearstream potentially handle them next for international holders.

(Click to enlarge)

Under the terms of Judge Griesa’s order on Monday, “In connection with the Citibank Withdrawal, Euroclear and Clearstream are permitted, but not required, to transfer their holdings of U.S. Dollar Argentine Law Exchange Bonds to Caja de Valores”. That doesn’t seem to solve this ambiguity in the payment chain.

The shadow of the pari passu litigation hasn’t yet passed over Euroclear and Clearstream’s particular role here. But they have already been named in Judge Griesa’s original injunction — back when it seemed to apply only to foreign-law restructured bonds, rather than extending to local-law ones which have any connection to the world outside Argentina.

The point being, that distinction isn’t what it used to be.

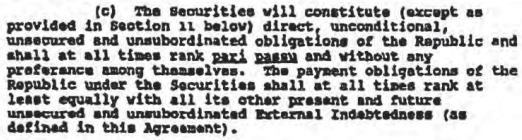

3) This was the bombshell in Judge Griesa’s earlier ruling this month: local-law bonds could be “external indebtedness” for the purposes of the pari passu clause which started this whole mess.

Citibank incidentally agreed not to appeal this decision, so it looks like it’s sticking.

That could matter well beyond Citibank’s predicament. As Anna Gelpern notes, expanding “external indebtedness” effectively shuts down new foreign-currency debt issuance by Argentina, given the deterrent effect on any bank handling the sale abroad. (It’s also going to annoy any other sovereign which has been busy Elliott-proofing the pari passu clauses in any newly-issued debt, but which probably wasn’t watching the “external indebtedness” definition as carefully.)

The holdouts don’t really need to push to broaden the injunction at this point given the strength of the deterrence. They’ve even had an interest in the past in letting some new issuance out — like the Repsol settlement which involved $5bn of newly-minted Argentine paper — because that agreement might provide a blueprint for the government to eventually sit down and negotiate with its pari passu claimants.

On the other hand, Argentina’s Bonar 2024 and Boden 2015 bonds are both trading above par in the current market. Holders of both are probably watching the clock on the Kirchner government leaving office in October (just after the Boden matures). Whether that confidence is justifiable is another matter. Still, both issues are local-law bonds but not restructured debt, which has so far kept them away from the pari passu saga.

Given the terms of Citibank’s ‘reprieve’ — and the fact Argentina hasn’t been forced to the table yet — we’d question how long they’ll stay that way.

Keine Kommentare:

Kommentar veröffentlichen