Are you an EM fund manager?

Do you live in London or New York?

Were you by any chance offered some of the $1.4bn of Bonar 2024 bonds issued byArgentina on Wednesday, bought by Deutsche Bank and BBVA on Thursday, and settling this Friday? Or maybe you’d like to buy these bonds in the near future.

Then congratulations. You might well also be buying yourself a ticket to the next exciting stage of the pari passu saga.

PS: this may now involve the holdouts personally hunting you down.

___________________

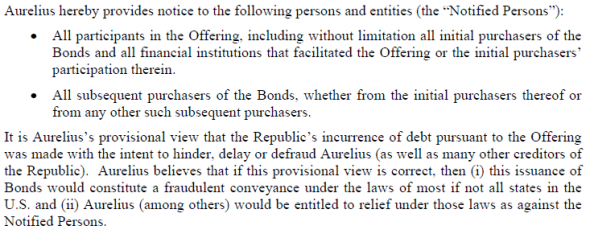

That at least is the latent threat from Aurelius, one of the holdouts…

Click for the full release, which was sent late on Wednesday. Note the line about “subsequent purchasers” of the bonds. The pari passu case has obviously pitted Argentina’s creditors against each other before. That’s the logic of both ratable payment itself, and the way in which the holdouts led by Elliott Management have turned sovereign debt enforcement on its head. Other creditors are the weak spot.

This — crying fraud all the way down the bondholder chain — is something else, however. It suggests the stakes have suddenly risen higher in the saga.

The Bonar sale might mean Argentina has found a perfectly legal way around the pari passu embargo, enough to keep raising new money and to drag the saga out without negotiating with Elliott, months before a presidential election. There is a limit to even the most advanced attempt to enforce sovereign debt to date after all, in short.

Or, maybe, Argentina has just given Elliott the opportunity to push the Bonar 2024s (and everyone buying them) into the embargo too. That would mean the injunction could become stronger than ever.

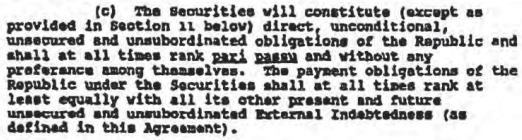

The answer, curiously enough, might just lie in the original pari passu clause — specifically, the bit about external indebtedness.

___________________

Bonars are local-law, US dollar bonds. Argentina, incidentally, really needs dollars from external investors buying its bonds at the moment. Reserves are ebbing (chart via Bank of America, below).

The identities of many of the ultimate buyers may lie abroad for this reason.

Whether that means Argentina offered the bonds abroad is what matters though.

Bonars aren’t local-law, US dollar restructured bonds. Elliott did successfully stop Argentina paying its local-law exchange bonds without paying their holdout debts this year, which led to the farce with Citibank and Judge Griesa’s “reprieve”.

This so badly jolted the international plumbing for all of Argentina’s local-law bonds that for a while it looked like payments on the Bonars might get caught too, while an earlier, equally clandestine issue of new Bonars was scuttled. No disruption on Bonar payments so far though, given they’re not after all exchange bonds.

Except Judge Griesa indicated last month he would also look at whether bonds counted as “external indebtedness” given it’s mentioned in the clause which Argentina has supposedly been violating all along. Anything that isn’t “offered exclusively within the Republic of Argentina” could fall under the term.

Which made it interesting to note the line taken by Robert Cohen, the lawyer for Elliott’s NML Capital, on Tuesday as news of the Bonar sale came out:

Those contemplating participation in Argentina’s latest attempt at aglobal offer should understand that it appears to have all the hallmarks of external indebtedness that is covered by our pari passu rights. We are closely scrutinizing this highly unusual transaction to determine what enforcement actions are appropriate.

Curiously though, when it came to Judge Griesa’s hearing on Wednesday, external indebtedness didn’t really come up at first.

The judge wasn’t particularly interested in whether the bond sale has been specially designed to evade his injunction, and Cohen asked for discovery on the nature of the transaction basically to enforce other bonds on which Elliott already won judgments years ago. (These are outside the pari passu case.)

Argentina’s lawyers, however, did go out of their way to deny the external indebtedness point: “It’s a purely domestic transaction; it has no road show externally; it has no external offering documents… there is no evasion.” Curious.

What’s perhaps more revealing is just to look at the (scant) details of how Argentina carried out the sale.

The first point: quickly. A transaction lasting two days hasn’t given Elliott (usually pretty fast at getting to a courthouse) much time to gather information, hence the rushed hearing on Wednesday. The government even appears to have waived regulations which normally require foreign buyers to keep bonds in the country for 72 hours until they can be shipped out via Euroclear.

A potential smoking gun might be Deutsche hawking the Bonars (of which it bought $1bn, Elliott’s lawyer claimed) around the trading desks of clients in well-heeled Mayfair or leafy Connecticut. Hence our question at the top of the post.

But then one problem there might be ID-ing the bonds. One of the things Elliott demanded to know in the hearing on Wednesday was the Bonar’s ISINs. That would recall one other previous farce in the saga, when Citibank argued it couldn’t actually sort local-law exchange bonds from paper Argentina had issued to Repsol, and which immediately ended up on the open market. The ISINs were the same.

There are lots of Bonar 2024s out there already. This could get confusing — including for any ‘fraud’ threat by Aurelius.

So, plenty of reason for Axel Kicillof, the Argentine economy minister, to crow about (er) evading the holdouts?

We wonder actually. The new bonds still have to trade internationally. The previous scares about the infrastructure underlying them suggest how fragile this could be, and these bonds are pretty fully priced. (We now live in a world where Argentine bonds are par assets.) The risk of Bonars being added to external indebtedness one spring day in Judge Griesa’s courthouse seems obvious. Though investors might just bet that the election will bring change in a few months anyway… or that the 8.75 per cent coupon is worth it in the meantime.

But then that would be the thing Kicillof neglected to mention. These bonds have a yield of 9 per cent — or double those for Paraguay, Argentina’s landlocked northern neighbour. Mexico can issue bonds for a 100 years at 4 per cent. Iraq, fighting off Isis, can be lent to for 7.5 per cent.

Maybe this is “market access” even so. But it isn’t coming cheap.

Keine Kommentare:

Kommentar veröffentlichen