Summary

- The National Bank Of Greece cannot fund itself using the ELA forever.

- Worsening credit quality and higher debt shows there is more pain to come.

- Lack of any semblance of a bull case.

- Short-term scenarios do not favor NBG.

Overview

National Bank of Greece (NYSE:NBG) has had a rough few months due to conflicts between the incumbent Greek government and its EU creditors over Greece's bailout terms. Last week, its share price fell over 10% in a single day on news that the ECB was considering reducing or setting additional restrictions on emergency funding for Greek banks. The very next day, shares went on a massive rally on news that the Greek government was ready to make concessions. We recognize that NBG Group owns significant stakes in other banks such as Finansbank, Stopanska Banka and other East European banks, which are generally profitable unlike its operations in Greece. Hence, this article will focus on the National Bank of Greece itself instead of the Group, as it is the key driver of the Group's performance.

ELA Mechanism

To evaluate NBG, we first have to understand the mechanisms that support its finances. While Greece continues to tussle with its EU partners over bailout terms, Greek banks are currently locked out of regular ECB funds. Instead, NBG and other Greek lenders have access to $74B euros of Emergency Liquidity Assistance from its own central bank (Bank of Greece). The ELA is basically a short-term lending program where funds are disbursed from National Central Banks to help aid short-term liquidity issues at commercial banks. There is a cap on emergency assistance that is reviewed by the ECB Governing Council regularly to determine if it should be raised or lowered. As bank deposit outflows increased in the past few months due to uncertainty and fear over Greece's financial circumstances, NBG has been matching the outflows with inflows through the ELA scheme. Hence, this mechanism is crucial in ensuring NBG has sufficient liquidity.

What sparked the intra-day 10% fall in NBG's share price was the mention of an increase in the discounts applied to securities that banks use as collateral when borrowing through the ELA mechanism. Essentially, a discount would 'reduce' the value assigned on these securities and Greek banks would be forced to borrow less or post more collateral (whatever little they have left) to sustain their level of borrowing.

'Phantom Bond' Borrowing

Since 2013, NBG had been issuing phantom bonds to use as collateral in order to borrow more money from the ECB. The current Greek Finance Minister wrote an excellent article detailing this practice here. In essence, Greek banks such as NBG issued bonds with no intention of selling them to private investors. Instead, the coupon payments were made to themselves (i.e these bonds were issued by them to themselves). The banks then took these phantom bonds to be guaranteed by the Greek government, and then used them as collateral for borrowing more cash from the ECB.

Under this scheme, NBG borrowed up to $14.235B Euros before the ECBoutlawed this form of collateral as of 1 March 2015. The financing already given out by the ECB to Greek banks was then transferred to the ELA. In essence, this means NBG is solely dependent on the ELA programme for liquidity as it is no longer able to take out loans using phantom bonds (unsecured government-guaranteed bonds) as collateral. This reduces the ECB's exposure to Greece's economy, and essentially shifts the risk of lendingto the Bank of Greece (BoG).

This has devastating implications.

Firstly, this alludes to the thinking of the ECB: they are no longer willing to increase their exposure to the Greek economy probably because they have no confidence that Greece will recover. Indeed, pessimists would argue that this is the first step to extricating Greece's finances from the Eurozone. However, a more balanced view would be that the ECB Governing Council is sending a message to Greece's government - that they are not afraid to cut Greece's funding and that they are no longer exposed to the same extent as in 2008.

Secondly, given that NBG has almost no cash to pay the principal when loans from the ECB and liabilities due to other creditors expire, how will they roll these loans over without additional borrowing from the ECB? NBG is essentially locked out of the international debt markets, and equity issuance to raise funds would be wholly insufficient. The only conceivable funding source is the ELA. However, the ELA is only meant to be used for short-term liquidity needs; it is not a long-term solution for banks like NBG to remain solvent. If the Governing Council of the ECB, which consists of all the EU finance ministers (many whom are not exactly best friends with Mr. Varoufakis), decide that the issue is no longer one of liquidity but of solvency, they could vote to stop the ELA program, in which case NBG would almost certainly fail. Furthermore, as an indication of its reliance, NBG issued another $4.1M Euro of bonds to itself on 8 April 2015 in order to create collateral out of thin air.

NBG can continue to survive as long as the ELA tap is turned on. However, the mention of a possible "haircut" of the value of collateral used for ELA lending could seriously jeopardize NBG's chances of survival. Currently, NBG is still able to draw funds from the ELA using phantom bonds guaranteed by the Greek government. However, if a haircut is applied, the ability of NBG to borrow from the ELA would be significantly reduced - up to 50% of the amount it would be able to borrow now with the same collateral. This would undoubtedly create a liquidity squeeze. Coupled with the current run on Greek bank deposits, NBG would face a probable collapse.

A Long-Term Truth

While most investors recognize NBG is exposed to severe risks, what they fail to realize is the longer-term truth: that Greek banks will almost certainly never be able to pay back its debts in the far, far future.

As of their latest disclosure, NBG owes $20,481M to the ECB and other Central banks, and only has 1,876M in cash. In both 2014 and 2013, the bank continues to make large pre-tax losses of -$2050M and -$501M respectively, mainly due to heavy impairment charges and credit writedowns. These sustained losses show that NBG has not begun to turn the tide on its unsustainable debt.

Furthermore, while it has been over 6 years since the crisis started in 2008,the pain is not over for NBG as writedowns continue to mount even after recapitalization measures and reforms by the Greek government.

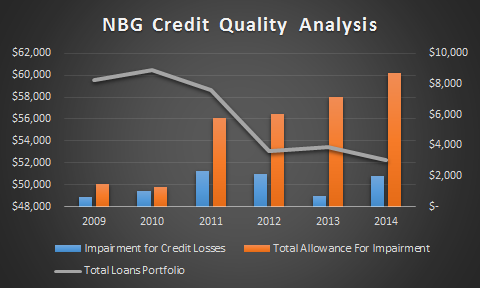

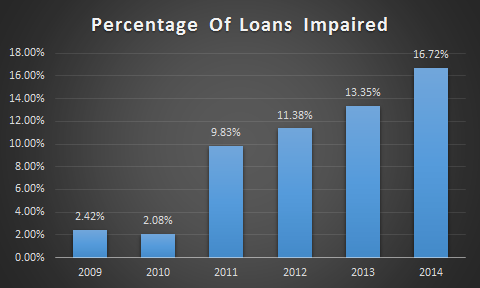

As observed, NBG continues to take high writedowns on its loans and are making much higher allowances for impairment in anticipation of a higher default rate. This indicates that the bank has not finished cleaning up the dirt on their balance sheets; instead, impairment charges jumped from 2013 to 2014, reflecting a worsening of credit quality. In essence, there have been no significant signs of improvement in the loans portfolio to support a bullish case.

As seen above, the percentage of total loans impaired continues to surge, indicating there are more losses to come. Moreover, this number actually understates the worsening quality of the loans portfolio, as NBG gives generous concessions for loans in forbearance and loans that are past-due but not impaired, which total roughly $3251M in 2014.

With the loans portfolio continuing to worsen and losses continuing to mount, there is no visible light at the end of the tunnel for NBG. Furthermore, there is simply a lack of reasons for a bull case.

Typically, more spending, investment and other expansionary policies spur bank growth as households and entrepreneurs use more banking services and are more willing to take out loans to invest or buy goods and services. However, NBG is still in a deleveraging cycle which will not end anytime soon, given how large lenders are actually taking on more debt. Hence, I expect the share price to continue its downward trajectory as long as the credit quality of NBG's loans portfolio continue to decline. NBG will not be able to grow unless it thoroughly rids itself of the thrash in its house.

Another major impediment is the lack of confidence in the banking system as seen through the rapidly increasing bank deposit outflows. If the Greek government and the Eurogroup do not reach an agreement soon, ELA borrowing might balloon disproportionately, resulting in an even more stringent review from the ECB.

Short-Term Scenarios

Now that we've established NBG is unlikely to pay off its debts in the next 10, 20 or even 30 years, and that they are heavily saddled with debt that they desperately need to roll over, we compute the possible scenarios:

- The Greek government reaches an agreement with EU which lifts the restriction on using securities guaranteed or issued by the government as collateral for ECB funds. This would allow NBG to borrow directly from the ECB and roll over their debt.

- No agreement is met and the ECB does not lift the restriction. This would almost certainly result in a default sooner or later as the ELA is not a long-term mechanism to maintain bank solvency. This would result in Greek taxpayers bailing out Greek banks as the phantom bonds used as collateral to borrow ELA funds are guaranteed by the Greek state.

- EU allows for a debt writedown or forgives part of Greece's debts. Highly unlikely given the aggression and hostility towards Greece right now.

- Greece defaults and leaves the Eurozone.

Even under the most hopeful scenario, NBG's problems will remain unresolved. Granted, NBG would probably rally if an agreement between Greece and the EU creditors is reached as hordes of speculators start buying. However, the key determinants of NBG's prospects are how quickly can they writedown the bad loans and assets on their balance sheet, and how quickly they can deleverage and if consumers will develop confidence in the banking sector.

In all probable short-term scenarios, there is no catalyst for the resolution for these two key issues. Hence, expect more pain down the road.

While I do not conclude that NBG is beyond hope, any form of salvation would indeed be far, far away. Simply put, the risks are too severe and there is insufficient evidence for a bull case. This is simply not the right time, nor the right stock, to be bottom-fishing. Let the buyer beware.

$$$ GENUINE LOAN WITH 3% INTEREST RATE APPLY NOW $$$.

AntwortenLöschenDo you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email: shadiraaliuloancompany1@gmail.com

LOAN APPLICATION DETAILS.

First Name:

Last Name:

Date Of Birth:

Address:

Sex:

Phone No:

City:

Zip Code:

State:

Country:

Nationality:

Occupation:

Monthly Income:

Loan Amount:

Loan Duration:

Purpose of the loan:

Email: shadiraaliuloancompany1@gmail.com

$$$ GENUINE LOAN WITH 3% INTEREST RATE APPLY NOW $$$.

Do you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email: shadiraaliuloancompany1@gmail.com

LOAN APPLICATION DETAILS.

First Name:

Last Name:

Date Of Birth:

Address:

Sex:

Phone No:

City:

Zip Code:

State:

Country:

Nationality:

Occupation:

Monthly Income:

Loan Amount:

Loan Duration:

Purpose of the loan:

Email: shadiraaliuloancompany1@gmail.com