Venezuelan Credit Dashboard: October Payments Total $1.8 Billion

Venezuela, which has the largest crude reserves on the planet, has defied predictions of default since the oil collapse started in 2014, and analysts are split as to how long the nation of 30 million can hold out. With that in mind, Bloomberg is taking a close look each month at some of the key components that may determine its fate.

Debt Payments

The government and state oil company Petroleos de Venezuela SA need to make $1.75 billion in debt payments this month -- including a principal payment of $1 billion on a PDVSA bond that matures Oct. 28 -- after payments totaling $310 million in September, according to data compiled by Bloomberg.

Investors will be keeping a close eye on this November. If PDVSA can complete aswap of its 2017 notes in exchange for longer-maturity securities, it could potentially reduce what it needs to pay next month from $2.9 billion to only $896 million. The company’s 8.5 percent notes that mature in November 2017 have a $2 billion principal payment due next month.

“Significant participation could allow some breathing room,” Siobhan Morden, the head of Latin American fixed-income strategy at Nomura Holdings Inc., said in a note on Sept. 28. “We are closely monitoring the FX reserves and imports as the only potential flexibility on remaining current on external debt service.”

Bond Prices

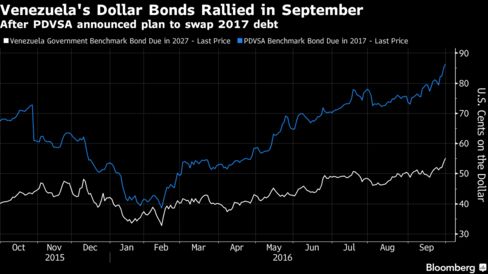

Venezuela’s dollar bonds rallied in September as PDVSA announced the swap offer and new drilling plans to tap reserves in the Orinoco heavy crude belt.

The government’s $4 billion of benchmark notes due 2027 rose 10.3 percent in September to 54.9 cents on the dollar as yields declined to 19.3 percent.

Credit-Default Swaps

Trading in credit-default swaps show that investors decreased short-term default expectations in September, with the the implied probability that it happens over the next 12 months falling to 43 percent from 50 percent at the end of August. That’s much less then the implied risk of 83 percent seen in February.

The probability of a default in the next five years is 87 percent, down from 91 percent a month ago, according to credit-default swaps. Highlighting the risk of nonpayment, S&P Global Ratings on Sept. 19 downgraded PDVSA and said the planned voluntary bond swap would be “tantamount to default.”

As long as PDVSA continues to pay, a “selective default” credit rating shouldn’t trigger the payment of CDS, JPMorgan Chase & Co. analysts led by Javier Zorrilla wrote in report on Sept. 23.

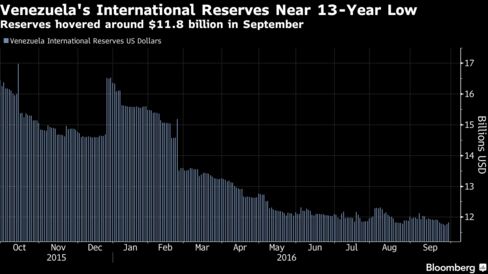

Central Bank Reserves

Venezuela’s international reserves were little changed in September, hovering around a 13-year low of $11.8 billion. Reserves have fallen about $4.5 billion this year, according to data compiled by Bloomberg.

Currency Rates

Venezuela’s weakest official exchange rate, used mostly for imports deemed non-essential, started to depreciate again in September and weakened 2 percent, ending the month at 658.1 bolivars per dollar.

The complementary system, known as Simadi or DICOM, accounts for about 8 percent of the government’s hard currency sales. The rest of Venezuela’s greenbacks are sold at the priority rate of only 10 bolivars per dollar.

The Simadi bolivar has weakened a staggering 70 percent this year.

Crude Prices

The price Venezuela receives for its oil exports fell 4 percent in September to $38.81 a barrel even as West Texas Intermediate rose almost 8 percent, suggesting the country hasn’t yet been able to capitalize on PDVSA president Eulogio Del Pino’s efforts to lobby for OPEC production limits.

Acknowledging a decline in output, PDVSA said last month that it was getting ready to start what it’s dubbed “one of the world’s largest drilling projects” in the Orinoco heavy crude belt with investment totaling $3.2 billion to add 250,000 barrels a day of new output over the next 30 months.

Marking a turnabout for many international oil service companies operating in the country, Schlumberger Ltd., Horizontal Well Drillers LLC, and Venezuela’sY&V Group were selected after a worldwide tender, with Halliburton Co. and Baker Hughes Inc. providing support for specific parts of the project.

The opposition continues to insist on a recall referendum this year to remove President Nicolas Maduro but the National Electoral Council said the next stage in the process, the collection of 20 percent of signatures from registered voters, won’t happen until late October, effectively pushing the process into 2017.

The opposition continues to push for a recall vote this year and is planning to stage protests nationwide on Oct. 12.

Keine Kommentare:

Kommentar veröffentlichen