Physical Gold Delivery Failure By German Banks

The physical gold delivery failure to clients of Deutsche Bank who own Xetra-Gold, the gold exchange traded commodity, was confirmed yesterday by Deutsche Bourse who said that the inability to deliver gold was not limited to Deutsche Bank and that other German banks were having "problems" delivering gold.

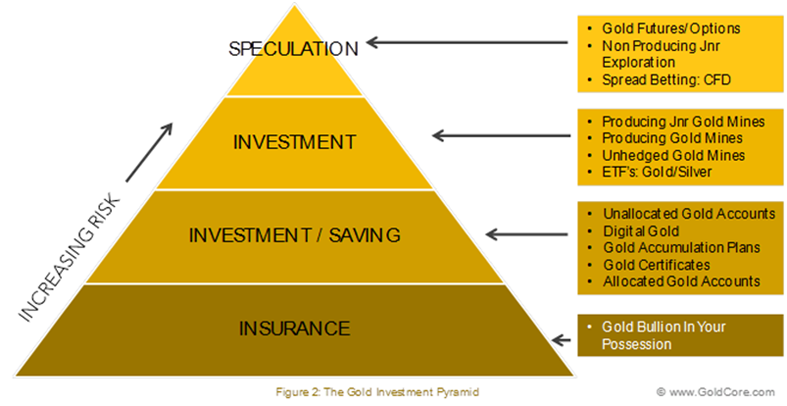

This is yet another example of a bank not making good on promises to redeem their gold investment products, as seen with ABN Amro in 2013 and indeed Julius Baer in recent months as we pointed out yesterday (see here). It is the latest example of the unappreciated risk of owning gold exchange traded commodities (ETCs), exchange traded funds (ETFs) and indeed most institutional gold investment offerings.

Xetra-Gold filed an official response yesterday regarding the physical gold delivery failure, one which can be read in German on the following page and was reported and commented on by Zero Hedge overnight:

What is notable is that instead of immediately refuting the story - as it should have done if there is no breach of prospectus covenants - and declaring that any and all physical gold demands have and will be satisfied, Xetra took a very circular approach to responding, one which in effect confirmed our concerns, that the issue was not so much with Xetra, but with the sponsor bank, in this case Deutsche Bank.Furthermore, the author of the original godmode article, Oliver Baron, penned his own reaction, in an article titled "Deutsche Boerse takes a stand." He writes that "yesterday's article "Xetra-Gold: Nothing but a scrap of paper?" has struck nerves: Not only that GodmodeTrader was cited among others, at "Zero Hedge" a financial website influential on Wall Street, but also at Deutsche Bank and at Deutsche Boerse, where the article has caused quite an internal stir, as Godmode traders was informed."He further writes that Deutsche Boerse Commodities has released a fairly spongy formulated observation on the physical delivery of Xetra-Gold. The key phrases are:"The Deutsche Boerse Commodities GmbH points out that holders of Xetra-Gold shares can at any time exercise the right to delivery of securitized gold. Deliveries are made via a branch of a bank indicated by the investor. The requirement is that the branch offers this service because the delivery can take place only through the depository bank of the investor."As we reported yesterday, what made this particular "failure to deliver" notable is that the original client had asked for delivery via a Deutsche Bank branch, the same bank as the ETC's sponsor, which is why, as we noted before, this appears to have been a problem involving not Xetra-Gold, as much as Deutsche Bank itself.Baron agrees. As he writes, "in other words, it depends, according to Deutsche Boerse Commodities, on the particular bank branch whether the physical delivery can be carried out."And, as we learned last night, it does appear that if the delivery is requested at a Deutsche Bank branch, the answer is no.But this is where it gets even worse. As Baron adds, in a telephone conversation with the author, the Deutsche Boerse Commodities exchange was unwilling to supply further information to Godmode traders whether physical delivery is generally feasible at most bank branches or not. And worst of all, "the exchange was unable to name any bank which is in a position to deliver physical gold without problems."Baron's conclusion: "the "right" for actual delivery at Xetra-Gold is theoretical: physical delivery is only possible if the respective bank branch also cooperates. Suspicious gold investors should consider Xetra-Gold as another form of paper gold and not as a physical gold investment."Our take is slightly different: while we already know that physical delivery at Deutsche Bank appears to have been compromised, according to the Deutsche Boerse response, the ability of any and every other bank in Germany to deliver gold is now likewise questionable. Which begs the question: where is all the physical gold?

The risks inherent in investing in gold exchange traded funds (ETFs) and exchange traded commodities (ETCs) is something that we have warned of since these new gold proxy investment instruments came on the scene in 2003.

See Beware of Exchange Trade Funds (ETFs) Bearing Gold and watch the Bloomberg video from 2012 below:

Keine Kommentare:

Kommentar veröffentlichen