Venezuela Avoiding Default Again Shows Doomsayers May Be Wrong

Over the past year, no shortage of bond investors and analysts have predicted a Venezuela default. Just last week, Loomis Sayles & Co. and Ice Canyon LLC joined the fray, saying the country, rocked by the plunge in oil prices, would likely halt debt payments next year.

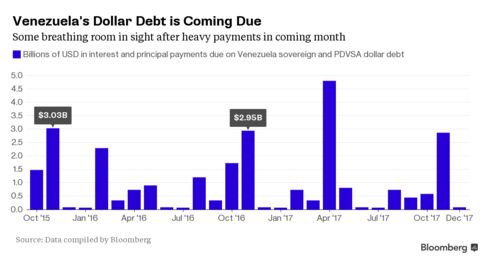

Yet the cash-strapped nation has managed to stay current on its notes. Bond prices show investors increasingly expect Venezuela’s state-owned oil company to pay $4.3 billion due over the next month and the government to make good on payments of $2.1 billion due in February. After that, the country wouldn’t have another foreign debt payment on principal until August 2016.

To Rogge Global Partners and Bank of America Corp., Venezuela may just confound the doomsayers again next year. The government could continue a policy of reducing imports to preserve the cash it needs to pay debt, a strategy that helped it save about $20 billion this year alone, said Francisco Rodriguez, an economist at Bank of America.

“Analysts always say, this year they can make it and next year will be critical, but we had the same discussion a year ago,” said Michael Ganske, who helps oversee $4.5 billion of debt including Venezuelan bonds as head of emerging markets at Rogge Global Partners in London. “You have substantial default risk priced in.”

Traders in credit-default swaps are signaling there’s a 68 percent chance Venezuela will stop paying its bonds by October 2016. That’s the highest in the world for a sovereign.

Venezuela’s Information Ministry didn’t respond to an e-mailed request for comment on PDVSA’s plans to make bond payments.

Petroleos de Venezuela SA has a $1.45 billion payment due on its 5 percent notes that mature Wednesday. The securities traded at 99.3 cents on the dollar as of 12:12 p.m. in New York, data compiled by Bloomberg show. The oil producer also is due to pay next Monday $2.1 billion on its 8.5 percent bonds maturing in 2017. The price of those notes has soared to 71.95 cents on the dollar from a record low of 50.08 cents on Jan. 21.

The government’s notes due on Feb. 26 have also rallied. They’ve climbed 63 percent from their 2015 low in January to 88.86 cents on the dollar.

With Venezuela’s foreign reserves hovering close to a 12-year low of $15.2 billion and the economy in tatters, the prospect of a default is still high. The International Monetary Fund forecasts Venezuela’s economy will shrink 10 percent this year, the most in the world, while its inflation rate will reach 159 percent. Oil, which is down 48 percent in the past year, accounts for 95 percent of the country’s export revenue.

At a Bloomberg event in New York last week, Edgardo Sternberg, a money manager at Boston-based Loomis Sayles, said a default is “surely” coming sometime next year.

At the same event, Paulo Vieira da Cunha, the head of macroeconomic research at Ice Canyon LLC in Los Angeles, said Venezuela will make payments this year and in the first quarter of 2016 but will default afterward unless it sells part of PDVSA to the Chinese.

To Bank of America’s Rodriguez, Venezuela has the ability to change economic policies or seek more funding from China that could help it avoid having to halt payments on its debt.

“I don’t think that you can conclude that Venezuela is inevitably on the road to default in the way that the market and some analysts are concluding,” he said from New York. “This could end in two possibilities, with Venezuela defaulting or with Venezuela fixing its policies. I do not think the solution would be to think that Venezuela will default.”

Keine Kommentare:

Kommentar veröffentlichen