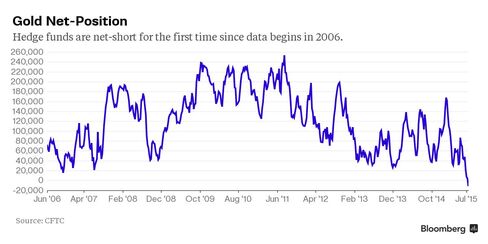

Hedge Funds Are Holding First-Ever Gold Net-Short Position

Hedge funds are holding the first ever bet on a decline in gold prices since the U.S. government started collecting the data in 2006.

The funds and other speculators shifted to a net-short position of 11,345 contracts in New York futures and options in the week ended July 21, according to figures from the U.S. Commodity Futures Trading Commission.

Gold futures on Friday fell to the lowest since 2010 on the Comex, and the short wagers show investors expect the rout to deepen. Bullion has fallen almost every day in July, leaving the metal poised for the biggest monthly decline since June 2013.

“Undoubtedly, we’ve seen a sentiment shift in gold,” Dan Denbow, a portfolio manager at the $700 million USAA Precious Metals & Minerals Fund in San Antonio, said by phone. “Gold has a lack of enthusiasm.”

Prices are collapsing amid mounting speculation that U.S. interest rates will climb this year, curbing the appeal of bullion because it doesn’t pay interest like competing assets. At the same time, China bought less of the metal than analysts were expecting, and the dollar keeps getting stronger.

Goldman Sachs Group Inc.’s Jeffrey Currie says the worst is yet to come for gold, and that prices could fall below $1,000 an ounce for the first time since 2009. “The risks are clearly skewed to the downside,” Currie, the bank’s New York-based head of commodities research, said in a phone interview Tuesday.

Currie isn’t alone in predicting more declines. ABN Amro Bank NV’s Georgette Boele and Robin Bhar of Societe Generale AG say bullion will approach $1,000 by December.

Gold has led a retreat among raw materials, as the Bloomberg Commodity Index this week fell to a 13-year low. Lower prices are spurring suffering for miners. Shares of Barrick Gold Corp., the world’s largest producer, fell this week by the most since April 2013 in Toronto.

Keine Kommentare:

Kommentar veröffentlichen