How Dwindling Reserves Are a Positive for Argentine Bondholders

Updated on

hen Argentine President Cristina Fernandez de Kirchner hands over the reins in December, her successor may find a central bank running extremely low on cash. That could be good news for bondholders.

While gross reserves are $33.5 billion, after subtracting debt arrears, special drawing rights, dollars owed to importers, private deposits and a currency swap with China, the cash portion could be close to zero by year-end, according to Jefferies Group.

The silver lining for creditors is that dwindling reserves will prompt the next government to negotiate a solution to a decade-long legal battle with holdout hedge funds in order to regain access to international capital markets, said Andres Borenstein, an economist at Banco BTG Pactual. Advisers to leading presidential candidate Daniel Scioli are now publicly acknowledging the need to settle with investors led bybillionaire Paul Singer’s Elliott Management Corp.

“Leaving aside whether there’s a political will to do it, we know that whoever comes along will need to negotiate because there are few reserves left,” Borenstein said in Buenos Aires. “If they had $100 billion in reserves there would be no hurry for the government to negotiate.”

Argentina’s dollar-denominated bonds due in 2033 have risen to their highest level in eight years after economist and adviser Miguel Bein appeared in an interview alongside Scioli and said a new government would have to negotiate with holdouts. The leading opposition candidate, Mauricio Macri, has also said he would talk with the hedge funds. The notes rose 1.9 cent to 107 cents on the dollar at 3 p.m. in New York.

Argentina defaulted for the second time in 13 years in 2014 after U.S. District JudgeThomas Griesa blocked the nation from making interest payments to holders of restructured bonds unless it pays the holdouts in full. Fernandez’s government has refused to comply with the ruling and calls the investors vultures.

The run up to the Oct. 25 presidential election is exacerbating the shortage of dollars as the government resists a devaluation of the peso to keep real wages high for voters. The peso has weakened just 8 percent this year, lagging neighbors including Brazil to Colombia where currencies have tumbled by about 30 percent.

Argentines are taking advantage of the overvalued peso to spend abroad, adding to the drain of dollars. Spending on credit cards jumped 58 percent in July from a year earlier.

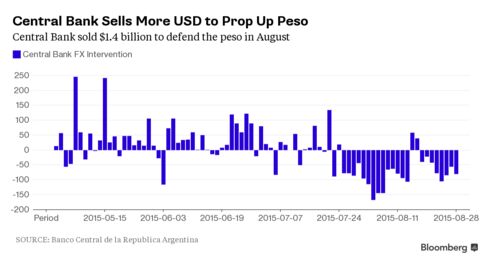

The central bank, which uses a crawling peg system to control the currency, sold $1.4 billion in the currency market last month to support the peso.

Regaining access to credit markets by negotiating a settlement with holdouts won’t be enough, said Siobhan Morden, the head of Latin America fixed income strategy at Jefferies in New York. The next government will have to carry out structural reforms such as a devaluation and the elimination of utility subsidies in order to avoid a balance of payments crisis, she said.

Negotiating with the holdouts “is a given,” Morden said. “It really raises the stakes for an adjustment because to assume that the market will lend to you is a mistake. The market will not typically lend into bankruptcy.”

The government may buy itself some time by offering a debt swap ahead of a $6.3 billion maturity on Oct. 3, said Maximiliano Castillo, director of Buenos Aires-based consultancy ACM. He estimates that a new government will assume power with gross reserves of $29 billion, or $18 billion when subtracting the amount of Chinese yuan included from the currency swap.

“The fact that there’s such little wiggle room with reserve levels is generating incentives for the next government to seek rational negotiations and look for a quick solution,” Castillo said.

Keine Kommentare:

Kommentar veröffentlichen