This comes via Shearman & Sterling, in their note on Argentina’s crunching defeat at the Second Circuit (and its Supreme Court litigation options for avoiding paying holdouts alongside current restructured bondholders, which it might have just blown up)…

Emphasis on ‘illustrative’. This is a case where an appeals court ruling has just landed about four months after it was first described as ‘imminent’.

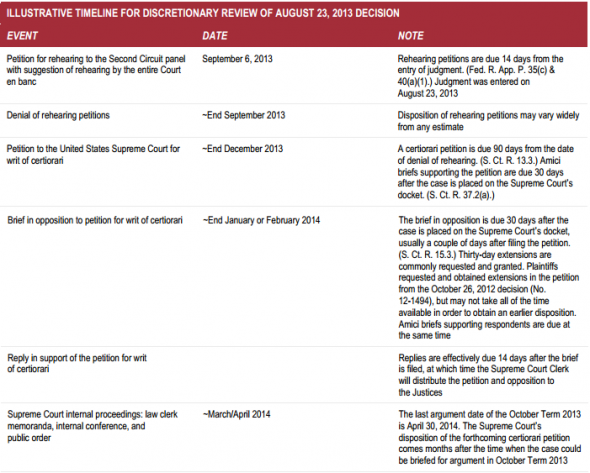

Still, Supreme Court procedure is consuming the entire pari passu saga for now, and it’s very finicky. (Argentina set the ball rolling weeks before Friday’s defeat with arequest for the court to take the case.) So we found these points by Shearman interesting:

- Can two pari passu cert petitions from Argentina exist in the same universe without breaking reality? It looks like Argentina can file a second petition to the Supreme Court (buying it time), although a footnote of the Second Circuit decision huffs about Argentina not having waited first. Shearman say Argentina might have cause to worry that this will lead the Supreme Court to deny the first petition and wait for the second. Which would look bad, so expect Argentina to argue it should get both bites somehow. (And after all, Argentina is now designing a bond swap which sounds predicated on bad news from the court.)

- Bank of New York might get the opportunity to file its own cert petition, after the Second Circuit’s remark that it “has standing to appeal”, alone of the third parties who have been trying to extricate themselves from pari passu’s black hole. This is interesting, but also weird, because Argentina has started acting like BNY (trustee for the restructured bonds) is a serious flight risk, with its local-law swap.

- The other third parties might still seek to send briefs to the Supreme Court. This makes sense — if France couldn’t keep its hands off, surely we can’t expect the Exchange Bondholders to stay away. Fintech (a separate restructured bondholder) has already written a brief as an amicus curiae, and you can see from it how third parties might still want to argue about everything from the details of the bond payment process to the Fifth Amendment and the Takings Clause.

So that’s today’s helping of legal technicality. Of course, Shearman point out that all of this stuff breaks down if Argentina gives the courts a reason to lift the stay and require a ratable payment next time it makes any payment. Which brings us back to the half-crazy swap: on the one half, it prepares restructured holders for that very event of the stay blowing up all of a sudden. Update: it’s also far from crazy, as pointed out here, if the swap is also a device for Argentina to remove obstacles to an eventual settlement with Elliott. But the crazy half (or so it appears to us still) is that it would close off the road to Washington.

And one more date for the diary? September 5 — on the Belgian side of the saga.

Keine Kommentare:

Kommentar veröffentlichen