So, do you believe that “exceptional and unique” story about sovereign debt restructuring in the eurozone?

Then, as advised in a recent paper by Lee Buchheit, Mitu Gulati, and Ignacio Tirado — which we’re revisiting as Cyprus bailout talks heat up — stop reading here.

Why not look through prices for Cypriot government bonds instead — the 2020 bond is trading at around 75 cents in the euro. Still pretty cheap if a full bailout is decided on as the best solution for Cyprus after this month’s election.

If not…

This post is about the alternative, as outlined by the paper. It’s all about ways to make a write-down of foreign-law bonds work. Last month, the authors sought to convince their Cypriot audience on two particularly timely — but contrarian — points:

- If it wants to restructure, Cyprus has options within its existing bond terms and conditions to defend itself when (not if) holdouts come knocking on a courthouse door.

- But if the eurozone wants Cyprus to restructure without any risk from holdouts, it has its own options for making that possible, too.

In the last post, we went into some detail on Iraq’s experience with a so-called debtor shield a decade ago. That’s because the paper’s proposal on the second point is a debtor shield, immunising sovereign assets and preempting holdouts.

And like Iraq at the UN, Cyprus (or any future eurozone sovereign) would gain the shield through an international treaty. Step forward, one permanent bailout fund. From the paper:

We believe that the Eurozone has within its power a unique ability to deflate expectations on the part of prospective holdouts that they will realize a higher recovery by staying out of the sovereign restructuring…The appropriate mechanism, we believe, would be an amendment to the 2012 Treaty Establishing the European Stability Mechanism (“T/ESM”). Something along these lines:ARTICLE ___Immunity from judicial process1. The assets and revenue streams of an ESM Member receiving stability support under this Treaty which are held in, originate from, or pass through the jurisdiction of an ESM Member shall not be subject to any form of attachment, garnishment, execution, injunctive relief, or similar forms of judicial process, in connection with a claim based on or arising out of a debt instrument that was eligible to participate in a restructuring of the debt of the beneficiary ESM Member after the effective date of this Treaty.2. The immunities provided in the preceding paragraph shall automatically expire when all amounts due to the ESM from the beneficiary ESM Member have been repaid in full.

As Buchheit has put it to John Dizard, it’s a “shark cage”.

In other words, the point isn’t to stop holdouts getting a court judgement that Cyprus has violated bond terms, and should pay them if it defaults. That part of the history of sovereign debtor immunity is, well, history.

Instead, the ESM amendment idea aims to stop the enforcement of any judgement by using sovereign assets held within the eurozone. ‘Within the eurozone’ has its limits — the presidential plane could probably be left idling at Charles De Gaulle pretty safely, but not Heathrow or Geneva, for example. But it would use ESM members’ domestic law (where they’ve ratified the treaty) to neuter foreign-law claims. That would turn the holdout trade on its head.

To understand why, it first helps to see why Cyprus’ foreign-law debt has such a formidable reputation. If you already know all about this then you can skip to the next part, where we wonder whether a Cypriot shield could really work alongside European law — and if it does, whether it could be a euro resurrection of the long-dead SDRM.

_________________________

So, you want to hold out in Cypriot bonds

As Buchheit and his co-authors put it, “foreign holders can literally smell the official sector’s fear of a messy sovereign debt workout in Europe.” Beyond that, the mechanics get a bit complicated.

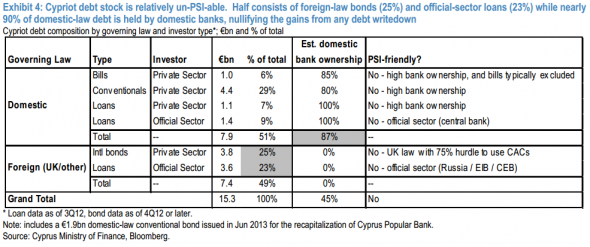

Most eurozone sovereigns have foreign-law debt to some degree, but its preponderance in Cyprus is relatively rare. It’s a kind of reverse-image to what’s already been a busy year for eurozone governments using domestic law to preempt activist creditors (in rescued banks, not sovereigns). Anyway, here’s an illustrative chart from a recent JPMorgan piece titled “Cyprus: the sleeping (mini)crisis”. Click to enlarge, and note the headline’s conclusion:

There’s domestic-law debt there too, naturally held by the banks who already need bailing out – a whole other post. For now, watch the foreign-law bonds. No domestic holdings, so in theory, a handy place to focus a write-down. But there’s a problem.

First, bailout arithmetic, we suppose. “The structure of the government debt is pointing strongly against a PSI operation,” Nomura analysts Dimitris Drakopoulos and Lefteris Farmakis argued in a recent piece: “The foreign held restructurable bonded debt is too small (less than 21% of GDP) to make a difference in the context of 140%+ of GDP debt ratio in 2014.”

First, bailout arithmetic, we suppose. “The structure of the government debt is pointing strongly against a PSI operation,” Nomura analysts Dimitris Drakopoulos and Lefteris Farmakis argued in a recent piece: “The foreign held restructurable bonded debt is too small (less than 21% of GDP) to make a difference in the context of 140%+ of GDP debt ratio in 2014.”

It will get even smaller after June, when a single large bond matures. Then again, that’s arguably the point of default: each full payment of these bonds would migrate risk to the official sector. It’s also worth noting how large the ‘official’ share of Cypriot debt already is. Russia is already being asked to term out its portion for another five years.

But then there are the bond contracts themselves.

The English-law bonds can’t be written down by direct legislative fiat. More to the point, they also contain so-called “ICMA-style” collective action clauses. In this prospectus, for example, the CACs require holders to amass 75 per cent of a bond’s principal before a “yes” vote to restructuring can bind the bond’s other investors. Easier for holdouts to building a blocking stake, essentially. For comparison, the CACs being piped into new eurozone sovereign bonds as of January require 66.67 per cent.

That all makes it hard to restructure through launching a voluntary swap offer. Some features could also complicate a straight payments default, just in case Cyprus had this as a Plan B. The bond terms have a familiarly spiky “payments” version of the pari passu clause for example, and a cross-default provision.

So it’s not surprising that the first response from Buchheit et al is to answer back with bits of the bond contract that suggest sneaky loopholes instead. When it comes to attachment of assets, the business end of any litigation, they point out for example that Cyprus’ waivers of immunity “do not apply to the Republic’s title or possession of property … necessary for the proper functioning of the Republic as a sovereign state.” Which could be anything.

It’s a clever trick. Still, as the paper acknowledges, being able to use it would mean Cyprus and the eurozone would already be locked in enforcement proceedings. Hence the debtor shield.

_________________________

A euro-SDRM, maybe

So, would an ESM-treaty shield work?

Cast your mind back to Iraq and Resolution 1483, where we opened our first post. There is not a lot in this world that can countermand a UN Security Council decision under Chapter VII — except possibly human rights law.

Maybe that doesn’t make Iraq such a good precedent for Cyprus now, notwithstanding that Iraq was unique in lots of other ways too. Now, the ESM treaty is an independent international pact, separate from the EU treaties. But we’ve known since late last year, with Pringle v Ireland, that the European Court of Justice is ready to review any ESM treaty provision that it thinks it might not be compatible with ESM members’ obligations under EU law.

Among those obligations you could count Articles 17 and 47 of the EU Charter of Fundamental Rights. Article 17′s about property rights, while Article 47 guarantees rights to an effective remedy and a fair trial from national courts.

Trying to think of holdout litigation strategies one day, Article 47 was our initial objection to the ESM amendment. Mitu Gulati’s response caught the essence of how the shield functions. It’s not designed to enforce an automatic stay on all holdout lawsuits but to simply make enforcement an uneconomic proposition.

In any case, Gulati pointed to the possibility that there are competing rights and obligations here — Cyprus and its other creditors (not just the official lenders but other bondholders who might take an exchange deal) have an interest in an orderly restructuring. (It’s also worth noting that Article 17 has one of those ‘public interest’ caveats.)

There is arguably some backing for this in the ECJ’s view of the ESM. In Pringle v Ireland, the court suggested that member-states are fine to use the ESM to do areas of ‘economic policy’ where the EU lacks specific competence. ‘Economic policy’ in this case would mean a fairly organised process for restructuring sovereign debt.

Which is where the IMF’s old SDRM proposal comes in. This is how the paper from Buchheit et al concludes:

An amendment of the T/ESM along the lines suggested above would, together with the other measures already taken within the Eurozone, substantially replicate the key features of most corporate insolvency regimes and would cover much of the ground that the IMF’s proposed Sovereign Debt Restructuring Mechanism sought to address in 2002. Specifically,• Supermajority creditor control of a future Eurozone sovereign debt workout will be effected through the use of the aggregated collective action clauses that the T/ESM mandates be included in all Eurozone sovereign bonds issued after January 1, 2013. Control of the workout process by a supermajority of affected creditors, and the ability to bind any dissident creditors to the will of that majority, is a fundamental feature of most insolvency regimes.• Supervision of the workout process will in practice be the province of the Troika (the ECB, the IMF and the European Commission) in much the same way as they have been doing in the bailouts of Greece, Ireland and Portugal. This supervision implicitly covers issues such as assessing whether a debt restructuring is required in the debtor country, whether the terms proposed in any such restructuring are proportional to that country’s needs, whether the country is undertaking appropriate macroeconomic adjustment measures, and whether the burden of the adjustment is being shared equitably among all stakeholders (citizens, creditors and official sector sponsors).

There’s been some talk of reviving the SDRM following Argentina’s troubles with the pari passu litigation. It’s unlikely to get anywhere, because there’s not muchdiplomatic capital in supporting Argentina these days.

Restarting the SDRM in one of the biggest capital markets on the planet might be a different story. It’s not just Cyprus with the immediate problem either. Whether to pay or not to pay foreign-law, likely holdout-held debt is also a choice that Greece and the Troika will continue to face in the coming years, with billions of euros still out there. For now they’ve decided that it is better to pay.

And that’s probably why a euro SDRM would still elude us. The politics of even thinking about a debt restructuring is complex in the first place — as Cyprus may yet prove.

Keine Kommentare:

Kommentar veröffentlichen